To renew your Enrolled Agent (EA) credentials with the IRS or to meet the CPE requirements for CPA licensure renewal in your state, you must acquire enough approved continuing professional education credits. From ethics courses to courses on new tax preparation software, CPE courses will help you grow your practice and stay eligible as an EA or CPA.

With all those different courses and credits, it can be a real challenge to stay on target and avoid missing deadlines. So how should you manage your CE or CPE credits each year?

Challenges in Managing CPE Credits

On the surface, it may seem that taking courses and reporting CPE credits is simple. However, there’s more to managing CPE credits and CE credits than just showing up to a class a few times per year. Without an awareness of what credits you’ve earned and how many more you need by the deadline, you can jeopardize your standing.

It’s not uncommon for tax professionals to get contacted by the IRS notifying them that their credits for a course are invalid and they can no longer practice as an EA. You may also get notified by your state licensing agency of your deficiency. These alerts can be months or even years down the road from when you completed the course.

Be Smart About Your Options When Managing CPE Credits

The most common way to mismanage CE and CPE credits is by simply not completing enough hours by the annual deadline. Without the correct number of credits in the proper time period, you’ll hear from the IRS eventually.

Other mistakes that can cause problems with your federal or state compliance include taking courses from a provider that is not authorized by the IRS or your state or the course is in a non-approved format. Sometimes a completed course is simply not reported properly, or you chose a course that did not reflect an approved topic. Early and active management prevents these kinds of problems.

Monitor Your CPE Credits At Least Quarterly

Always verify that the CE or CPE course you want to enroll in is approved by the IRS or your state before you take it. Many tax professionals create a spreadsheet or use a calendar program to track their courses and completion dates. Electronic reminders can be invaluable in keeping to your schedule.

When you complete a CE or CPE course, there are several ways to ensure it is accurately reported. Approved providers are required to send confirmation of CE courses to the IRS. You are responsible for send confirmation to your state that you’ve completed a CPE course and how many credits you earned. You can also check directly with the IRS using your PTIN number to verify what they have received. Many state licensing agencies offer the same access. If you do discover errors, you have time to correct the deficiencies and resolve the issue.

Stay Organized

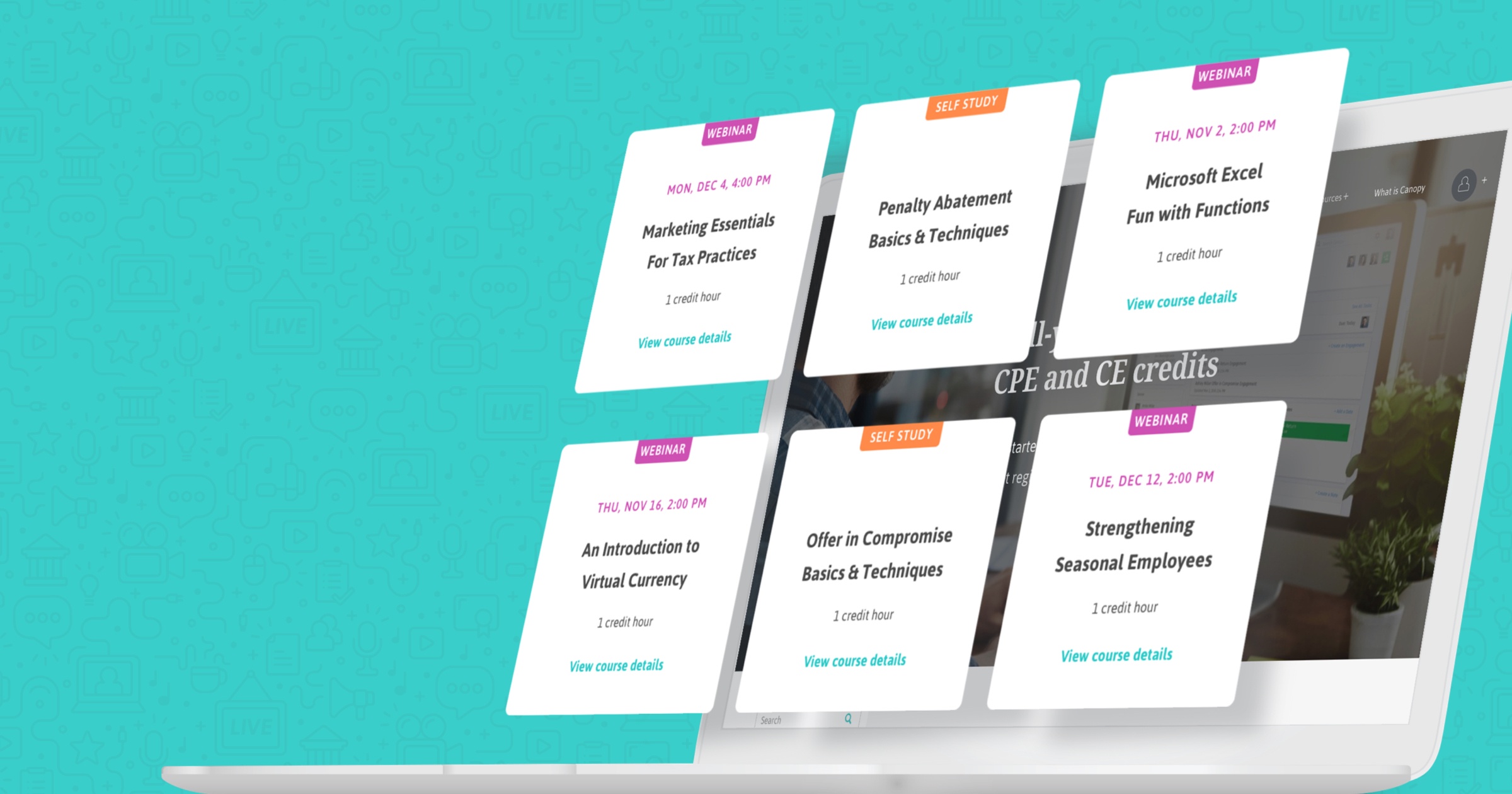

Keeping track of all your credits is key to managing your CPE and CE credits. If you're looking for help in this department, we've created a spreadsheet to help you manage all of your credits. Simply make a copy of our spreadsheet and start tracking your credits right away! You can also change and add columns to the spreadsheet as much or as little as you want. Canopy also offers free CPE and CE courses. If you're interested, check out our free course library here.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.