As we all know, technology is becoming an integral tool in every industry, especially within the finance and accounting world. The world's first accountants used abacuses but as technology advanced, calculators became a key facet of the job. Today, as cloud-based software and other digital technologies become a necessity in an accountant's life, the industry must adjust to the new tech.

As the profession changes, it's important to make sure up and coming CPA's are properly tested on appropriate and relevant skillsets. To adapt, the CPA Exam has recently been updated to test your knowledge on digital topics, IT, automation, data analyzation, and, business and operations management. The new blueprint for the CPA Exam went into effect the first of July, according to the AICPA. Here’s what you need to know.

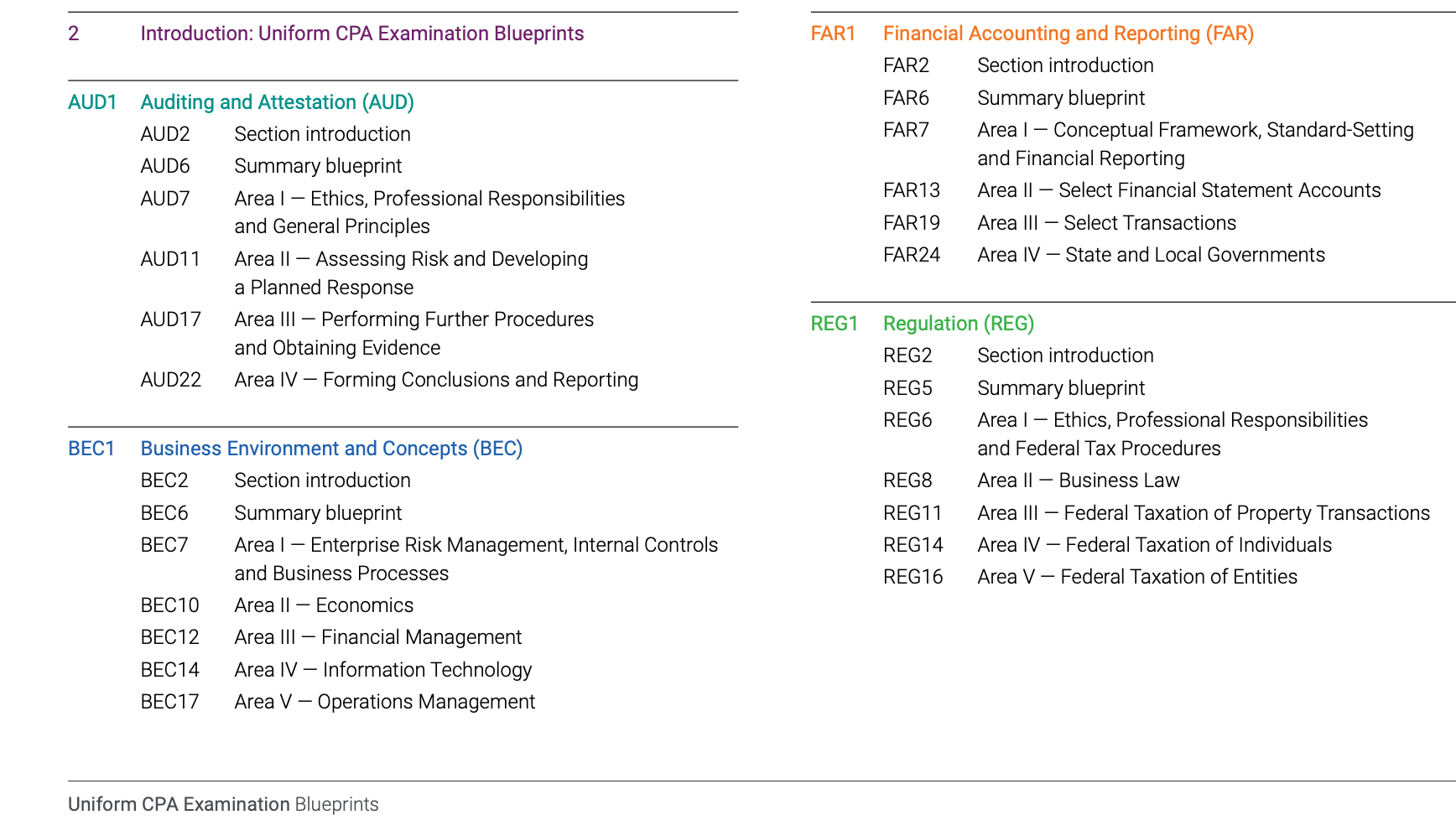

CPA Exam Sections

The four sections in the exam are:

-

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial and Reporting (FAR)

- Regulation (REG)

The sections of the CPA Exam. (Photo: AICPA)

The sections of the CPA Exam. (Photo: AICPA)

What's new?

The biggest additions to the exam curriculum are in the AUD and BEC sections, according to the AICPA. Test takers should be prepared to be evaluated based on their understanding of major business and data processes, enterprise resource planning (ERP) and the cloud. For the FAR and REG sections, some discussion points have been eliminated, including international financial reporting standards (IFRS) and estate tax and federal securities regulations, Accounting Today reported.

How to Take the CPA Exam

Now that you know what to expect, it's time to study. You can find CPA Exam resources by clicking here. Do you feel ready to take the exam? Well, first you have to make sure you're eligible. Then, you'll able to submit your application and eventually sign up to take the test. Find more information on the CPA Exam process from the AICPA here. Comment below what changes you think should come next to the exam!

Looking to brush up on your skills? Check out our CPE course library.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.