By now you’ve probably seen or heard of cloud accounting software at association meetings, trade shows, and online. Cloud-based tools may be one of the most impactful developments for accounting and tax firms in recent years. But how can you decide if cloud accounting software is right for your business? It’s helpful to educate yourself about the difference between cloud software and more traditional desktop versions.

What exactly is the cloud?

Accounting software helps tax professionals be more efficient and streamlines processes to provide better service to clients. Traditional accounting software runs on just one computer while cloud accounting software is housed on a widespread network of computer hardware that combines to form an online service, accessed through a web browser.

Cloud computing harnesses the power of the internet to perform tasks that are usually done on a desktop computer. In the days before the cloud, businesses would buy infrastructure by estimating what they might need. This would include servers, networks, office space, and even technicians. The cloud can run applications and software programs via the internet, which eliminates the need for all those things.

There are three categories that comprise cloud computing:

- IaaS, which means Infrastructure as a Service. It provides virtualized computing resources (like computer infrastructure, networking, and storage) over the internet.

- PaaS, which means Platform as a Service. It provides a platform where developers can develop and manage online applications for specific sets of users without building and maintaining the infrastructure.

- SaaS, which means Software as a Service. It provides a platform where a vendor makes applications and software available to customers over the internet.

It’s important for you to become familiar with how cloud technology works so you can compare it to the desktop alternative.

Comparing the cloud to desktop software

On the surface, it might seem like there isn’t much of a difference between cloud accounting applications and their desktop counterparts. However, there are numerous differences that come into play. Here are some of the major comparisons:

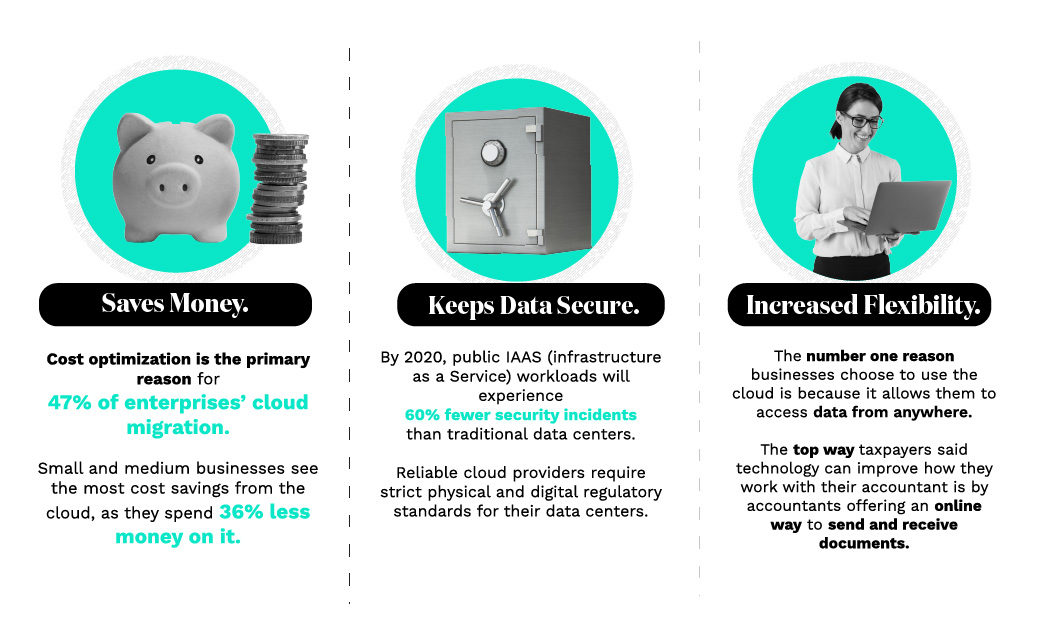

Security: Your client’s private financial information is extremely important, but cybercriminals are always on the lookout for ways to access it. Because cloud software runs from a data center with multiple layers of top-level security, a firm’s data is better protected than it would be with a firm’s safety protocols.

Worldwide access: When data is put onto a desktop computer, it can only be accessed by a person sitting at that keyboard. With cloud-based accounting tools, you can access data anywhere at any time, as long as you have an internet connection.

Plethora of platforms: With cloud accounting software, it doesn’t matter whether you access the data on a Mac or PC. Numerous platforms are supported and transitioning from one to another is seamless.

Backups and updates: Your own desktop requires endless software updates and regular backups to keep it current and safeguard the data. With cloud technology, those tasks are already done as vendors work to maintain the software, so the most current versions are always in use. Automatic backups store your data in multiple locations for extra security.

Affordable cost: To use cloud services, you’ll pay a monthly subscription that lasts however long you want. Software companies are pricing their cloud-based accounting software to be extremely competitive with traditional desktop software.

Of course, cloud-based technology does have some downsides, and you’ll need to make sure you understand the risks. Examples of these downsides include:

- No access without the internet

- Software vendor could go out of business

- Performance issues with server connections and page speeds

- Complications for migrating data should you choose to leave the cloud

Accounting firms are trending toward the cloud

Of course, you want your accounting or tax firm to work as smart, fast, and efficient as possible. Because cloud technology is growing in every business sector, accounting firms should not be left behind. The cloud is especially good for accounting or tax firms because it gives you access to important data anytime and anywhere, plus you get real-time insight into your business. Cloud technology also improves how you collaborate with your team and reduces up-front business costs associated with accounting software.

Want to try out cloud accounting software before you commit? Sign up for a free trial of Canopy, no credit card required.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.