It’s common knowledge that if you want to call the IRS and speak to a live agent, you should plan on settling in for a long time on hold. Tax professionals often share horror stories about how they’ve been on hold for hours, unable to leave their desks for lunch breaks. From the first few notes, that hold music is enough to lull you into a daze as you listen to it again and again in an endless loop. Worst of all, during peak calling times it’s common for those on hold to receive a courtesy disconnect, which happens when the switchboard is overwhelmed due to a high volume of calls.

While we can’t completely eliminate the problems you might face with being put on hold with the IRS, we can provide you with a few tips and strategies to make the wait time a little shorter and ensure that each call you make is ultimately more effective.

Be prepared before you dial

The first step is to be completely ready for your phone call to the IRS. Well before the hold music starts, you should go through the case quickly to refresh your memory of it and gather all the documents you need. Because you are calling about someone else’s account, you will need to have the following information on hand as the IRS will only speak to the taxpayer’s legal representative:

- The taxpayer’s full name, tax forms, and social security number or ITIN

- Verbal or written authorization from the taxpayer to discuss their account

- Preparer Tax Identification Number (PTIN) or IP PIN

- Previously filed third-party authorization forms, such as Form 8821 (Tax Information Authorization) or Form 2848 (Power of Attorney and Declaration of Representative)

Make sure you have all you need at your fingertips and that you’ll be able to best represent your client’s needs when it comes to dealing with the IRS.

Call the right number

It’s hard to imagine anything more frustrating than sitting on hold with the IRS only to discover that you’ve called the wrong department. Many tax preparers spend a long time waiting for a live agent, only to get transferred somewhere else to wait on hold. You should also spend some time on the IRS website as there are plenty of resources there that may help you out and you might not even need to call. Of course, nothing can replace a good one-on-one phone call, so always make sure you are dialing properly.

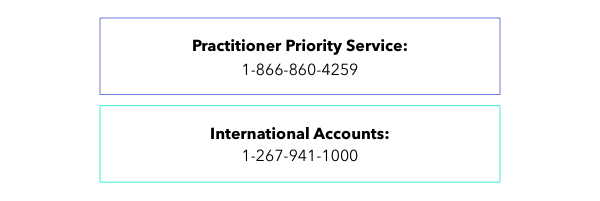

As you sit down to dial, make sure you’re calling the Practitioner Priority Service line: 1-866-860-4259. The wait is always much shorter than the regular IRS number. This support line exists specifically to help tax professionals with their questions. Note that if you have any questions about an international tax account, do not call the PPS line. Instead, use the International Accounts line at 1-267-941-1000.

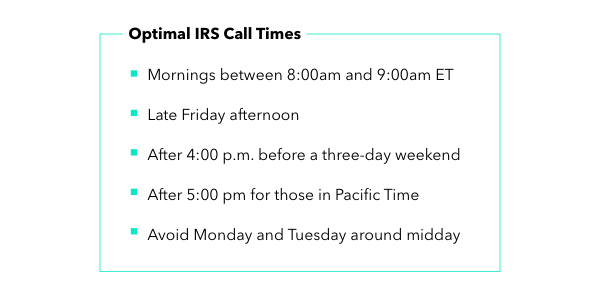

Choose the optimal times to call

There isn’t really a consistent time of the day or week where you are guaranteed a short wait time when calling the IRS. However, there are a few instances that have traditionally proven to be significantly shorter than others. While this is by no means a guarantee, there are certain times and days that won’t be as popular with your fellow tax professionals. In these instances, your wait time may be shorter than average. The PPS line is available from 7:00 am to 7:00 pm.

After waiting on hold for over an hour it’s easy to get flustered and want to rage out on the next human you speak to. Resist the urge. Tax agents can’t bend the rules just because you’re being nice, but they are more likely to go the extra mile to help you solve your problem if you’re courteous and understanding.

Be productive while you wait

Unfortunately, there is no surefire way to ensure your hold time will be shortened every time you call. However, there are things you can do. If you know you are going to put in the time to contact the IRS by phone, you can make your hold time seem shorter by staying busy. Whether you spend your time tackling tasks that are due ASAP, or you take advantage of this time to work on some of your backlog, you can count on this block of time to get things done.

Remember to choose busywork you can do that doesn’t take a lot of concentration and can be put down in an instant once your call is picked up. For example, you can spend time planning and organizing the rest of your day or extend it through the week. It’s helpful to choose lots of smaller projects as you can accomplish them rather than leave one big one unfinished. Of course, don’t schedule any conference calls or client calls during this time. When you are productive during a hold for the IRS, it just becomes “time” instead of “wasted time.”

Bonus tip:

This tip isn’t so much about waiting on hold, but it’s a sure way to get what you need from the IRS more quickly. Canopy offers a transcript tool that can pull multiple years of transcripts in as little as 2 minutes. To top it all off, your transcripts come with beautifully organized charts so you can compare each year at a glance. Click here to get started.

Canopy is a one-stop-shop for all of your accounting firm's needs. Sign up free today to see how our full suite of services can help you.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.