This summer, the IRS will transition its online services for tax professionals to third-party authentication software company ID.me. What does that mean for accountants? You’ll need to create an ID.me account to access the IRS website.

Now, some accountants and other tax professionals may have already created their ID.me account. But, for those who have yet to set it up, the deadline is June 15—that’s when the IRS will force adoption of the ID.me tool for e-Services applications. Until then, the IRS will allow individuals to access the IRS through their legacy login.

Here’s everything accountants need to know about the transition to ID.me:

You’ll need an ID.me account

With the integration between ID.me and the IRS, individuals will be using ID.me credentials to login to the IRS website. ID.me is simply facilitating a user’s login process to the IRS.

According to an email sent by the IRS in May, the following products and applications will be impacted due to the IRS transition to ID.me:

-

- Affordable Care Act (ACA) for Transmitter Control Code (TCC)

- Application Program Interface (API) Client ID Application

- e-File Application

- Information Returns (IR) for TCC

- Income Verification Express Service (IVES) Application

- State Applications (State EFIN and TDS State)

- TIN Matching, including Bulk and Interactive TIN Matching

- Transcript Delivery System (TDS)

- Secure Object Repository (SOR)

- Modernized e-File (MeF)

- ACA Information Returns (AIR)

On June 15, the IRS will require adoption of the ID.me tool for e-Services applications. After June 15th, you will no longer be able to access e-Services applications using your legacy secure access credentials.

You no longer have to use facial recognition software

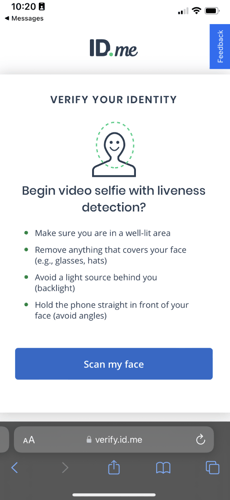

In response to backlash from privacy advocates about ID.me’s facial recognition software, the company now allows users to opt out of that step. Users can still use the software to verify their identities, but it is no longer mandatory. For those who want to skip the facial recognition step, ID.me will allow users to video chat with a “trusted referee” instead. Prior to the change, the option to speak to a human agent to verify your identity was only available after a failed attempt with the facial recognition software.

Additionally, once verification is complete, ID.me deletes the biometric information collected from users who choose to verify their identities through facial recognition. This is a one-time process to verify identities, and once it’s completed users will simply use their login credentials to sign into the platform.

All users will need to use MFA (multi-factor authentication) to login as well.

How to set up your account

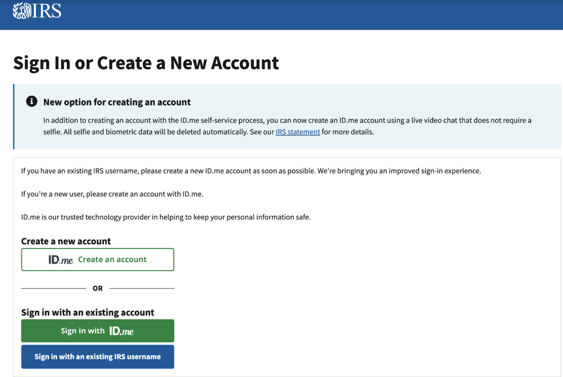

First, open the IRS website.

Navigate to the “sign into your account” page.

If you already have an ID.me account, select “Sign in with ID.me.” Until June 15, you’ll also have the option to sign in with existing IRS credentials.

If you are creating an ID.me account, select that option.

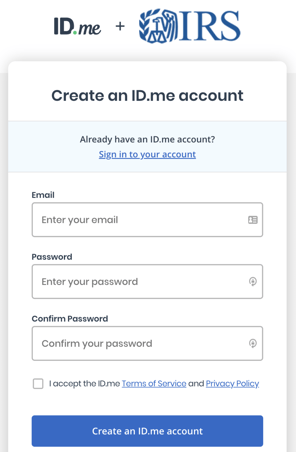

Enter your email and choose a secure password.

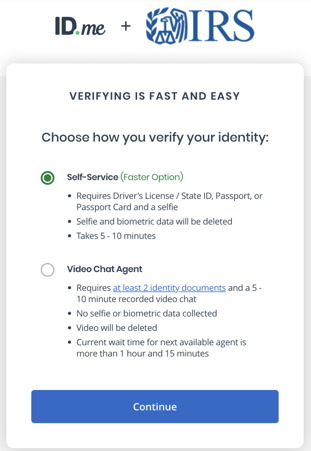

Next, choose how you wish to verify your identity.

If you choose to use biometric authentication, you’ll need to upload a photo of a government ID document. Then, ID.me will request access to your camera and a window will pop up to scan your face. This will compare the photo in your government ID to your actual face.

If you choose to video chat with an agent, you’ll need two identification documents and have to wait for the next available agent.

History of ID.me and the IRS

During tax season, the IRS announced it had transitioned away from the use of the third-party tool in an attempt to avoid mass disruption to taxpayers.

"The IRS takes taxpayer privacy and security seriously, and we understand the concerns that have been raised," said IRS Commissioner Chuck Rettig in a statement. "Everyone should feel comfortable with how their personal information is secured, and we are quickly pursuing short-term options that do not involve facial recognition."

The IRS is not the only government agency to use ID.me—in fact the Social Security Administration and other government agencies currently use the software as well.

The transition to using ID.me comes in an effort to increase security and identity verification, according to the IRS.

"Identity verification is critical to protect taxpayers and their information. The IRS has been working hard to make improvements in this area, and this new verification process is designed to make IRS online applications as secure as possible for people," said Rettig in a statement at the time of the initial ID.me/IRS partnership announcement.

In response to privacy concerns and backlash, the IRS committed to finding alternatives to ID.me and will eventually shift to Login.gov, a government-controlled sign-in service. However, logistics prevented a timely rollout of an alternative system and in the meantime, ID.me is still being used by the IRS with the updated option to allow users to opt-out of the biometric verification process.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.