If you're not utilizing client transcripts, you should be! While IRS transcripts are notorious for being convoluted, in the hands of a tax professional who knows how to read them, they can be incredibly useful. Transcripts can help you to better serve your clients and meet their needs. The first step to using transcripts to their fullest potential is becoming authorized to access them. Not sure where to start? Keep reading—in this post, we'll simplify the options for gaining access to your clients' transcripts.

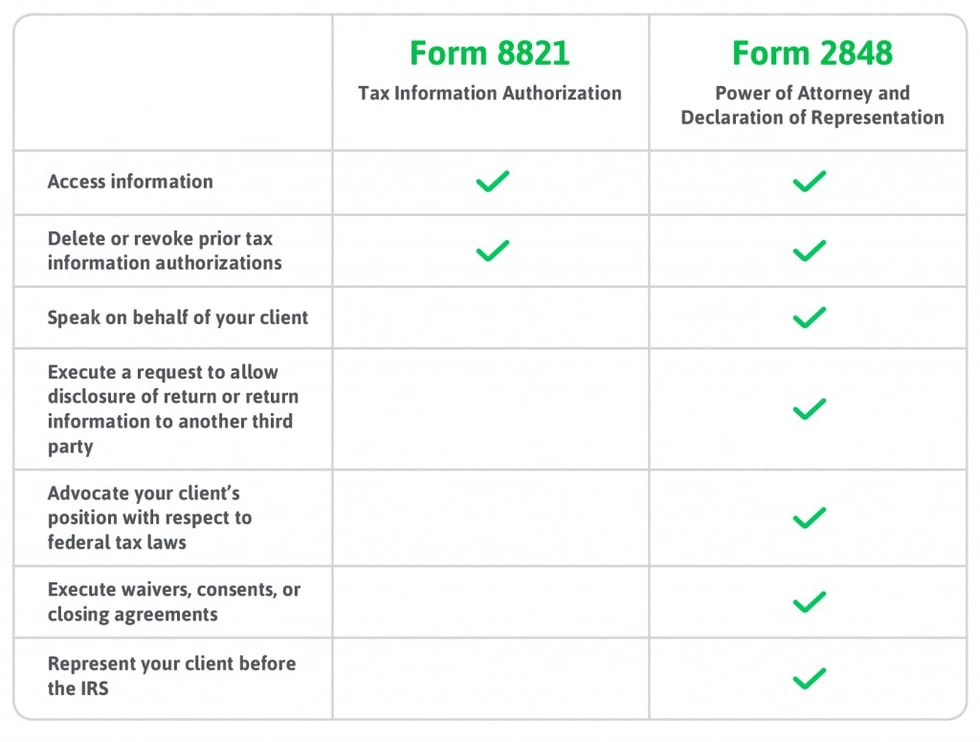

There are two different forms that will give you authorization to access your clients’ transcripts: Form 8821 and Form 2848.

What are the differences between the two forms, and when would you use one over the other?

What is Form 8821?

This is the form you’ll use most often as a tax preparer. Authorization can be granted to anyone your client chooses. Because Form 8821 is just consent to grant someone access to his or her information, the appointee does not have to be a tax professional. To be valid, this form must be sent to the IRS within 120 days of the date it was signed by your client.

And Form 2848?

As a best practice, Tax Resolution professionals should file this form for every client. Many parties, including EAs, CPAs, attorneys and officers, can be authorized with this form, with various restrictions. For more complete information on which parties can be authorized and what their restrictions are, check out the IRS Instructions for Form 2848.

This form has a different deadline depending on if the authorization is from a domestic client or a client residing abroad. You must sign the form within 45 days from the date a domestic client signed and 60 days from the date a client residing abroad signed.

Looking for more in-depth information about transcripts?

Becoming authorized to access transcripts is only one small part of the complexity of analyzing and using them. For more information, check out the ebook IRS Transcripts: An Easy-to-Understand Guide that this amended excerpt came from. Download it for free.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.