The IRS will often require taxpayers to submit Form 433 in order to resolve a tax matter. This form is extremely important because it will often change the outcome of your client’s tax issue with the IRS. The most commonly used form is Form 433-A. Here's a look at how to navigate Form 433-A, as well as how it differs from other Forms 433.

Form 433-A

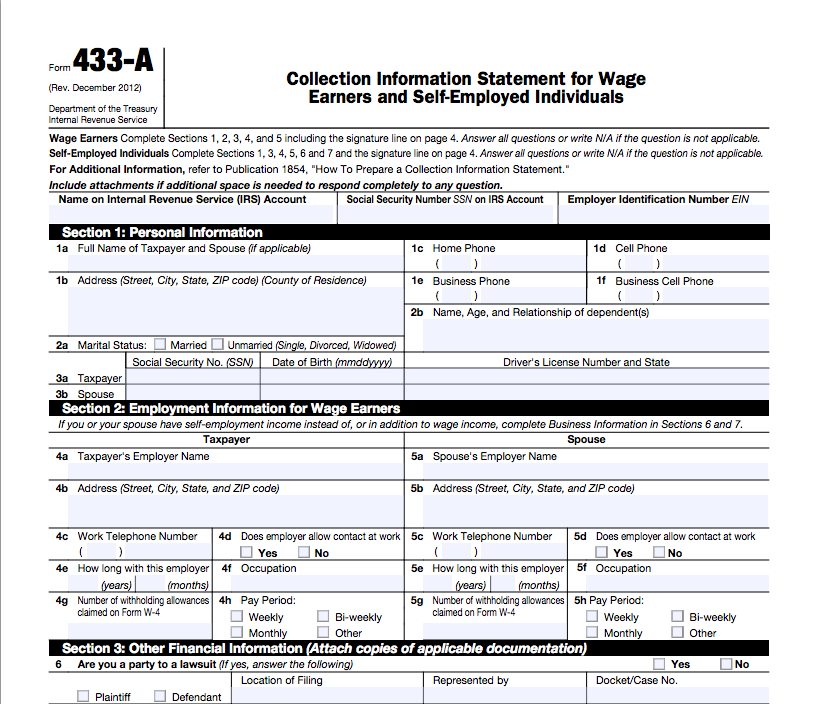

Form 433-A – Collection Information Statement for Wage Earners and Self-Employed Individuals is the form the IRS uses to determine a taxpayer’s financial hardship. Your client must list all their income, expenses, assets, and liabilities. This form will be submitted for multiple reasons, including requests for installment agreements. If approved for an installment agreement, this form will have to be often resubmitted so the IRS can ensure that there have been no changes that would allow your client to afford to pay more of the tax debt. The IRS can demand that your client resubmit this form at any time to reflect their current income and expenses.

Each section of the form will go through the following:

- Section 1: Personal Information

- Section 2: Business Information (if applicable)

- Section 3: Employment Information

- Section 4: Other Income Information

- Section 5: Bank, Investment, Credit, and Insurance Assets

- Section 6: Other Legal Information

- Section 7: Vehicles, Real Estate, Personal & Business Assets

- Section 8: Accounts Receivable

- Section 9: Monthly Income and Expenses

The IRS will scrutinize each section in order to get a clear picture of your client's financial situation. They will compare the family size and expenses of your client to the national standards provided on the IRS website. Your client will need to submit the form along with prior tax returns and proof of all current expenses. It is critical to guide them through this form before they submit their information to the IRS.

Other Forms 433

Form 433-A (OIC) – Collection Information Statement for Wage Earners and Self-Employed Individuals is the same as the standard Form 433, except it is specifically for applications for an offer in compromise. The form is included in the Offer In Compromise Booklet, also known as Form 656.

Form 443-B – Collection Information Statement for Businesses is a financial statement form, similar to Form 433-A, but for businesses.

Form 433-D – Installment Agreement is the actual form used to request installment agreements.

Form 433-F – Collection Information Statement is used for tax debts that are smaller, generally less than $50,000. It is more streamlined and simpler, due to the smaller size of the tax debt. If the tax debt becomes greater, then your client will be required to use Form 433-A instead.

The IRS will ultimately decide which form that your client will be required to submit when determining their financial situation. No matter which form your client must submit, urge them to consult with a tax professional before submitting any information to the IRS.

Want more information on how to help tax resolution clients? Check out A Foolproof Guide to Getting Your Offer in Compromise Accepted.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.