Tax return fraud has skyrocketed in the past few years. The emergence of new technologies has allowed hackers and criminals to find many new ways to steal taxpayers’ information in order to falsify tax returns. And with the introduction of e-filed tax returns on the state and federal level, taxpayers have had their information stolen more often than ever.

How Identity Theft Occurs

The surge in popularity of identity theft through tax returns has resulted in tax practitioners going to great lengths to protect their clients’ information through measures such as password protected documents, encrypted websites, and secured servers. Identity fraud is an extremely serious crime that can leave the victim in debilitating circumstances, and therefore, information security has become a paramount part of a tax practitioner's business.

Generally, tax return fraud occurs when the perpetrator files a false tax return using a fake W-2 with the taxpayer’s full name, social security number, and birthdate. Once filed, the perpetrator deposits the fraudulent tax return into a prepaid debit card that is cashed immediately. Tax return fraud often occurs early in the tax season––perpetrators want to ensure that they file their fraudulent returns before the taxpayer files their real return and before the IRS obtains the correct W-2 information from the taxpayer’s employer.

How Tax Return Transcripts Can Help

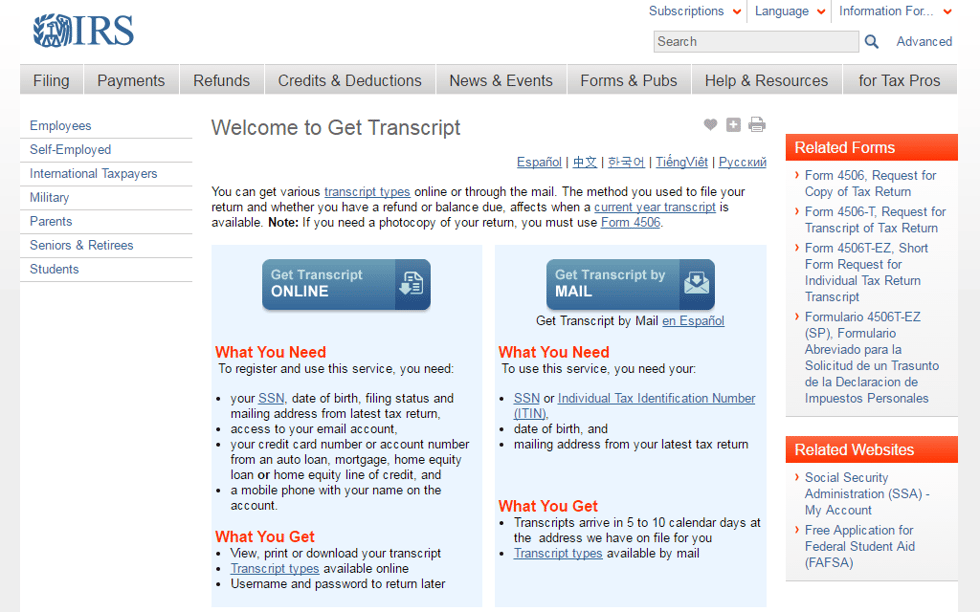

IRS tax transcripts essentially summarize the IRS’ records of a taxpayer's’ tax returns. Transcripts are faster and easier to obtain than actual copies of the returns themselves.

Transcripts can be ordered over the phone at 1(800) 908-9946 or by mail or fax. It is generally easier to obtain them online at the IRS's Get Transcripts portal, as seen below:

As a tax professional, if you are alerted to any sort of suspicious activity about your clients’ tax returns, then you should immediately pull and review your client’s tax return transcripts. For example, if the IRS contacts your client regarding income they didn’t earn or a rejected return that they did not file, then they may be a victim of identity theft.

Authorized tax practitioners are able to access their clients’ transcripts online through the IRS portal if there is an active Power of Attorney on file with the IRS. This portal will allow you to view tax return and wage/income transcripts that will allow you to immediately determine if information was falsified using your clients’ identity.

Lastly, you should counsel your clients to retain copies of their tax returns in the event that there is suspicious activity under their name or social security number. Taxpayers can use those copies of the returns to compare line items and determine if identity theft did occur.

What To Do If Identity Fraud Occurs

If you believe that identity fraud has occurred, you will need to immediately call the IRS in order to alert them of the situation. The IRS has a specialized unit that deals with identity theft. The Identity Protection Unit has useful information on their website, and the contact number for victims of potential victims of identity theft is 1(800) 908-4490.

The taxpayer will likely need to also fill out an Identity Theft Affidavit, IRS Form 14039, so the IRS can begin investigating the case. The IRS will ask for a correct copy of your client’s tax return with the affidavit as well. Once these steps are completed, the IRS will assign the taxpayer an Identity Protection Personal Identification Number (IP PIN) that the taxpayer will use to file their tax return safely.

All taxpayers are eligible to obtain an IP PIN on the IRS website for additional protection against identity fraud. This protection is not foolproof, as the IRS has had to suspend the program in the past due to hackers stealing information once again.

Protect Your Clients

Tax practitioners should be proactive in protecting their clients’ information. Being aware of tools like tax return and wage/income transcripts can help you maximize the security of your clients’ information in an increasingly technological world.

Learning how to effectively use transcripts in your tax practice can save you hours per case. Get a crash course in how to get access to transcripts and better use them in our ebook, IRS Transcripts: An Easy-to-Understand Guide, which you can download for free!

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.