For the average person, receiving a collections notice from the IRS is a very stressful experience, especially if they can’t pay. For a tax practitioner, however, a client in collections is an opportunity to help someone with excessive federal tax debt find alternate options to stop the IRS collection activity.

Common IRS Collection Methods

Liens, levies, and garnishments are collection methods used by the IRS to collect on a federal tax debt. The IRS will use these measures to seize your client’s assets, bank accounts, and any other potential source that will pay off the debt owed. It is important for a tax practitioner to understand the different types of IRS collection methods that are available to the IRS once a tax debt has gone into delinquency.

Liens

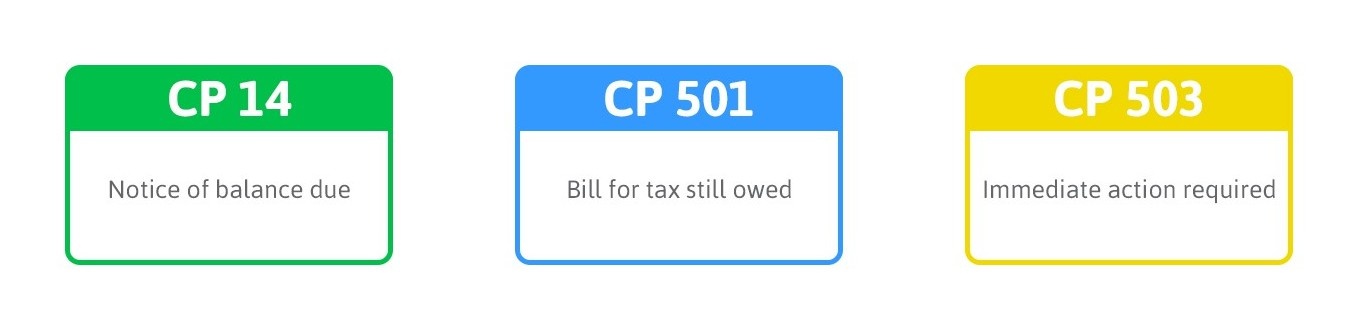

A tax lien is considered a legal claim the IRS has to a taxpayer’s property once a tax debt has been unpaid. The IRS cannot suddenly issue a tax lien; it generally occurs after the deadline has passed and multiple notices have been sent to the taxpayer warning them of collection activity. These notices can include (but are not limited to):

The taxpayer will eventually receive a Notice of Federal Tax Lien, which means the IRS has filed a public document to notify creditors that the IRS has a legal right to the taxpayer’s assets. If the taxpayer has not made a payment, appealed or set up some sort of agreement with the IRS, the the a tax lien will be issued against the taxpayer’s assets. A lien can be placed on any type of asset including a home, automobile, bank account, or rental property. After the lien is issued, the IRS will move forward to levy the assets in order to obtain funds to satisfy the tax debt.

It is important to note that this lien will be reported on a taxpayer’s credit history unless they can have it released or removed. The taxpayer can either pay the debt in full or file Form 12277, Application for the Withdrawal of Filed Form 668. This form will remove the public record so the lien does not appear on the taxpayer’s credit report, but the taxpayer will still be liable for the amount due.

Levies

Once a lien is imposed, the IRS has a legal claim to a taxpayer’s assets so levies are issued in order to seize the taxpayer’s properties, vehicles and bank accounts in order to satisfy the tax debt.

If the taxpayer continues to avoid contact or payment, then the IRS will have the authority to issue multiple levies against the taxpayer’s assets. The funds obtained from these assets will be put toward the taxpayer’s tax debt, but penalties and interest will continue to accrue on the account. This presents a dire situation for taxpayers in collections as their assets will be seized and the penalties and interest on their tax debt will continue to accumulate.

Garnishments

A garnishment is a method to obtain a taxpayer’s salary or earnings to satisfy the tax debt. In this method, a taxpayer’s employer withholds a portion of the taxpayer’s paycheck then submits that portion to the IRS to pay off a tax debt. Garnishments are continuous and remain in effect until the tax debt has been paid off or forgiven – this process can sometimes last for several years.

The IRS can issue wage garnishments on salaries, wages, bonuses, commissions, and even retirement benefits or pension earnings. A garnishment can even reach forms of compensation like social security disability benefits and VA benefits.

How to Obtain IRS Collection Relief

Before issuing any sort of lien, levy or garnishment, the IRS will send several notices to taxpayers alerting them of the potential collection activity. However, if the lien, levy, or garnishment has already been issued, then the taxpayer will need assistance to release the assets seized.

Often times, the levy, lien, or garnishment is the result of an underpayment or nonpayment of tax due to the IRS. If this is the case, the taxpayer or the tax practitioner can simply contact the IRS in order to request a payment plan (formally known as an installment agreement) or an offer in compromise (“OIC”) to settle the tax debt for a lower, agreed-upon amount. Once this payment plan or OIC is set in place, the lien, levy, or garnishment will be released unless the taxpayer does not abide by the terms of the payment plan or OIC. For example, if the taxpayer misses a payment, then the IRS will have the authority to revoke the entire payment plan and go after the taxpayer for the full tax debt owed.

Another source of accumulating tax debt can be missing or incorrect returns. If the taxpayer or tax practitioner simply files or amends these returns, then the tax debt can be significantly reduced. These methods show the IRS the taxpayer wants to be compliant and helps them avoid collection activity. Ignoring or avoiding the IRS is often the most common mistake that will result a lien, levy or garnishment.

IRS Collection Relief Made Simple

Canopy can help tax practitioners navigate through these complex IRS collection methods imposed against their clients. Canopy will use IRS standards to give a recommendation regarding which outcomes are most likely, along with all the directions, forms, and templates needed to provide your client with the best solution available. (Sound easy? It is. Try it for free here.)

Have a client with a mountain of federal tax debt? Find out What You Need to Know About Common Tax Penalties now.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.