- Product

- Solutions

- Pricing

- Resources

- About Canopy

- Log In

Secure, seamless, and designed for the way accountants actually work.

“Canopy has made me much more efficient in tax resolution work. Not only does the software create efficiencies, but using it has helped me complete tax resolution faster, saving me valuable time.”

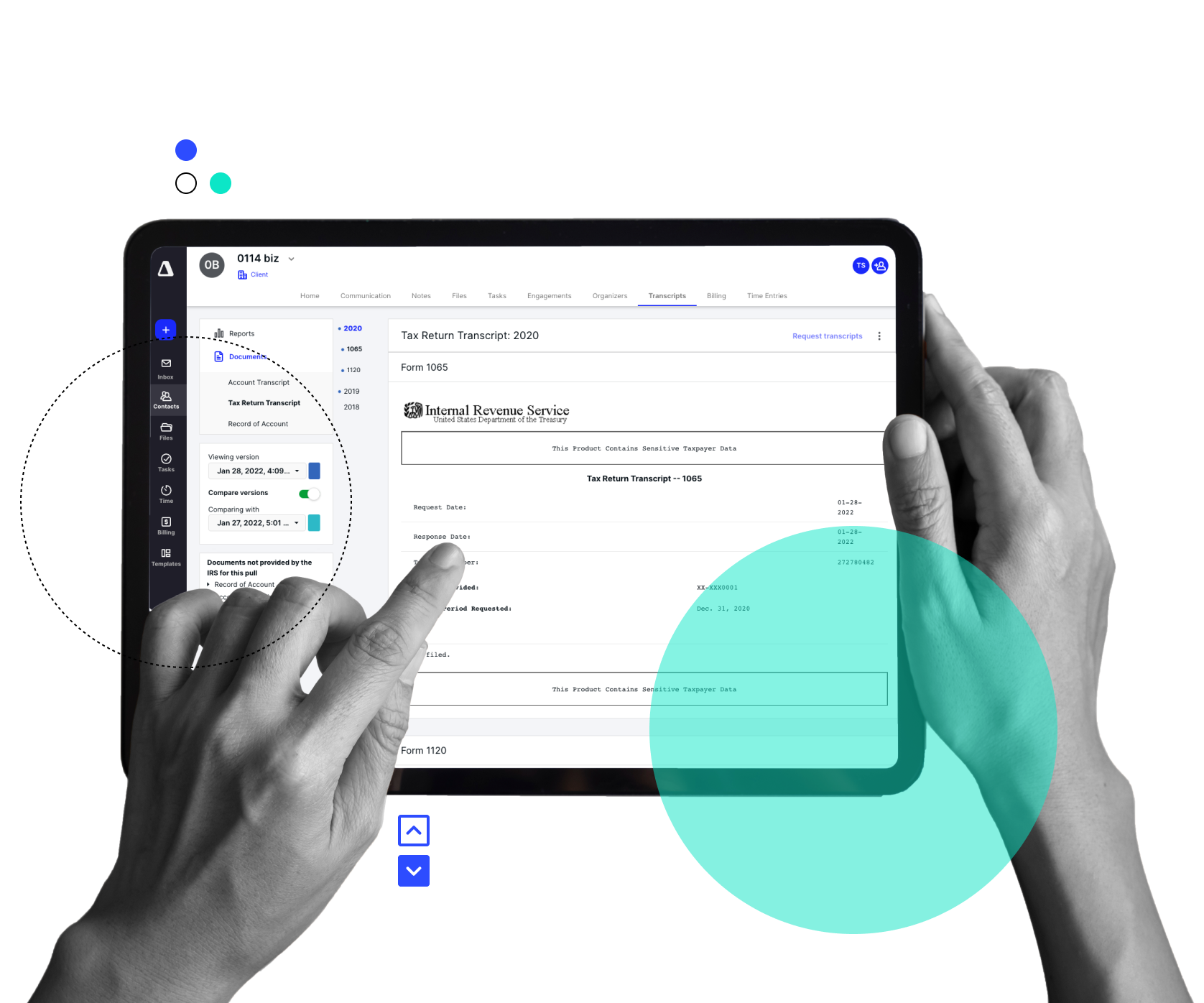

Automate transcript pulls and easily compare versions to identify recent changes and potential notices.

Automate Transcript Retrievals

The ultimate form of proactivity—the kind that requires no action from you.

Sleek IRS Integration

Secure log-in allows you to pull multiple transcripts at once. Say goodbye to multiple logins, navigation, and download after download...after download....after download.

Simplify Notice Creation

No need to memorize how to respond to any of the thousands of notices.

For pesky evaders or evaluating new tax prep clients.

Lauren Johnson

You have better things to do than memorize millions of notices (or, at least, we hope we do).

“What we didn't know - until we used it - was just how much time we save with pulling IRS transcripts through Canopy versus pulling transcripts through IRS e-services. Once your Form 2848 is on file with the IRS, you can pull every transcript for which you're authorized for a given client with the touch of a button. They download directly from the IRS in PDF format, and with one more button you can save every transcript to the client's file. The time savings is incredible, versus downloading individual transcripts one year and one form at a time.”

With Canopy's Transcripts & Notices tool, once you have POA on file with the IRS, you can pull upwards of 20 years of transcripts with one click. Better yet, schedule automated pulls for when you need to closely monitor a client and their standing with the IRS. Plus, get all of that data displayed in one easy-to-read table and bypass reading through pages and pages of un-ideally formatted content.

Whether you’re resolving a tax issue or monitoring an at-risk client, Canopy’s transcript tool delivers the info you need—instantly.

Can’t find the answer you are looking for? Reach out to our support team.

No. But once you have sent the form to the IRS and the authorization is filed, you can pull transcripts for that client until the authorization is withdrawn or revoked.

You can get as many years of data as you’re authorized for. We recommend that you pull all years in the range that you have authorization for.

Yes. But all users that will request transcripts need their own Transcripts license in Canopy and their own ID.me account with the IRS.

The IRS assigns a CAF. You can use our 2848 or 8821 form to fill out and then send to the IRS to get a CAF number. This blog will walk you through it.

You can get as close as possible to a notification as notifications get regarding notices. When you compare transcript versions, if a newer version of a transcript is different than an older version see the little blue dot. From there, you can compare the two versions and find the difference. This difference can often relate to a notice that may have been sent to your client, but not always.

Yes, after you have made your initial pull for each client. We recommend you pull all authorized years of data on your first pull so that any pull after that grabs all of those years of data. You can also select multiple clients and pull transcripts for all of those clients in bulk.

Yes. We recommend you schedule transcripts to pull at different intervals for your clients. For example, have 20% scheduled to pull on Monday, 20% on Tuesday, and so on. The IRS publishes transcript changes every week. Splitting up the scheduled pulls ensures a higher likelihood of all scheduled pulls completing during the time your token is activated after connecting to the IRS.

Submit this form, and we will be in touch soon to give you a custom demo.

Set a time for one of our product specialists to give you a guided tour practice.