Owning a home comes with certain tax benefits. However, the raising of the standard deduction under the Tax Cuts and Jobs Act of 2017 diminished some of those benefits. The standard deduction is now $12,000 for individual taxpayers and $24,000 for married taxpayers who file jointly. If the itemized deductions for owning a home (plus the other items a taxpayer reports on Schedule A) do not add up to more than the standard deduction for a taxpayer, then it isn’t worth itemizing. In this post we go over the tax benefits of owning a home that are still in place under the new law, as well as the taxes associated with selling a home.

Keep in mind, for a homeowner to claim any of the mentioned deductions, their home must be a qualified residence. A qualified residence is a principal residence or a second home, such as a vacation home. If the second home is rented, the homeowner must personally use the home 14 days or 10% of days rented, whichever is greater. For example, if the home was rented for 200 days, the homeowner would have to personally use the home for 20 days.

For reference, principal residence is defined as where you live. If you have more than one home, the one you physically spend more time at is usually considered the principal residence. Other factors looked at include where your car is registered, what address is on your driver’s license, and where are you registered to vote.

Living in a home

Items that are tax deductible for homeowners while they are living in their home include mortgage interest, points paid at acquisition, and property taxes. To get these deductions, they must be reported on Schedule A. Keep in mind, mortgage insurance is no longer deductible.

Mortgage interest

It used to be that a homeowner could have a first mortgage up to $1 million that they used to buy their home, and they could have an additional $100,000 of a HELOC type loan, and they could deduct the interest on all of it. Now, the total cannot be more than $750,000, and all of the loans have to be used for buying, building, or improving the home.

It was common for people to do a cash-out refi to pay down credit cards and medical bills since the interest was deductible, but they can’t do that anymore. If someone does a cash-out refi now, the interest on the portion of the loan they used to pay off other debt is no longer deductible.

Points paid at acquisition

Points are basically prepaid interest. Prepaid interest is normally not deductible all at once but rather over the life of the loan. The exception to this is points paid on a home mortgage. In order to deduct all of the points paid in the first year, the loan must be for purchasing or improving the principal residence. It must also be common practice in that area to charge points, and they must be a customary amount.

The safe harbor automatically treats points as currently deductible if:

- The settlement statement (or HUD-1) designates the amounts as points, loan discount, discount points, or loan origination fees.

- The amount is calculated as a percentage of the principal loan amount.

- The loan is paid to acquire the principal residence and secured by that residence.

- Points are directly paid by the taxpayer via earnest money, escrow deposit, or down payment at closing.

No part of the points may be lieu of appraisals, property taxes, or other fees normally paid at closing. Although a taxpayer meets the safe harbor rules, the points may still not be deductible in the first year. An example is if a taxpayer pays points with the refinance of their loan, they must amortize them over the life of the loan.

Property taxes

Property taxes are deductible in the year the homeowner paid them. If they are escrowed into their mortgage payment, they are deductible in the year the mortgage company makes the payment. Any combination of state property taxes (whether real or personal property) and state income taxes added together is limited to $10,000. This limit makes it more difficult for taxpayers in high tax districts to get all the deductions they used to get. This limitation is only for personal residences and does not apply to rental properties. Additionally, foreign real property taxes are no longer deductible.

Refinancing a home

What happens to tax deductions if a homeowner refinances their home? There are three main reasons homeowners choose to refinance:

- To get a better interest rate

- Because they want to pay off other debt at a lower interest rate

- To remodel their home

For two out of three of those reasons, the homeowner can still deduct all of the interest. However, as mentioned previously, if they refinance to pay off other debt that has nothing to do with their home, they cannot deduct that portion of the interest. They would need to go through and allocate their interest as deductible and non-deductible.

Working from home

Those who are self-employed and work from home may qualify for the home office deduction. The deduction is no longer available for those who aren’t self-employed. To qualify, taxpayers must meet the following conditions:

- They have a dedicated space used exclusively and regularly for business.

- They do not conduct substantial administrative or management activities at another location.

For example, a dining room typically wouldn’t meet the qualifications for a home office, even if it’s where a homeowner does their work. Used “regularly” means it’s a location where the homeowner runs their business from whether that means meeting with clients, take phone calls, etc. Not conducting substantial administrative or management activities at another location means that you don’t do your billing, paperwork, etc. from somewhere else.

Activities that will not exclude a taxpayer from qualifying for the home office deduction include:

- Having others conduct administrative or management activities at locations other than the taxpayer’s home office (billing activities for example).

- Carrying out administrative and management activities at sites that are not fixed locations of the business (such as cars or hotel rooms) in addition to performing the activities at the home office.

- Conducting an insubstantial amount of administrative and management activities at a fixed location other than the home office. For example, occasionally doing minimal paperwork at another fixed location.

- Having suitable space to conduct administrative or management activities outside of the home but choosing to use the home office for those activities instead.

- Conducting substantial non-administrative and non-management business activities at a fixed location other than the home office. For example, meeting with or providing services to customers, clients, or patients at another fixed location.

What you can deduct with the home office deduction

100% of direct business expenses, such as office supplies, are deductible.

Mortgage interest and property taxes will be allocated, as will other expenses that are not typically deductible unless the homeowner has a home office for business use. The allocation is based on square footage. You take the square footage of the office space and divide it by the total square footage of the house. You would then take that percentage of mortgage interest, property taxes, and other expenses (such as homeowner’s insurance, utilities, HOA dues, repairs to the home, cleaning services, and any other expenses that can partly be attributable to the business) and deduct those as part of your home office deductions.

Even though interest and property taxes are deductible on Schedule A, if the homeowner runs a Schedule C business, these items reduce the income for paying self-employment taxes. If the total of these expenses amount to more than what their net income is, they can only reduce it down to $0. The mortgage interest and property taxes will carry over to Schedule A and the rest will carry over to the following year.

To claim the home office deduction, the taxpayer has to be able to substantiate their claims with receipts and/ or copies of checks. They have to provide documentation for their expenses, and they technically need to be able to pass an on-site exam if someone were to show up to their house and say, “Show me your office.”

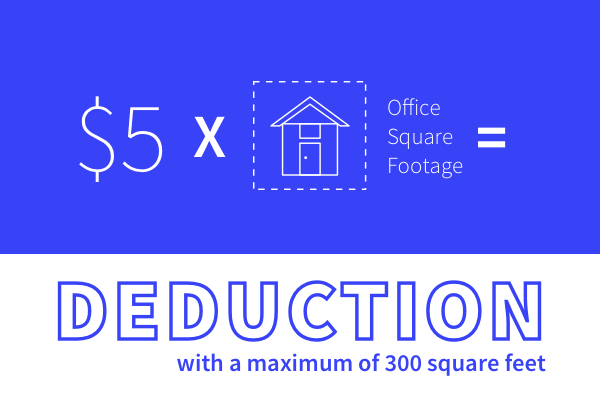

Safe harbor test

There’s also a safe harbor test under the home office deduction. Under the safe harbor test, the taxpayer doesn’t have to keep track of expenses or documentation, they can just use the equation: $5 x office square footage= deduction, with a maximum of 300 square feet for a maximum of a $1,500 deduction.

The caveat to using the safe harbor is that the taxpayer cannot carry over any excess if it is more than the net income.

Selling your principal residence

It used to be simple to not pay taxes on selling a principal residence. If the homeowner took the money from the sale and bought a new home that cost as much or more, they had no taxes to pay. However, that rule changed in May 1997. Now there are ownership, usage, and timing tests one has to meet, even if they buy a new house.

Individual taxpayers can exclude up to $250,000 gain on the sale/ exchange of their principal residence. Married taxpayers filing jointly can exclude up to $500,000. To get the $500,000 maximum deduction, married taxpayers must meet the following requirements:

- Either spouse meets the ownership test

- Both spouses meet use test

- Neither spouse has used exclusion in the previous two years

The ownership test is that the home was owned by the taxpayer for two of the last five years. The use test is where the taxpayer used it as their principal residence for at least two of the last five years. Both of these two-year requirements are based on the closing date, not December 31. If the taxpayer sold a house on January 7, 2019, then the date to go back to would be January 7, 2017.

A surviving spouse can use the $500,000 exclusion if the sale of their house occurs within two years of the death of their spouse and both spouses satisfied all of the above requirements.

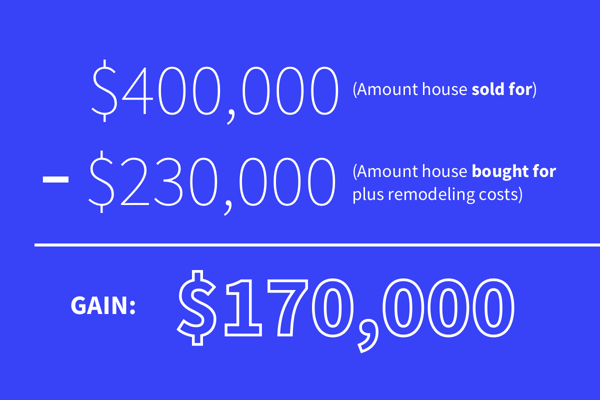

Calculating gain

Gain has nothing to do with how much equity an owner has in their house, how much they owe on the house, or how much cash they get when they sell the house. To determine gain, start with how much the taxpayer bought the house for. For example, maybe a taxpayer bought their house for $200,000. If they remodeled or landscaped while they lived there, those costs would be added to the $200,000. If those costs were $30,000, the starting point for calculating gain would be $230,000. If the taxpayer sold the house for $400,000 five years later, the equation for calculating gain would be:

$400,000 - $230,000 = $170,000

The gain would be $170,000. If the taxpayer was single, that gain would be compared to the exclusion limit of $250,000. Since the gain is lower than the exclusion limit, the taxpayer wouldn’t owe any taxes on the sale of the house.

Keep in mind, in this blog post we covered some of the most basic rules around homeownership and taxes. As with most rules, there are exceptions. The most common exceptions are related to being a member of the military or other reasons that a taxpayer may have in moving and selling a primary residence less that two years after the prior exclusion. There are also other requirements that apply if the taxpayer rents part of their home, acquired it in a like-kind exchange, or it was a rental property in the past. If a homeowner has more complicated situations such as these, they should be sure to research the rules.

Interested in reading more tax preparation articles? Check out this section of our blog.

This post was originally published on the Latino Tax Pro blog.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.