The tax landscape is constantly evolving, and this year brings many changes and updates that can significantly impact your financial situation. We've covered you, from the Inflation Reduction Act to the latest developments in Student Loan Forgiveness, Annual Adjustments, and COVID-19 Retirement Distribution Repayments. We'll also explore the latest form updates, tax exemptions, and required minimum distributions and take a closer look at the proposed legislation that could shape the future of taxation. So, if you're wondering what to expect and how to navigate the complexities of this year's tax season, stay tuned for insights, tips, and essential updates that will help you make informed financial decisions. Let's dive into the world of taxes and prepare you for the 2023 tax season and all the individual updates you need to know!

Inflation Reduction Act

Subheading 1.1: Affordable Care Act Subsidies

For a long time, we had to qualify for the subsidy; the taxpayer had to have income between 100% and 400% of the federal poverty level, and the 100% went away. After that, we had a qualification that was not based on the federal poverty level but was instead based on the insurance cost compared to the family household income.

So, the question became how much the marketplace insurance cost compared to how much the family household income was. And, of course, family household income will include the income of anyone living in the home. As of December 31, 2022, that percentage was 8.3%, increasing to 9.12%. If you doubt whether the cost of health insurance is rising faster than wages, here's confirmation: the United States government is unequivocally stating that health insurance costs are increasing. They are doing so at a rate faster than wages.

Subheading 1.2: Energy-Efficient Home Improvement Credit

The Inflation Reduction Act introduced significant changes to the energy credit program. Formerly known as the nonbusiness energy property credit, it had limitations such as a 10% credit rate, a lifetime maximum of $500, and limited eligibility. Under the name "energy efficient home improvement credit," these limitations are replaced with a 30% credit rate and an annual maximum of $1,200. This extended and improved credit applies to both primary residences and second homes in the United States, offering taxpayers greater opportunities to receive tax credits for energy-efficient home improvements starting in January 2023 and lasting nearly a decade.

Subheading 1.3: Clean Vehicle Credit

A new initiative called the Clean Vehicle Credit aimed to promote battery-operated cars. Under the previous credit, manufacturers phased out after selling 200,000 vehicles to encourage the adoption of battery-powered cars. However, this limitation has been removed in the new credit, benefiting companies like Tesla and General Motors, which had already reached the previous cap.

The Clean Vehicle Credit offers a substantial maximum credit of up to $7,500 for qualifying vehicles. To qualify, the vehicles must have final assembly in North America, meet manufacturing and battery assembly specifications, have a minimum battery capacity, and meet price limits of $80,000 for vans, SUVs, and trucks and $55,000 for all other vehicle types. This change in the credit system has significant implications for the electric vehicle industry.

Modified Adjusted Gross Income (MAGI) limitations for “Clean Vehicle Credit”

- $300,000- (MFJ, QW)

- $225, 000 (HOH)

- $150,000 (all others)

Another interesting thing about this credit is that the taxpayer can transfer the credit to the dealer, which then reduces the vehicle's purchase price. Also, if somebody goes above the income limits, they must repay it, and the credit will be reconciled on their 1040.

Subheading 1.4: Previously Owned Clean Vehicle Credit

People who buy a used electric car can qualify for a credit, with some very strict limitations. So, first off, the credit is less than $4,000 or 30% of the sale price. However, the vehicle's sale price can be at most $25,000. The Previously Owned Vehicle Act comes with additional requirements. To qualify for the credit, the car must be at least two years old, with a model year two years earlier than the calendar year when the taxpayer purchases it. The original owner must be someone other than the taxpayer. Shenanigans are not allowed to acquire the vehicle; it must be obtained through a qualified sale meeting the same criteria as new vehicles, including final assembly in America and battery requirements. Dependents of other taxpayers are not eligible for this credit to prevent potential misuse.

Modified Adjusted Gross Income (MAGI) limitations for “Previous Owned Clean Vehicle Credit Act:

- 150,000 (MFJ, QW)

- $112,500 (HOH)

- $75,000 (all others)

Subheading 1.5: Commercially Owned Vehicles Credit

Qualified commercial electric vehicles can qualify for a taxpayer credit, with the credit amount being 15% of the vehicle's basis or 30% for vehicles not powered by gas or diesel engines. The IRS will guide the maximum credit, up to $7,500 for vehicles rated under 14,000 pounds and up to $40,000 for heavier vehicles.

To qualify, the vehicle must have a battery capacity of at least 15 kilowatt-hours (7 kilowatt-hours for lighter vehicles) and must be charged by an external source of electricity. Mobile machinery and qualified commercial fuel cell vehicles are also eligible.

These qualifying vehicles must be depreciable property for trade or business, not personal use. Additionally, the state and local tax limitation (salt provision) is set to expire at the end of 2026, providing an extension beyond its original expiration date in 2025.

Student Loan Forgiveness

Pell Grants, which used to cover 80% of college costs, now only cover 33%, leaving the typical undergraduate student with around $25,000 in debt upon graduation. This is a significant issue for many students, and it's worth noting that this debt figure is for undergraduate education alone, not including higher degrees like doctorates or law degrees.

Fun Fact: The cost of four-year colleges has tripled since 1980.

Subheading 2.1- No Student Loan Interest Act

The "No Student Loan Interest Act" proposes setting the interest rate at zero percent for certain federal student loans. This applies to existing loans made under the federal family education loan program or the federal direct loan program, with the first disbursement created before July 1, 2022, as well as new loans made under the federal direct loan program with the first disbursement made on or after July 1, 2022. It's important to note that this act has yet to pass; it remains a proposal.

Subheading 2.2 - Biden’s Plan

This act, currently halted in court, aimed to offer targeted debt relief. Pell grant recipients with Department of Education-held loans could receive up to $20,000 in debt cancellation, while non-Pell grant recipients could receive up to $10,000. These amounts were capped at the total debt. Income restrictions were relatively generous, with $125,000 for individuals and $250,000 for married filing joint filers. The act also extended the pause on student loan repayments through December 2022, limited borrowers' monthly payments to 5% of discretionary income for undergraduate loans, and increased the income threshold for loan balance forgiveness after ten years of payments for those with $12,000 or less. Additionally, unpaid monthly interest would not be taxable as debt cancellation income at the federal level, though state tax implications may vary. However, due to legal challenges, the outcome of this act remains to be determined.

Fun fact: Current student loan debt is rising at 1.6 trillion dollars.

Annual Adjustments & Timely Reminders

Subheading 3.1: Filing Thresholds:

To determine whether clients need to file a tax return, the income thresholds vary based on age and filing status. Here are the minimum income requirements:

- Under age 65: $12,950

- Age 65 or older: $14,700

- Household under age 65: $19,400

- Household age 65 or older: $21,150

- Married filing jointly (twice the single amount): Varies

- Married filing separately (any age): $5

- Qualified widow(er) under age 65- $25,900

- Qualified widow(er) age 65 or older- $27,300

Subheading 3.2: Standard Deduction

The qualified widow and widower on the 1040 has been changed from QW to QSS-qualified surviving spouse. As you can see here, the IRS has yet to change it in all of its documentation, which will take a while. But as you'll see, when we go through the 1040 changes, it's now QSS.

The standard for MFJ and QSS, twenty-five thousand nine hundred, had a household of nineteen thousand four hundred, single twelve thousand nine fifty, married filing separately, twelve thousand nine fifty. Now, remember the standard deduction for married filing separately. They either both have to take the standard deduction, or they both itemize.

If you have two people who are married and filing separately, we don't get to have a situation where one of them, because, of course, we know this would happen. One takes the standard deduction, and the other takes all the itemized deductions for the couple. So that's what the IRS is trying to prevent by having this rule that MFS either takes the standard or itemized it.

Additional deductions for age or blindness, MFJ, and QSS get an extra fourteen hundred dollars, and single or head of household receives an extra seventeen fifty. You don't get double if you're both old and blind, by the way. You don't get to hit this twice. You get one or the other, but you don't get to double it.

Subheading 3.3 : Dependent Standard Deduction

Only under earned income, the standard deduction is one thousand one hundred and fifty dollars earned and earned unearned income. The standard deduction is eleven fifty or earned income plus four hundred dollars not to exceed the normal standing deduction for the filing status, and whichever is the greater of those two, the eleven fifty or the earned income plus four hundred dollars. So that's the dependent standard deduction.

Subheading 3.4: Who is not eligible for the standard deduction?

Regarding tax filing, there are some unique situations to consider. One of them is married couples choosing to file separately. If one spouse decides to itemize deductions, then both partners must follow suit and itemize. However, there are exceptions. Individuals who are non-resident or dual-status aliens during the year, those who file a return for less than twelve months due to a change in their annual accounting period, and state or trust common trust partners fall into different categories.

Interestingly, regardless of the date, even as early as January 2, someone who passed away during the year is entitled to the full standard deduction. The standard deduction remains unaffected by death; it doesn't get prorated as it does for changes in accounting periods. Understanding these nuances can make a significant difference when navigating the complexities of tax season.

Subheading 3.5: Personal exemptions

The Tax Cuts and Jobs Act brought significant changes, including the repeal of the personal exemption until 2025. However, understanding this number remains crucial for various purposes, such as defining the income threshold for someone to qualify as a dependent. The key figure to keep in mind is $4,400. Although we no longer have a personal exemption in the traditional sense, when determining if someone earns too much to be considered a dependent, the magic number to remember is $4,400. This knowledge can be invaluable for taxpayers navigating the intricacies of the U.S. tax code.

Subheading 3.6: Educator expenses

The Teacher's Tax Credit, initially introduced as a temporary deduction in 2002 and 2003, has a rich history spanning two decades. Originally set at $250 per teacher, married couples who were both educators could claim $500. Over the years, this deduction was extended six times. However, the Protecting Americans from Tax Hikes Act (PATH Act) of 2015 made this credit a permanent fixture. While it's a positive step forward, the credit has only been bumped up to $300, which, when considering inflation, falls short of the mark. Had the initial $250 from 2002 been adjusted for inflation, it would be worth $411 today. This increase is appreciated, but it doesn't truly reflect the financial burden that teachers often bear when buying classroom supplies, as any educator will readily attest.

Subheading 3.7: Education credits

The tuition and fees deduction is no longer available, and it's been gone for a while. Not many folks used it more than once in their careers, so the IRS bid it farewell. Now, the focus is on the Lifetime Learning Credit and the American Opportunity Tax Credit. In the past, these credits had different phase-out income limits, allowing some flexibility for taxpayers. However, that's no longer the case. Both credits now share the same phase-out amounts. For single filers, the phase-out occurs between $80,000 and $90,000 of income, completely phasing out at $90,000. If you're married and filing jointly, the phase-out begins at $160,000 and maxes out at $180,000. Remember that non-resident aliens can't claim these credits unless they treat their non-resident alien spouse as a resident alien. Married couples filing separately are also excluded, a common practice in the tax code to prevent potential manipulation. Lastly, if you're a dependent on someone else's tax return, these education credits won't be in your financial playbook. Stay informed to make the most of these opportunities when filing your taxes!

Subheading 3.8 : Medical Deductions/Contributions

For 2022, the per diem limitation for long-term care benefits remains at $390 per day, mirroring the figures from the previous year. Regarding long-term care premium deductions, the numbers vary depending on your age. If you're aged 40 or below, you can deduct $450 on Schedule A. For those between 41 and 50, the deduction increases to $850, while those aged 51 to 60 can deduct up to $1,690. As you move into the age bracket 61 to 70, the deduction jumps to $4,510, and for those over 70, it's $5,640.

Now, here's some good news. Tax software often automates this process, ensuring you stay within the maximum allowed deduction based on age. Shifting gears to Health Savings Accounts (HSA), in 2022, the contribution limit for self-only plans is $3,650, while family plans allow for double that amount at $7,300. However, these figures are set to increase in 2023, with self-only contributions rising by $200 to $3,850 and family plans increasing to $7,750.

If you or your clients are considering catch-up contributions for HSA, individuals aged 55 and older can contribute an extra $1,000. However, it's essential to note that HSA contributions must cease when the account holder enrolls in Medicare. Contributions can be made until April 15 of the following year, providing extra time for those who may have overlooked this aspect of their financial planning. Remember, though, no extensions are granted, even if you've extended your tax return deadline. So, remember these figures and deadlines to make the most of your tax planning opportunities.

Subheading 3.9: Non-refundable Adoption Credits

In 2022, finalized adoptions come with a valuable perk – the federal adoption tax credit, which can reach a substantial sum of up to $14,890 per child. However, it's important to note that this credit is non-refundable. There are specific qualifications in place to be eligible for this tax credit. Firstly, the child being adopted must not be a stepchild; they should be under eighteen or physically and mentally unable to care for themselves. Additionally, your income must fall within certain limits. For the tax year 2022, families with a modified adjusted gross income below $214,520 can claim the full credit – quite a substantial amount, right? But as your income approaches $263,410, the credit gradually phases out until it's fully phased out. Here's an interesting twist: families finalizing the adoption of a child with special needs in 2022 can claim the full credit, regardless of whether they had any adoption-related expenses.

On the other hand, for non-special needs adoptions, the credit is limited to the expenses incurred, capped at $14,890. Furthermore, employees can exclude any amounts paid or heard by their employer from their gross income under an adoption assistance program. So, if you're considering adoption, these tax credits could provide significant financial support during this beautiful journey of expanding your family.

Subheading 3.10: Gift Tax Exclusion

- 2004-2005 $11,000

- 2006-2008 $12,000

- 2009-2012 $13,000

- 2013-2017 $14,000

- 2018-2021 $15,000

- 2022… $16,000

Subheading 3.11: Exclusion for Estates and Gifts

- 2021 exclusion was $11,700,000

- 2022 exclusion is $12,060,000

- Doubled due to TC&JA and is set to expire in 2026

- In 2021, 3,442 (about 0.1%) of estates had to file an estate tax return due to exceeding the exemption amount.

Subheading 3.12: Social Security

In 2022, the average monthly social security benefit is $1,657, offering crucial financial support to retirees. It's important to note that the full retirement age gradually increases from 65 to 67, impacting when individuals can claim their full benefits. If you decide to work while receiving social security and have yet to reach full retirement age, your benefits may be reduced. For those under full retirement age, there's an earned income limit of $19,560, meaning your benefits might be affected if you earn more than this amount. However, once you reach the year of your full retirement age, this limit increases to $51,690. The good news is that after you've hit your full retirement age, there's no limit on your earned income, giving you more flexibility in managing your finances during your retirement years. Understanding these key aspects can help you make informed decisions about your social security benefits as you plan for a comfortable retirement.

|

Year of Birth |

Full Retirement Age |

|

1955 |

66 Years & 2 Months |

|

1956 |

66 Years & 4 Months |

|

1957 |

66 Years & 6 Months |

|

1958 |

66 years & 8 Months |

|

1959 |

66 years & 10 Months |

|

1960 and Later |

67 Years |

Subheading 3.13: Standard Mileage Rates

In the ever-evolving world of tax regulations, staying on top of changes that might affect your financial situation is crucial. For the first half of this year, the business mileage rate stood at 58.5 cents, which many of us are familiar with. However, in the year's second half, it bumped slightly to 62.5 cents. Medical and moving expenses increased from 18 to 22 cents for the latter half. Meanwhile, security expenses remained steady at 14 cents. While the exact origins of these rates may seem shrouded in mystery, one constant is the unchanging debt component.

However, what has yet to shift is the depreciation component of business mileage, which typically constitutes about half of the standard mileage rate. Surprisingly, despite the rate adjustment, this component remained untouched. Why? Well, the culprit behind the rate fluctuation is the price of gas. Thankfully, this means that the depreciation aspect remains consistent throughout the year.

So, when your clients come knocking with their questions and confusion, some might come armed with meticulous calculations for both halves of the year, while others might look at you a bit lost. How you handle this discrepancy is where your personal touch comes into play. Whether you advise a simple cut-in-half approach or guide them through the intricacies, your expertise, and style make all the difference in navigating these tax changes. Stay informed, stay adaptable, and keep helping your clients make sense of the ever-changing tax landscape.

|

Standard Mileage Rates |

Jan 1 – June 30 |

July 1 – Dec 31 |

|

Business mileage |

58.5 cents |

62.5 cents |

|

Medical and moving |

18 cents |

22 cents |

|

Charity |

14 cents |

14 cents |

Subheading 3.13: Medicare Part B & 2022 Premiums

Navigating Medicare can be a financial rollercoaster, and here's the twist: your Part B premium can skyrocket based on your income. In 2022, the standard Part B premium is $170.10, but for individuals with an income below $91,000 or $182,000 for couples. Now, brace yourself. The premium takes off like a rocket if your income exceeds these thresholds. For those earning between $91,000 and $114,000 for individuals, or $182,000 to $228,000 for couples, that $170.10 turns into $238.10 per month – that's a $68 jump. But wait, there's more! If you're in the next income bracket, $114,000 to $142,000 for individuals or $228,000 to $284,000 for couples, your premium skyrockets to a staggering $340.20 per month, double the standard amount. So, if you suddenly find your income soaring due to a property sale or a crypto windfall, don't be shocked when your Medicare Part B premium follows suit two years later. It's essential to inform clients about this potential financial shock and advise them on filing the necessary SSA forms to address unusual income changes. After all, nobody wants to be blindsided by a doubled Medicare bill.

COVID Repayments

In 2020, amidst the chaos of the COVID-19 pandemic, the IRS introduced a unique provision - the Coronavirus Disaster Retirement Plan Distributions. This program allowed individuals to withdraw up to $100,000 from their IRAs or retirement plans without facing the usual 10% penalty. What made it remarkable was the self-certification aspect; it wasn't about proving how severely the pandemic had impacted one's life, but rather a flexible measure to help people navigate the financial challenges posed by the pandemic. The idea was simple: empower individuals to access their retirement funds as a lifeline during these uncertain times. While it might have raised eyebrows for some, it demonstrated a commitment to supporting those facing financial turmoil due to the pandemic.

Subheading 4.1 The 8915 Series

Form 8915-F is a revamped version of the old Form 8915. Starting in 2021, there won't be additional alphabetically labeled versions of this form (like Form 8915-G or Form 8915-H). Instead, Form 8915-F will be used for reporting distributions related to qualified 2020 disasters and any qualified disasters that may occur in 2021 and beyond, if applicable. The checkboxes in items A and B on the form help identify the specific year and nature of the reported disaster-related distributions. Previously, there were separate forms for each year's disasters.

So, who should file Form 8915-F? Anyone who received a qualified disaster distribution from an eligible retirement plan received a qualified distribution, included a qualified disaster distribution from a prior year in their income over three years (with that period still ongoing), or made a repayment of a qualified disaster distribution. It's important to note that this form is still necessary if none of the distribution was reported as taxable income in 2020. Also, remember that the repayment deadline is based on the distribution date, not the tax return due date.

Subheading 4.2: Kiddie Tax

The "Kiddie Tax" is a provision that affects children's taxation, and it applies if a child meets certain criteria. Firstly, a child must be under 18 at the end of the tax year or be between 19 and 24 and a full-time student without earning more than half of their support. Additionally, they should have unearned income exceeding $2,300, including various types of income like interest, dividends, and more. If a child's parent is alive at the end of the tax year, and the child must file a tax return but doesn't file a joint return, the kiddie tax applies. These rules also extend to legally adopted and stepchildren, regardless of their dependent status. The kiddie tax means a child's income may be taxed at their parents' higher marginal tax rates. This tax is reported using either Form 8615 for the child or Form 8814 on the parent's return. Understanding these rules is crucial for families to navigate their tax responsibilities effectively.

2022 Revisions for the Form 1040 S

Subheading 5.1: Changes to Schedules 1 through 6

- Schedule 1: Net operating loss and gambling income are still there, but other items like cancellation of debt, foreign earned income exclusion, and taxable health savings account distributions have made their way into the spotlight. There's also a mention of activities not engaged in for profit, including hobby income and stock options. Surprisingly, there's even a line item for Olympic medal winners!

- Schedule 2: Line 8 now includes a checkbox that says, "If not required, check here." Oddly enough, they still need to explain this change. Also, "The Advanced Child Tax Credit" payments are no more; for many, that's not a cause for sorrow.

- Schedule 3: We observe a new feature on line E, which is divided into two parts: the alternative motor vehicle credit (Form 8910) and the qualified plug-in motor vehicle credit (Form 8936).

- Schedules 4, 5, and 6: The End of Pandemic Changes Schedule 4 has bid farewell to more pandemic-related items. Likewise, Schedule 5 and Schedule 6 have seen the end of pandemic changes. This gives us a glimpse of Schedule 8812 for 2022, though it's important to note that this information is based on a draft version.

Subheading 5.2: Charitable Deductions & Limits

The rules surrounding charitable contribution deductions can be complex, but they're essential to understanding for anyone looking to maximize their tax benefits while supporting charitable causes. Generally, individuals can deduct up to 60% of their Adjusted Gross Income (AGI) when it comes to cash donations. Noncash contributions, on the other hand, have a lower limit at 50% of AGI. However, contributions to specific organizations like veterans' groups and nonprofit cemeteries have a further reduced limit of 30% of AGI. This 30% limit also applies to gifts of long-term capital gain property unless the donor chooses to reduce the property's Fair Market Value (FMV) by the potential long-term capital gain amount, in which case the 60% limit applies.

Here's an important update: In 2021, the Taxpayer Certainty and Disaster Relief Act suspended the 60% limitation on cash charitable contributions, allowing taxpayers who itemized and donated cash to deduct up to 100% of their AGI. This was a temporary provision for that year only, and it's crucial to note that the 100% deduction limit expired after 2021 and has yet to be extended to 2022. Therefore, while the tax landscape can change, staying informed about the latest regulations and consulting a tax professional to make the most of your charitable giving while staying within the established limits is always advisable.

Subheading 5.3: Charitable Deduction Carryover

Regarding charitable contributions and taxes, it's essential to understand how income limitations can impact your deductions. If you cannot fully deduct your charitable contributions in a given year due to income restrictions, there's a silver lining. The tax code allows you to carry over the excess amount for up to five years, offering some relief. However, it's crucial to be aware that any remaining charitable contribution carryover beyond that period will be forfeited. Additionally, it's important to note that the same income limitations that applied in the year the initial contribution was made will continue to apply to the carryover years. So, while this provision provides flexibility for those facing income restrictions, planning your charitable giving strategy thoughtfully is essential to maximize your deductions effectively.

Tax Extenders

Subheading 6.1: Mortgage Insurance Premiums

Premiums paid or accrued for qualified mortgage insurance, commonly referred to as private mortgage insurance (PMI), in connection with acquisition indebtedness pertaining to a qualified residence of the taxpayer are treated as qualified residence interest. As such, they are deductible on Schedule A, Itemized Deductions. However, it's important to note that as of the current information available, the deduction for PMI premiums has not been extended to the tax year 2022. Taxpayers should stay informed about any updates or changes to tax regulations that might affect their eligibility for this deduction.

Subheading 6.2: Principal Residence Indebtedness Exclusion

The Taxpayer Certainty and Disaster Tax Relief Act has brought significant financial relief for homeowners. This Act retroactively extended the exclusion from income for discharges of qualified mortgage debt on a taxpayer's principal residence, allowing for up to $750,000 ($375,000 for married individuals filing separately) for discharges occurring after 2020. This exclusion comes into play when taxpayers face various homeownership challenges, such as restructuring their acquisition debt, foreclosure on their principal residence, or engaging in a short sale. Moreover, the Consolidated Appropriations Act of 2021 further extends this valuable provision, ensuring that the qualified principal residence indebtedness exclusion remains in effect for tax years before January 1, 2026. This extension provides homeowners with much-needed financial flexibility and security during these uncertain times.

Subheading 6.3: Child Tax Credit

The Child Tax Credit (CTC) is a significant financial benefit for families with qualifying children under the age of 17. It offers a tax credit of up to $2,000 per child, and up to $1,500 of that amount is refundable, meaning that even if your tax liability is lower than the credit, you can still receive a portion as a refund. However, it's essential to note that the child must have a Social Security number (SSN) to qualify for this credit. Another noteworthy aspect of the CTC is that it's available for married individuals filing separate (MFS) returns, offering flexibility in claiming the credit. Additionally, when determining who gets to claim the credit, the parent claims the child on their tax return, regardless of custodianship. Finally, be aware that phaseouts for the CTC, which are not indexed for inflation, kick in when your Adjusted Gross Income (AGI) exceeds $200,000 for single filers and $400,000 for those filing jointly, gradually reducing the credit amount as income rises.

Subheading 6.4: Child Tax Credit Expired Provisions

In 2021, significant changes were made to the Child Tax Credit (CTC) in response to the COVID-19 pandemic. The age limit for a qualifying child was extended to those under 18, and the credit amount saw a substantial boost, with $3,000 allocated per child and an impressive $3,600 for those under the age of 6. Additionally, new phaseout thresholds were introduced to determine eligibility, with limits set at $150,000 for married filing jointly or qualifying widow(er) statuses, $112,500 for heads of household, and $75,000 for single filers or married individuals filing separately. An important development was that the credit became 100% refundable for most taxpayers in 2021, providing a significant financial benefit. Furthermore, advance child tax credit payments were introduced to help families receive this vital support throughout the year. However, it's essential to note that these enhanced provisions exclusively applied to the 2021 tax year, and as of now, they have yet to be extended into 2022, signaling a shift in the landscape of this important tax benefit.

Subheading 6.5: Dependent Care Tax Credit Expired Provisions

The Child and Dependent Care Credit underwent significant changes in 2021, offering valuable benefits that unfortunately expired at the end of that year. These provisions included a maximum eligible expense limit of $8,000 for one qualifying person or an impressive $16,000 for households with two or more qualifying individuals. Additionally, the credit rate increased to 50% for those with an income of $125,000 or less, providing substantial relief but phased out entirely for those earning more than $438,000. A key feature was that the credit became refundable in 2021, benefiting taxpayers (or their spouses if filing jointly) who resided in the United States for over half the year. Furthermore, the expansion included a higher exclusion amount of $10,500 (or $5,250 for those filing separately) for employer-provided dependent care assistance.

Subheading 6.6: Earned Income Tax Credit

First and foremost, the minimum age to claim the EIC for childless individuals was lowered from 25 to 19, although full-time students needed to be at least 24 years old. Additionally, the maximum age limit of 65 for claiming the childless EIC was completely eliminated, allowing more individuals to qualify. This change also substantially increased the maximum EIC amount, which reached a high of $1,502.

However, it's important to note that these changes were only specific to the 2021 tax year. In 2022, the rules reverted to a narrower age range for those claiming the EIC without children, aged 25 to 64, and the maximum EIC amount decreased to $560. Taxpayers must stay informed about such changes and adapt their tax planning accordingly to make the most of available credits and deductions.

Subheading 6.7: Premium Tax Credit

In Section 36B of the tax code, a noteworthy provision comes into play for individuals who received unemployment compensation during 2021. If you find yourself in this situation, here's what you need to know: Firstly, you'll be considered an "applicable taxpayer" for this section. Secondly, the calculation of your eligibility for the refundable credit for coverage under a qualified health plan is different. Normally, household income plays a crucial role in determining this credit. Still, in your case, only the portion of your income exceeding 133 percent of the poverty line for a family of your size will be taken into account. This provision aims to provide some financial relief to those who faced unemployment during the challenging year of 2021, making healthcare coverage more accessible for those who need it most.

Other new stuff

Heading 7.1 : Common Tax Problems

Navigating the labyrinthine world of taxes can be daunting, and several common tax problems can trip up even the most conscientious taxpayers. One issue often arises from the income misattribution reported on a 1099-K form. This can occur when taxpayers receive a 1099-K under their Social Security Number (SSN), but the income belongs to a partnership or corporation they're involved with. Sharing a payment terminal with another person or business can further complicate matters, as the 1099-K may report income for both parties, creating potential discrepancies.

Another tax pitfall arises when a taxpayer needs to update their Taxpayer Identification Number (TIN) and business name associated with a credit card terminal after purchasing or selling a business during the year. This oversight can lead to misreported income and IRS inquiries.

Cash-back options during purchases are tempting, but they come with tax implications. When a business allows cash-back, the cash received is typically considered part of the income and must be reported accordingly.

Furthermore, businesses relying on a single payment terminal for multiple income sources can face problems. Each source of income should be tracked and reported separately, but when they all flow through the same terminal, it becomes a challenge to ensure accurate reporting. These common tax problems underscore the importance of meticulous record-keeping and staying up-to-date with tax regulations. Awareness of these issues and seeking professional guidance can help taxpayers navigate the complex tax landscape and avoid potential pitfalls.

Sub-Heading 7.2: Form 1099-K

In a significant change that took effect in 2022, a new law has brought about a sharp reduction in the reporting threshold for third-party payment settlement entities. This alteration, brought into action by the American Rescue Plan Act (ARPA), has far-reaching implications for businesses and individuals involved in payment transactions. To understand this shift fully, let's delve into the background. For over a decade, payment settlement entities were mandated to file Form 1099-K annually with the IRS, reporting the gross amount of reportable payment transactions for payees. This requirement applied to transactions that occurred between 2010 and 2021.

During this period, third-party settlement organizations enjoyed a de minimis exception, exempting them from filing Form 1099-K for payees with 200 or fewer transactions during the calendar year as long as the aggregate gross amount remained at $20,000 or less. However, ARPA ushered in a substantial change by amending this de minimis threshold. Starting from calendar years beginning after December 31, 2021, the new threshold is set at $600, with no minimum number of transactions required.

This shift has far-reaching implications, as many payees will likely receive Form 1099-K, which must be sent out by January 31 following the end of the reporting year. Understanding and complying with these new regulations is essential for businesses and individuals engaged in various payment transactions to avoid potential penalties and ensure compliance with the law. The landscape of financial reporting has evolved, ushering in changes that demand our attention and understanding in the years ahead.

Taxpayers need to be diligent when tax season rolls around, especially if they've received a 1099-K form. To ensure accuracy, start by cross-referencing the amount on the form with your payment card receipt records and merchant statements. Keep going; meticulously review your records to confirm that your gross receipts align with what's reported on your tax return. It's crucial to account for all payment forms you've received, whether cash, checks, or credit cards, as these should all be included in your gross receipts. Lastly, maintain comprehensive documentation that supports your reported income, as thorough record-keeping is your best ally during tax time. By following these steps, you can confidently navigate your tax obligations and minimize the chances of encountering any unexpected surprises.

Proposed Legislation

Sub-Heading 8.1: Secure 2.0 Act

One promising development on the horizon is the Secure 2.0 Act. Currently, both the House and Senate have crafted versions of this ambitious bill, with many overlapping provisions but also key differences that need to be reconciled. The prospect of Secure 2.0 becoming law has garnered significant attention from experts, many of whom anticipate its passage in 2022.

Starting from tax years after December 31, 2023, significant changes are coming for taxpayers aged 62 to 64 regarding catch-up contributions. The catch-up amounts are set to see substantial boosts: the retirement catch-up contribution will surge from $6,500 to $10,000, while the SIMPLE catch-up contribution will increase from $3,000 to $5,000. Additionally, the $1,000 catch-up for IRAs will be indexed for inflation. One peculiar aspect is that these catch-up contributions will be treated as Roth accounts for tax purposes, implying that they won't enjoy tax deferral benefits. This shift is poised to impact the financial strategies of individuals in this age group, and careful planning will be essential to maximize their retirement savings effectively.

A standout feature of the Secure 2.0 Act is its proposed penalty reduction for failing to take required minimum distributions (RMDs) from retirement accounts. Under the current system, individuals who miss these distributions face a hefty 50% penalty. However, if this legislation is enacted, that penalty would be reduced to 25% and 10% if the error is promptly corrected.

RBD’s would increase as follows:

- 73 starting in 2023

- 74 starting in 2030

- 75 starting in 2033

In a move designed to boost retirement savings, the Act mandates that employers auto-enroll eligible participants in §401(k) or §403(b) plans, initiating contributions at 3% and gradually increasing them by 1% each year until they reach 10%. It's important to note that existing plans and small businesses with 10 or fewer employees are exempt from this requirement, which applies solely to new plans established after the legislation's enactment date.

Another noteworthy feature of the Secure 2.0 Act is its recognition of the importance of charitable giving. The bill permits a one-time transfer of up to $50,000 to a charitable gift annuity or charitable remainder trust, encouraging philanthropy and financial planning.

The Secure 2.0 Act also recognizes the changing landscape of employment by reducing the requirement for employees to participate in a §401(k) retirement plan. Previously, individuals needed 500 service hours in 3 consecutive years to qualify. With Secure 2.0, this threshold is reduced to just two consecutive years, making retirement benefits more accessible to a broader range of workers.

In conclusion, The Secure 2.0 Act represents a significant step toward enhancing retirement security for Americans. With its innovative provisions aimed at reducing penalties, boosting savings, and encouraging charitable giving, this legislation could usher in a new era of financial stability and well-being for retirees and future generations. As it continues its journey through the legislative process, the Secure 2.0 Act promises a more secure financial future for all.

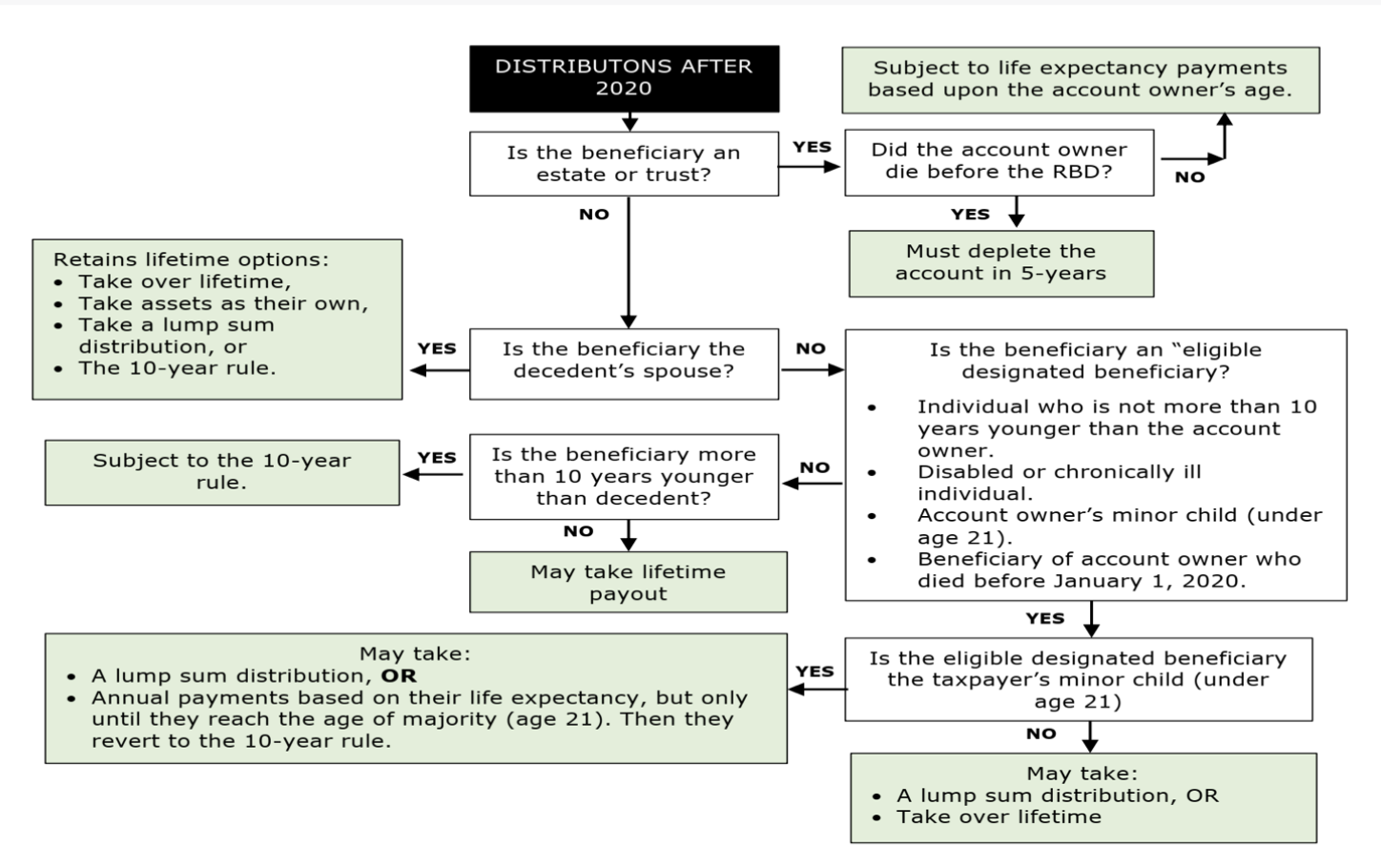

Secure 2.0 Flow Chart

Subheading 8.2: Understanding the First-Time Homebuyer Credit: A Closer Look at the 2021 Changes

If you've been considering making the leap into homeownership, the First-Time Homebuyer Act of 2021 brings some exciting changes to the table. Introduced in April 2021, this legislation brings a fresh perspective to the first-time homebuyer tax credit, potentially making the dream of owning your own home more attainable than ever before.

Under this new act, eligible first-time homebuyers can enjoy a credit amounting to 10% of the purchase price of their principal residence, with a cap set at a maximum of $15,000. It's important to note that if two or more unmarried taxpayers decide to embark on this journey together and purchase a home, the combined credits allowed to all parties involved cannot surpass the $15,000 maximum threshold.

Now, what exactly does it mean to be a first-time homebuyer? According to the act, an individual (and their spouse if married) qualifies as a first-time homebuyer if they meet two critical criteria. Firstly, they must not have held any ownership interest in any residence during the three-year period leading up to the date of their principal residence's purchase. Secondly, they must not have claimed this credit in any previous taxable year.

However, it's essential to understand that this credit isn't available to everyone. The act stipulates that no credit will be granted to taxpayers whose Modified Adjusted Gross Income (MAGI) exceeds a certain threshold. Specifically, the threshold is set at 160% of the Area Median Income as determined by the Secretary of Housing and Urban Development. This figure takes into account factors such as the area in which the principal residence is located, the size of the taxpayer's household, and the calendar year in which the principal residence is purchased.

Aspiring homeowners should take a closer look at these provisions to fully grasp the potential benefits and limitations of the First-Time Homebuyer Act of 2021. This legislation is designed to provide much-needed support for those looking to make their first foray into homeownership, but it's essential to navigate the intricacies to ensure you're making the most of this opportunity.

Subheading 8.3: Responsible Financial Innovation Act

The Responsible Financial Innovation Act emerges as a beacon of hope, aiming to streamline the integration of existing banking and tax laws into a comprehensive regulatory framework for digital assets. At its core, this groundbreaking legislation seeks to provide clarity and structure to the world of cryptocurrencies and blockchain technology. The Act lays out a meticulous definition of digital assets, encompassing a broad spectrum of natively electronic assets that bestow economic, proprietary, or access rights through the use of cryptographically secured distributed ledger technology. This all-encompassing definition spans virtual currencies, ancillary assets, payment stablecoins, and other securities and commodities that meet the specified criteria.

One of the most noteworthy provisions of the Act is its treatment of digital assets obtained through mining or staking activities. According to the Act, these assets would not trigger tax implications until they are sold, offering a welcome relief to those actively participating in blockchain networks. Moreover, the Act redefines the regulatory landscape by categorizing most digital currencies as commodities under the jurisdiction of the Commodity Futures Trading Commission (CFTC), rather than subjecting them to Securities and Exchange Commission (SEC) oversight.

Digital asset exchanges, often the lifeblood of the crypto ecosystem, are acknowledged as financial institutions under this legislation, further cementing their role in the broader financial sector. Payment stablecoins, especially those issued by banks or credit unions, are given a unique status; they are neither commodities nor securities, signifying a fresh approach to these innovative financial instruments.

Perhaps one of the most significant steps forward is the Act's stringent requirements for stablecoins pegged to the US dollar. These issuers are mandated to maintain high-quality liquid assets equivalent to 100% of all outstanding stablecoins, ensuring their stability and safeguarding against potential crises. Additionally, issuers must possess the capability to redeem stablecoins at par, instilling trust and reliability in the stablecoin ecosystem.

In an era where digital assets are reshaping the financial landscape, the Responsible Financial Innovation Act emerges as a pioneering force, striking a delicate balance between innovation and regulation. By providing a clear regulatory framework, the Act promises to foster a more secure and accessible environment for digital assets, ushering in a new era of responsible financial innovation.

Subheading 8.4 : Virtual Currency Tax Fairness Act

In February 2022, a significant legislative proposal took center stage in the world of cryptocurrencies: the Virtual Currency Tax Fairness Act. This act, if passed, promises to bring some much-needed clarity and fairness to the taxation of virtual currency transactions. Under the provisions of this act, personal transactions made with virtual currency would be exempt from taxation if the gains amount to $200 or less. This is a welcomed development for crypto enthusiasts and advocates who have long argued that the tax treatment of virtual currency should mirror its intended purpose – enabling peer-to-peer transactions without the burden of excessive taxation. The act's potential impact on the cryptocurrency landscape is significant, as it paves the way for a more seamless and user-friendly experience when it comes to using digital assets for everyday transactions. It remains to be seen whether this act will become law, but it undoubtedly represents a step forward in the ongoing effort to create a fair and balanced regulatory framework for the burgeoning world of virtual currencies.

Staying informed about the individual updates for the 2023 tax season is essential for every taxpayer. These changes, whether they pertain to tax rates, deductions, or credits, can significantly impact how your taxes will go. By keeping up-to-date with the latest tax regulations and taking advantage of available resources and tools, you can navigate the tax season with confidence, ensuring you make the most of your financial opportunities while staying compliant with the law. To learn more about this hot topic, please visit www.getcanopy.com/courses and click here to take the “2023 Tax Season-Individual Updates” course and get your CPE/CE credit.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.