The CPA Exam is one of the most difficult professional licensing tests out there, and many accounting students are intimidated by it. Passing the CPA Exam is just one part of becoming a fully licensed CPA in your state. However, to achieve your goals of becoming a Certified Public Accountant, it’s one obstacle that you will have to overcome.

Many students wonder if it’s worth investing all the time, money, stress, and energy into passing the CPA Exam. The good news is that the benefits of earning a CPA license will positively impact your career as an accountant for many years to come. Not only are your potential career paths more diverse, but you’ll be eligible for many leadership and management roles with those letters after your name. Anything worth having requires effort, so don’t let your worries about the CPA Exam stop you from trying.

Rita Keller, a CPA firm management consultant, says, “Having the Certified Public Accountant designation is one of the most prestigious things you can accomplish in your professional life. Nothing worthwhile is easy.”

Here are the 10 most relevant questions that graduating students have about the CPA Exam.

1. Where does the CPA Exam come from?

The CPA Exam is formally known as the Uniform Certified Public Accountant Examination and it is developed by the American Institute of CPAs (AICPA), with input from the National Association of State Boards of Accountancy (NASBA). It is a computer-based test designed to measure the knowledge of entry-level CPAs to ensure that they are capable of representing the industry. The exams are administered at authorized testing centers across the country.

2. How do I apply to take the exam?

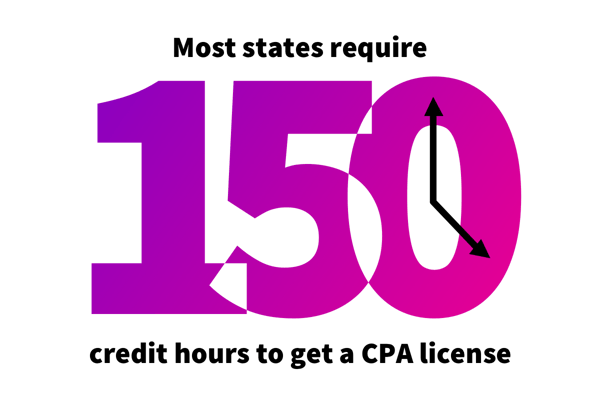

When you are ready to apply for the exam, you must know your state’s education requirements. Most states require 150 credit hours to get a CPA license, but many states allow students to sit for the exam after earning 120 hours. However, these states usually still require the full 150 hours before becoming a licensed CPA. Your state’s board of accountancy will have more details on what specifically is required for you to take the CPA Exam. The cost to take the exam also varies from state to state.

3. When can I take the exam?

Signing up to take the CPA Exam can seem confusing at first, but it’s really not difficult. After authorization from your state board of accountancy, you can register and pay the fee for a section of the exam. You’ll receive a Notice to Schedule (NTS) which allows you to schedule a testing time and date at the official testing center. The NTS is only good for six months before it expires. The testing windows happen throughout the year, usually open for two months and then closed for one month. There are test dates available all year long.

While you can sign up for the exam whenever you feel ready, Keller suggests taking the exam as soon as possible after graduation.

“Taking the CPA Exam is just another step in your educational process,” she says.

4. What is the CPA Exam like?

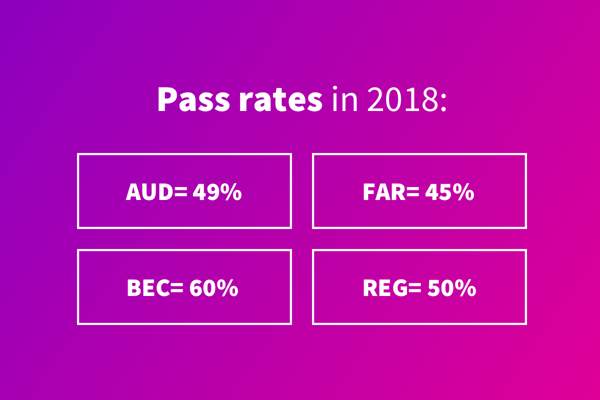

The CPA Exam is comprised of four sections: Auditing and Attestation, Business Environment and Concepts, Financial Accounting and Reporting, and Regulation. These are commonly abbreviated as AUD, BEC, FAR, and REG. Each of the 4-hour exams includes multiple choice questions, written communication tasks, and task-based simulations.

-2.png?width=600&name=Visual_2%20(1)-2.png) 5. How can I prepare to take the exams?

5. How can I prepare to take the exams?

With the breadth and depth of material, it’s wise to get study materials, practice exams and other preparation aids to maximize the chances of passing the exams. There are many commercially available test prep materials as well as exam resources from organizations like NASBA. It’s important to take as many practice tests as you can to identify areas of weakness, so you know where to focus your study efforts.

Also consider asking for advice from other people who have passed the exam.

Keller says, “Don’t feel like you are alone. Seek out your mentors and supervisors at your firm. They want you to pass and can offer ongoing support and encouragement.”

6. In what order should I take the exams?

There’s no requirement for the order you take the exams, and there are a few different strategies that test takers employ. Some feel that it’s best to start with the most difficult topic first, while others recommend beginning with the one that will be easiest.

7. What is the time limit to pass all four exams?

Participants typically have an 18-month window (determined at the state level) in which they must pass all four of the CPA exams. In other words, the credit for passing an exam is good for 18 months. However, if you haven’t passed the fourth exam by the expiration of your first passed exam, you will have to retake the first exam again. It’s important to plan properly so that you are not wasting time and energy.

8. Do most people pass the exams?

You must pass each section with a score of at least 75. All four sections must be passed within an 18-month time frame. In other words, you must pass the last section within 18 months of taking the first test. In 2018, the pass rates for the four exams were: AUD= 49%; BEC= 60%; FAR= 45%; REG= 50%.

9. What if I fail one of the CPA exams?

More people will fail the CPA exams than will pass, especially on the first try. It’s hard to recover after failing one of the exams, but you must redouble your efforts. As soon as you find out you haven’t passed a section, reschedule your next testing date. You are able to retake the CPA Exam as many times as you would like, but only take each section one time per testing window. Focus on the areas that you were weak in and perhaps change up your study patterns to make a difference.

10. What is the CPA Ethics exam?

Many state boards require CPA applicants to pass an ethics exam in addition to the standard CPA Exam. You should check with your state to see if that is part of your testing requirements to become a CPA. The tests vary from state to state, with many choosing the AICPA’s Professional Ethics Exam. Most students focus on the core exams first and then finish with the ethics exam. You can get more information about your state’s ethics exam requirements from your state board of accountancy.

Want to learn about what else it takes to become a CPA aside from the CPA Exam? Check out this blog post.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.