- Product

- Solutions

- Pricing

- Resources

- About Canopy

- Log In

Credit card processing for accountants. Getting paid should not be difficult. Period. Maybe even exclamation mark!

Get Paid 58% Faster

Canopy Payments cuts average DSO to 8–11 days—down from 19–31 with manual methods. For $20K+ invoices, firms see a 65% faster turnaround.

Consolidate Systems

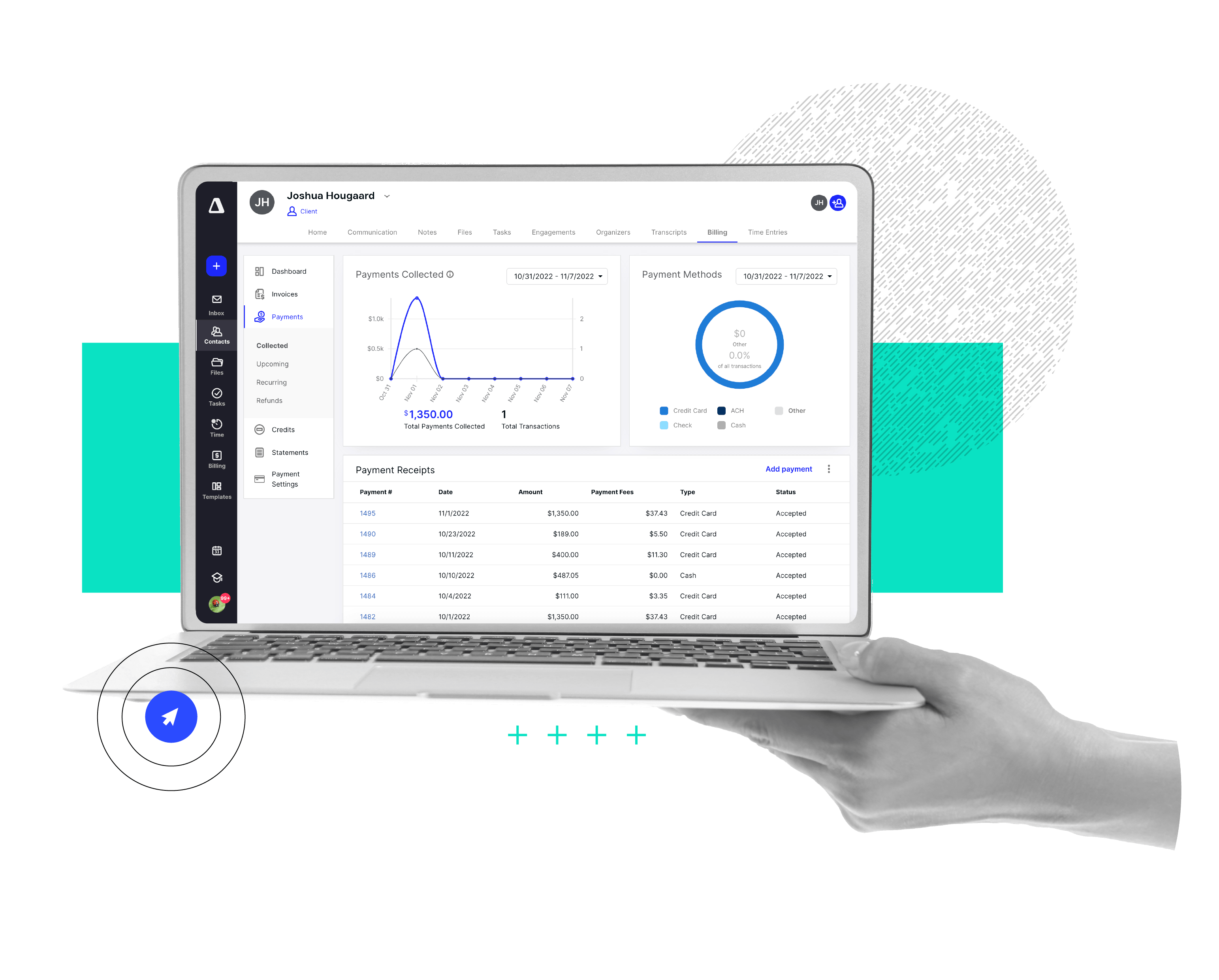

Process payments directly within Canopy—no more juggling disconnected systems. Less context switching, fewer errors, and more time back in your day.

Turn Payment Data Into Insights

Canopy’s built-in reporting tools let you track DSO trends, payment status, and client behavior all in one place.

Saving time starts with the smallest tasks—like setting up Payments. That's why we have partnered with a payment processing expert and built the merchant onboarding process directly into Canopy. Now, your firm can complete the application quickly and easily without ever leaving the platform.

Once you’ve invoiced your clients, it’s time to get paid (insert “raining money” gif here). Whether you need to take payments on a one-time basis or automate them, Canopy can do what works for you.

Canopy Payments takes all major card types—VISA, MasterCard, American Express (AmEx), Discover. Our card processing rates start at 3.30% + $0.20 per transaction. Rates vary based on processing volume.

Canopy offers low-cost ACH bank transfers for 1% per transaction with a $10 cap. If your firm or clients prefer not to deal with the limitations that come with credit cards like expirations dates or higher fees, look no further than Canopy ACH bank transfers for a simple, cost-effective alternative.

Make it easier for clients to pay, and more importantly for your firm to get paid, by saving payment methods in the Client Portal. Clients can easily add, manage, and update bank accounts or card payments. Clients can easily see their balance due and pay directly from our Client Portal on their browser or app, or share their payment methods with your firm so you can run it on their behalf.

Keep an eye on your payment data — view it aggregated for all clients or drill down by individual clients.

Give your clients a simple way to pay with the Canopy Client Portal app. Your clients can view and manage all of their billing-related data so they can:

Offer card payment options to your clients without taking on the financial burden to your firm. Pass on credit card fees to your clients with surcharging.

Quick Pay streamlines invoice payments by allowing clients to pay directly through a secure link in their email, bypassing the need to log into the Client Portal. It introduces a "Pay now" button in invoice emails for effortless payments. Don’t worry, clients can still access their Client Portal for partial payments or to use saved payment methods. Available with a Time & Billing license, Quick Pay requires signing up for Canopy Payments for faster, secure transactions without extra signup fees.

Get paid faster with payments embedded directly in your practice management tool (and client portal).

Firms get paid 58% faster when using Canopy Payments

Average time to collect payment on an invoice using Canopy Payments

AI & Automation actions taken in Canopy

This is serious stuff. Just know: our integrated payment partner has a PCI Level 1 certification providing your firm and clients with a secure, reliable payment platform. They’re audited annually, undertake regular penetration testing, and have maintained their PCI DSS compliance for more than a decade. Canopy dedicates internal teams to Information Security, Legal and Audit, focusing on best practice data management processes.

“We had one employee handling accounts receivable, and once we moved from five different merchant processors to Canopy, we basically bought back 25 hours of his week. What used to take 25–30 hours now takes just a couple hours.”

“[Canopy offers a] more streamlined payment collection process and better task/project management. We have saved hours upon hours of time with our team, our office manager alone has reduced the number of hours required to handle client payments by about 4-5 hours per month!”

Can’t find the answer you are looking for? Reach out to our support team.

No, there are no surprise fees! The rates for Canopy Payments will include all of the fees and costs associated with regular card transactions and ACH bank transfers if you choose to use this tool. Additional features or functionality may be offered in the future that may come with other costs, but we will communicate those costs as or if they happen.

For both card payments and ACH bank transfers, you can expect to have the payment processed within 2 business days.

Signing up for Canopy Payments is a streamlined process and easy for you to initiate. You can simply navigate to the Settings section of Canopy, select Billing Settings, and then select the Payments tab. This will take you to the screen to start your application.

The application will take you through a series of questions to gather important information about you and your firm. The information you provide in this application will constitute a legal agreement, so take your time to accurately fill in the information. For example, make sure you select the right designation if you are a business (registered legal entity) or if you are an individual.

Once you have completed the form and submitted the application, you can expect to receive an approval or denial shortly. If more information is needed, you will also be notified.

Yes! In the Canopy Client Portal app, we've made an easy, fast, and convenient experience for your clients to make payments anywhere a mobile phone can go and the internet can reach. Your clients can download the Canopy Client Portal App on iOS or Android. On top of making payments directly from their mobile device, they can also receive and respond to client requests, take and upload quality images of their documents (don't worry, they upload as a PDF), and more--which can improve your interactions and decrease the time it takes to get the information you need.

Submit this form, and we will be in touch soon to give you a custom demo.

Set a time for one of our product specialists to give you a guided tour practice.