How much should you charge for tax resolution services? It’s a difficult question to answer. After all, many tax professionals don’t advertise their fees, and even when you do find someone willing to talk pricing with you, the answer is almost always, “it depends.”

In order to provide a more helpful answer to this question, we have collected data from tax professionals all over the United States for the past few years about how they price six types of tax resolution services including:

- Offer in Compromise

- Penalty Abatement

- Innocent Spouse

- Installment Agreement

- Trust Fund Recovery

- Liens and Levies

While we can’t tell you exactly how much your firm should be charging for each tax resolution service, we can tell you how much other practitioners are charging so you have everything you need to make an informed decision.

Here are some of the highlights from the information we gathered for 2020:

How much is the average tax resolution case worth?

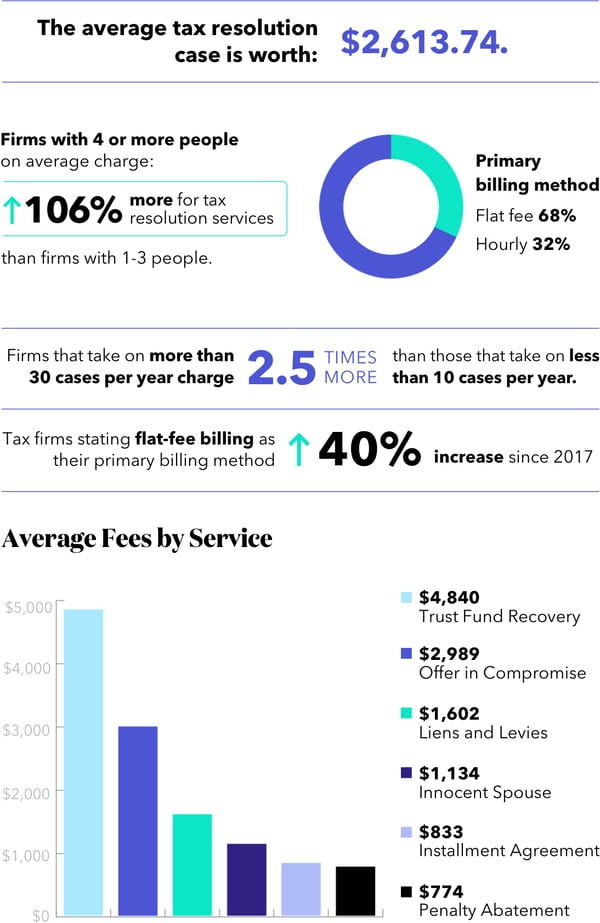

According to the data we gathered for our 2020 Tax Resolution Pricing Report, the average tax resolution case is worth $2,613.74. However, that average vastly changes once you narrow your scope by tax resolution service, firm size, and even how many tax resolution cases a firm takes on per year.

For example, firms with four or more people on average charge 106% more for tax resolution services than firms with 1-3 people.

When you look at tax resolution service prices based on the number of cases a firm takes on per year, firms that take on more than 30 cases per year charge about 2.5x more per tax resolution case than firms that take on 10 or less cases per year.

How much should you charge for different tax resolution services?

Based on the report, Trust Fund Recovery is the most lucrative service at an average of $4,840 per case or about $293 per hour, and Penalty Abatement is the least lucrative at $774 per case or $72 per hour.

Offer in Compromise comes in at $2,989 or $198 per hour. Liens and levies services are worth $1,602 per case or $223 per hour. Innocent Spouse is worth $1,134 or $227 per hour. Installment Agreement is $833 per case or $116 per hour.

What is the primary method for billing clients?

Hourly billing, which was once the industry standard for pricing, has lost ground to flat-fee billing in recent years. For 2020, 68% of tax professionals said they primarily charge their clients a flat fee rather than by the hour, which is a 40% increase from the pricing survey we conducted in 2017.

What should you charge for consultations?

An area that is not covered in the pricing report, but is still important to consider when structuring your pricing model is initial consultations. Initial consultations are vital for building trust and evaluating your clients' needs. But how much should you charge for this first meeting? There are three common philosophies for how to charge for initial consultations: free, low-priced, and high-priced. Let's take a quick look at why you might choose each.

Free consultations

Good for: Practitioners actively seeking new tax resolution clients

Offering free initial consultations is a good way to get potential clients in the door. Because it's free, there's no risk for the client seeking to solve an intimidating problem. If they don't qualify or their case is unlikely to be successful, they don't lose anything.

Low-priced consultations

Good for: Practitioners who want to weed out casual information seekers

Charging a small initial consultation fee of a couple hundred dollars ensures that you're working with clients who can actually pay you. Just as important, it will help clients to see your time as valuable.

High-priced consultations

Good for: Practitioners who provide a truly premium experience to their clients

If your firm specializes in working with high-end individuals or businesses (or you would like to), you will likely benefit from charging much more for your initial consultation. Michael Rozbruch, a leading tax resolution expert, advocates for initial fees in the $1,250 to $1,500 range. Remember though, if you choose to charge premium prices for your services, your clients will expect a premium experience with premium results.

Looking for more information about how to price your tax resolution services? Download the full 2020 Tax Resolution Pricing Report.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.