On a list of ways to deal with the IRS, “I’ll worry about it later” falls firmly in the Really Bad Idea column. Unfortunately, most of the taxpayers who come to you for help with a lien have probably already received and ignored multiple notices from the IRS.

By the time they’re sitting across the desk from you, a lien has likely already been filed against their assets. Your client is afraid that without intervention, they’re going to have some of their most valued things ripped away from them. To your client, assets such as their home and retirement accounts are more than just the sum of their monetary value. Those assets hold memories and provide security.

So, when your client comes to you and asks, “What can I do?”, they want to hear a clear and confident answer that they have options. Let’s look at one of those options.

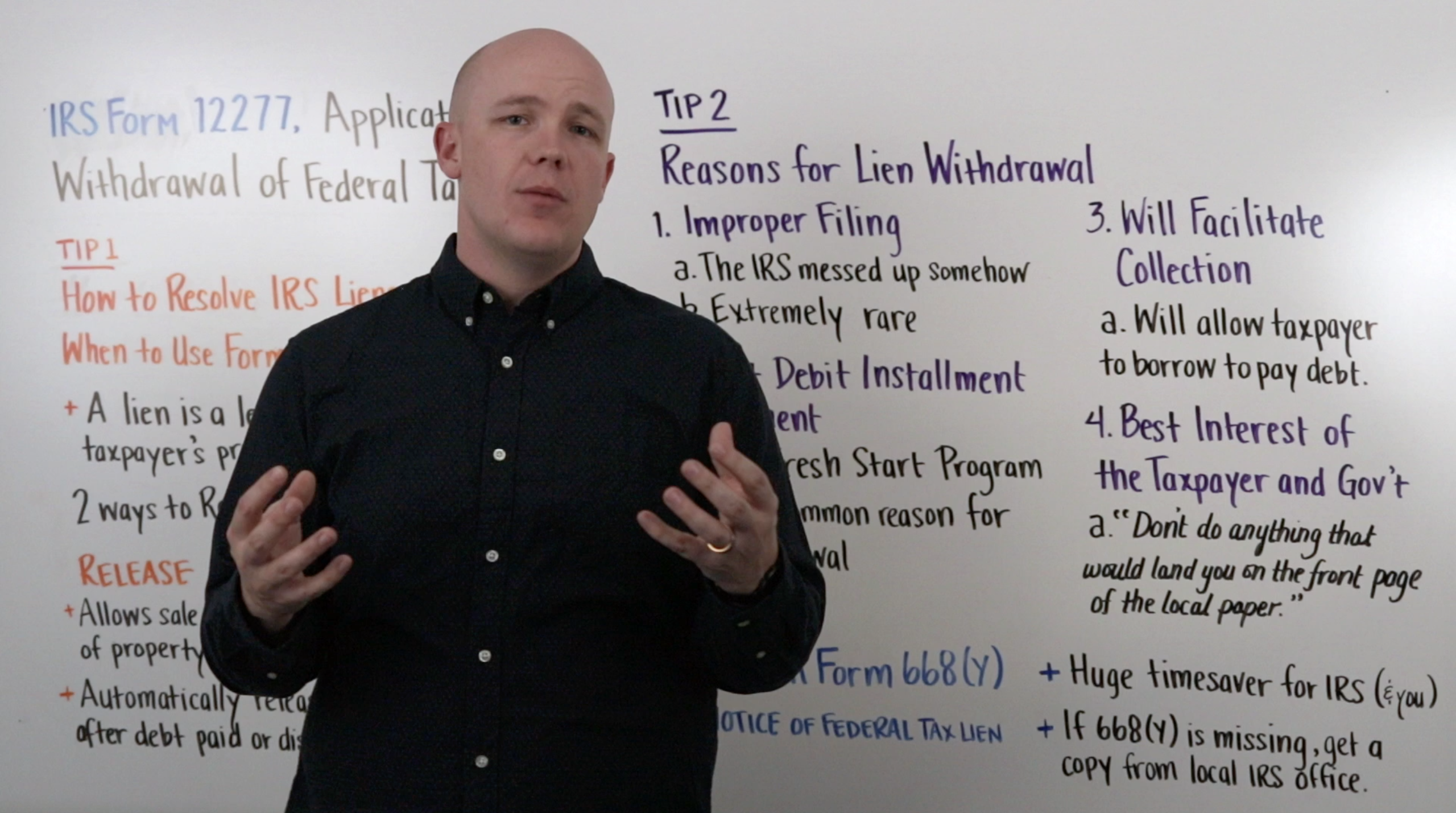

Lien withdrawal

When the IRS withdraws a lien, the lien is erased as though it had never existed. This outcome is ideal for your client, restoring their rights to their property, as well as reviving their credit score to pre-lien status.

The IRS will consider withdrawing a lien in any one of the following circumstances:

The IRS made a mistake in issuing the lien.

The IRS will withdraw a tax lien if the lien was filed “prematurely or not in accordance with IRS procedures” (IRS Form 12277). In other words, the IRS will withdraw the lien if the tax that prompted the lien was assessed in error or if the lien was filed without giving the taxpayer proper notice in advance.

The taxpayer has entered into a Direct Debit Installment Agreement.

The IRS Fresh Start Program allows the IRS to withdraw a lien if the taxpayer has entered into a Direct Debit Installment Agreement. In order to qualify for withdrawal, the taxpayer must have filed all their required tax returns for the last three years and must be current with any estimated tax payments (source).

Withdrawal will facilitate the collection of the tax.

Because a tax lien is so detrimental to a taxpayer’s credit, it will often affect their ability to borrow money. If the IRS can be convinced that withdrawing a lien will allow the taxpayer to borrow money and pay off their tax debt, they will likely withdraw the lien.

Want to learn more about liens and levies and how to help your clients get rid of them? Click here to download our free ebook, A Basic Guide to Liens and Levies.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.