What's new:

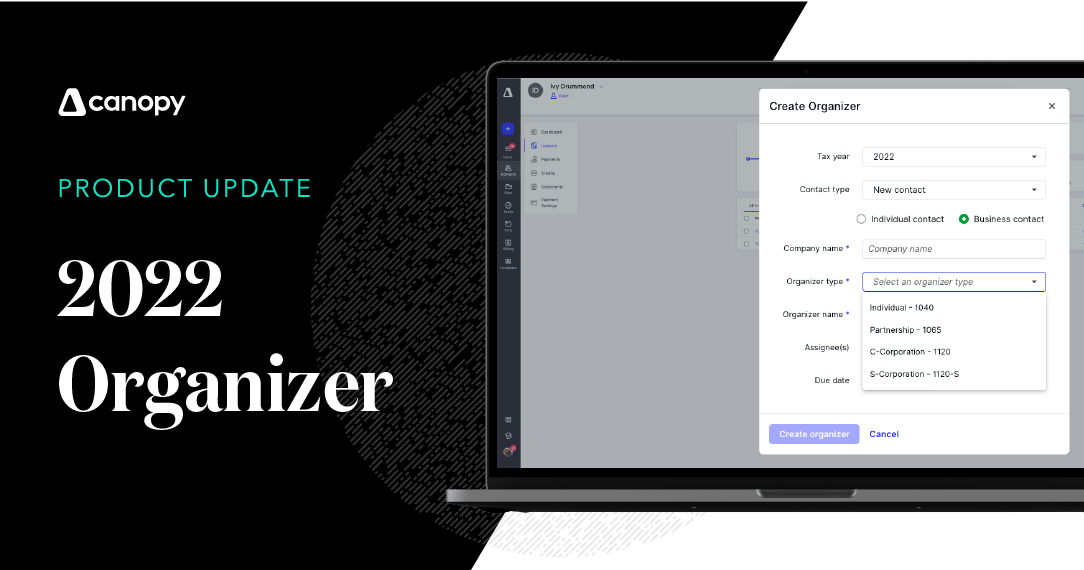

Not only do you have an organizer that reflects the changes for the tax year, but we also have some major improvements to the organizer itself! Including the addition of a business organizer.

Individual Organizer

-

The organizer has been simplified. Clear and concise language, shorter sections, less scrolling, and reorganization of questions help clients make it easy for clients to complete the organizer– whether it be because it speeds them up or makes it easier for them to complete it in bite sized segments.

-

Required responses.

-

Collect multiple addresses for taxpayers who have moved during the year.

-

Dynamic sections make it easy for you to have a configurable organizer. Based on a client’s response, they will then see specific follow up questions (i.e.the self employment section will appear based on answers in the income section).

-

Questions about deductions have been added so clients can indicate whether or not they want to itemize their deductions.

-

Questions about adjustments and credits have been added.

-

Clients can provide their Driver’s License ID.

-

Print the organizer as a PDF.

-

Clients can access help content that clarifies any technical terms that may be present on the organizer directly within the organizer without leaving.

-

Practitioners can see the help content when viewing the organizer so they can see what the client will see.

Business Organizer

- Not all businesses are sole proprietors. So, we built a solution that supports form Partnerships (Form 1065), S Corporations (Form 1120-S), and C Corporations (Form 1120).

- These organizers will help collect the following:

- General business information and questions

- Partner or shareholder details

- Income and expense information

- Balance sheet information

- Depreciable asset information

- The small sections and simplified language will also be present in the business organizer.

Why it matters:

Collecting tax information correctly and quickly is a value you know too well. Updated organizers that are easy to read and fill out mean more accurate data and in a more timely manner.

This also means less back and forth between you and your clients. With consolidated sections and help information, a client can get through the organizer with less friction.

How it works:

To learn more about the individual organizer, click here.

To learn more about the business organizer, click here.

To learn more about completing a business organizer, click here.

Where to find it:

Available in Canopy’s Client Management module.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.