- Product

- Solutions

- Pricing

- Resources

- About Canopy

- Log In

The tax problems your clients bring to you can be a mess. The process you use to resolve them doesn’t have to be.

(Canopy helps you resolve one of them.)

Simplify Processes

When it comes to taxes, there are soooo many items and processes to be able to just automatically know how to work on or respond to each of them. Fortunately, with Canopy, you don’t have to.

Utilize Templates

With pre-built workflows, letter templates, and more, you’ll find tax work a breeze. (Or, at very least, breezier.)

Automate Calculations

For both client surveys and calculation forms, Canopy will do the math on the backend for you.

For pesky evaders or evaluating new tax prep clients.

Shelley Loughrin

/ Tampa Tax Relief

Comes in handy when the heat is on and the stakes are high.

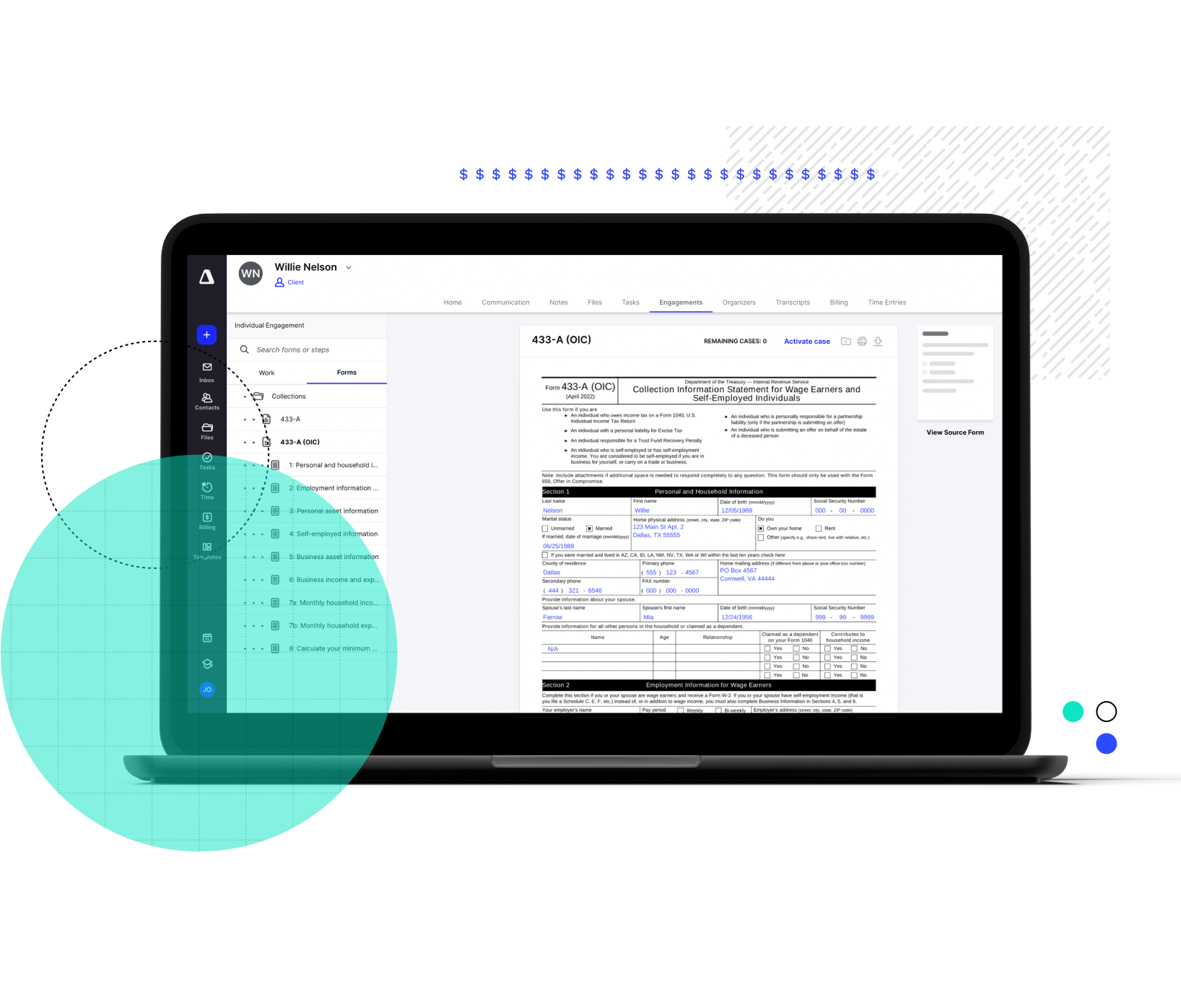

Tax laws and agency procedures are complex and almost innumerable. Canopy helps simplify the work you do to help your clients be compliant. Once you’ve selected the type of case you’re working on for your client, you simply follow the recommended next steps that Canopy has built out (or you can build your own custom step-by-step template).

Collections:

Installment agreements, offers-in-compromise, currently non collectible, liens, levies

Penalties:

Trust fund recovery, first-time penalty abatement, reasonable cause penalty abatement

Spousal Relief:

Innocent spouse relief, separation of liability or injured spouse allocation, equitable relief

Can’t find the answer you are looking for? Reach out to our support team.

Yes! We simplify the entire tax resolution process for accountants! With pre-filled forms, easy data collection via a simple client survey, and automatic payment plan calculations - tax resolution is quick and painless for you and your clients.

Of course. Canopy has the largest tax resolutions database. With 230 forms in our library (including every state's power of attorney and every federal collection form) – rest assured that if there's a form you need, Canopy likely already has it.

No. But once your documentation is processed with the IRS, you will be able to quickly and easily access Transcripts directly within Canopy (see the Transcripts & Notices page for more details).

Submit this form, and we will be in touch soon to give you a custom demo.

Set a time for one of our product specialists to give you a guided tour practice.