We've got another video for you to help you when filling out IRS forms. In this video, we cover some tips on how to fill out IRS Form 8821 to make sure your tax information authorization gets approved the first time. Watch it below and subscribe to our Youtube channel to be notified when we put out other helpful videos.

Get IRS form 8821 here.

Video Transcript:

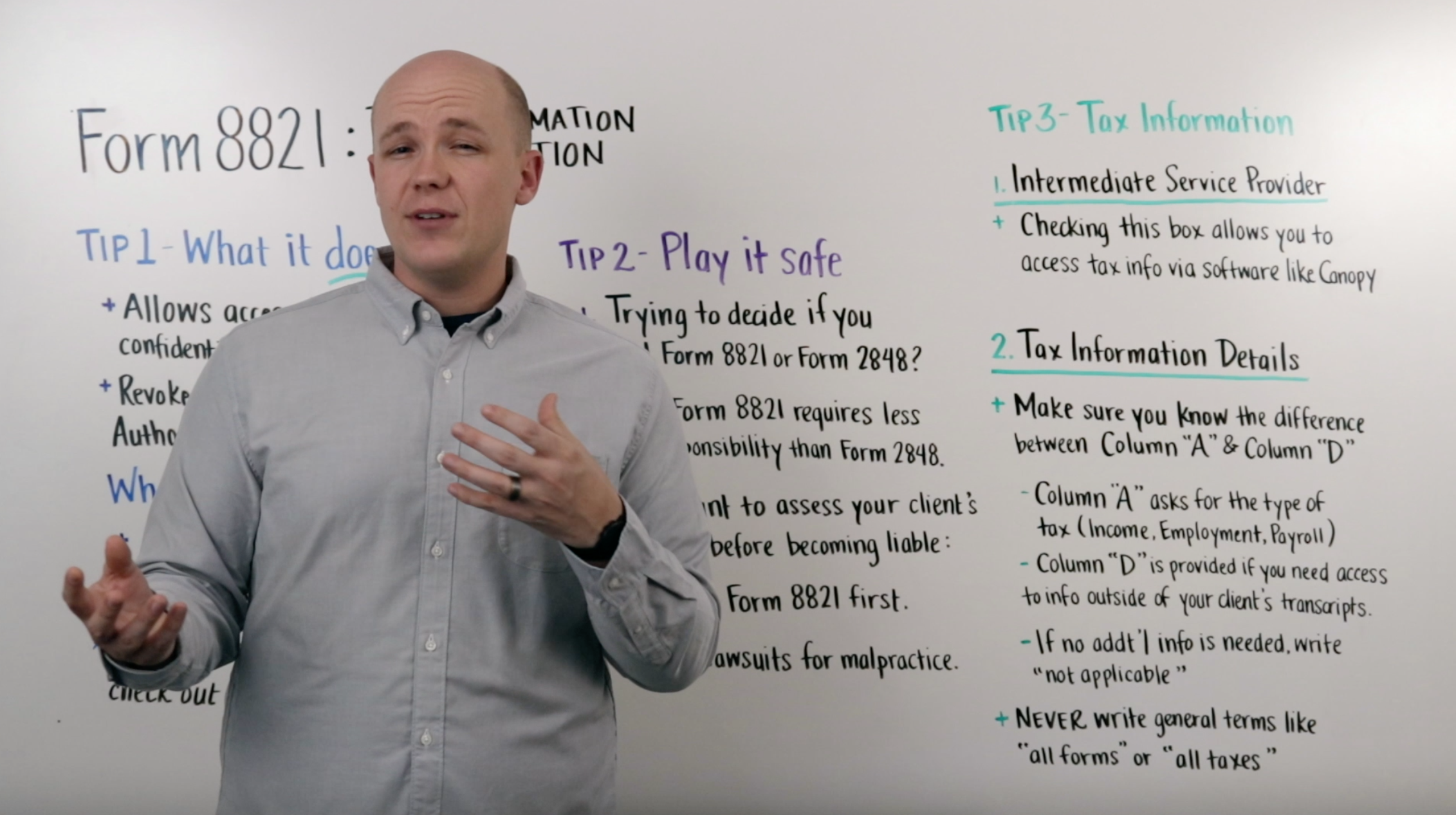

Hi and welcome to today’s video where we’re talking about IRS Form 8821: Tax Information Authorization. We’ll point out some common mistakes with this form and provide tips on how you can avoid them.

Tip 1: What is Form 8821 and when should you use it?

When helping your client resolve an issue with the IRS, you need access to their personal tax information.

Form 8821 authorizes any individual, organization, or tax professional to receive confidential tax documents for their client. It can also revoke previous tax information authorizations that are no longer required.

By accessing this information, you can identify what returns your client needs to file, how much tax, interest, and penalties are due, or if their account is in collections.

However, there are several actions that Form 8821 does not authorize you to do.

The biggest misconception with this form is that it authorizes representative power. Form 8821 can’t authorize you to represent your client in front of the IRS. This includes speaking on your client’s behalf, executing waivers, consents, closing agreements, or any other representative matters.

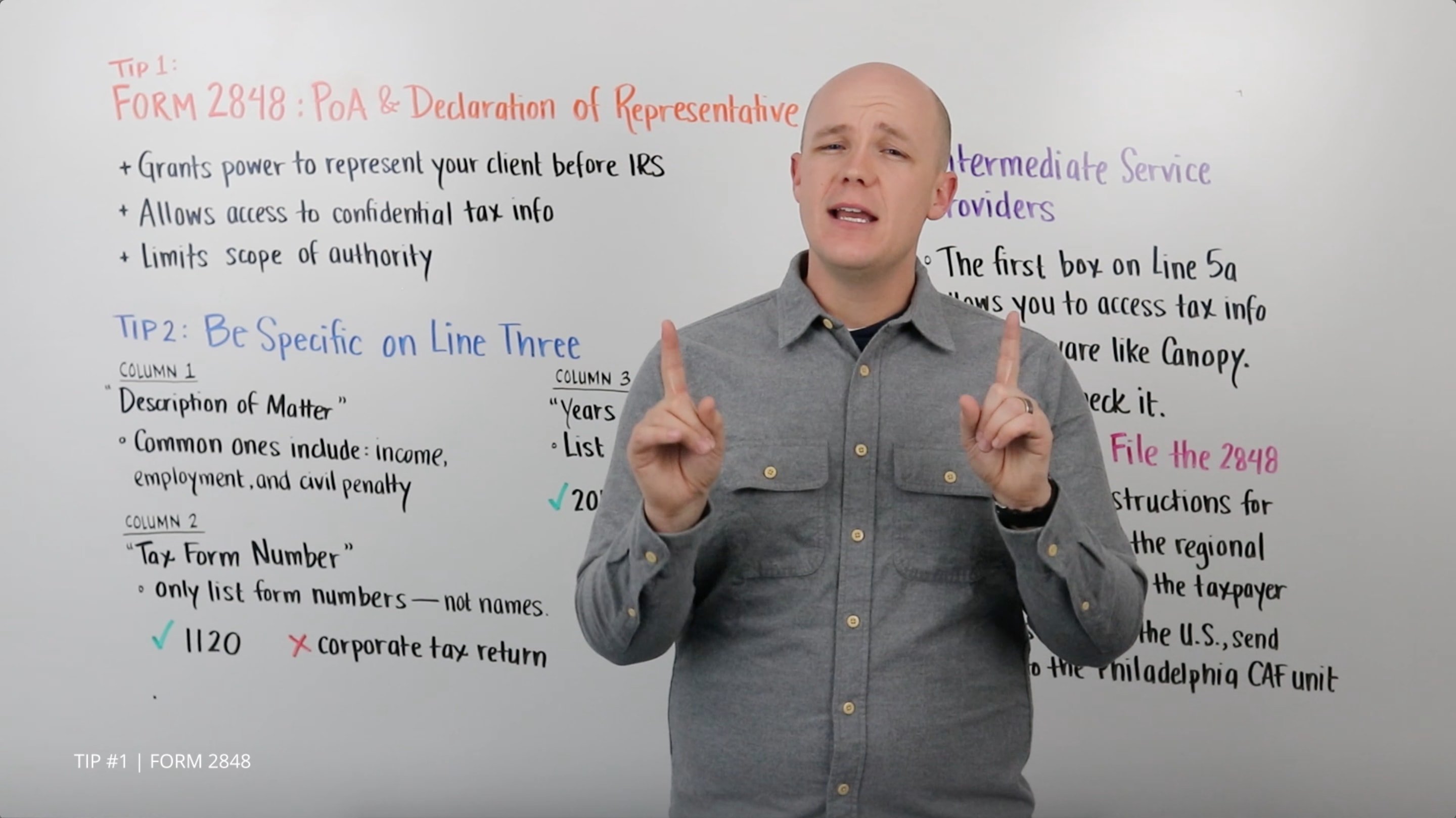

To receive this authorization, you need to fill out Form 2848: Power of Attorney and Declaration of Representative. Go check out our video on Form 2848 to learn more about it.

Tip 2: Play it safe

You’re probably wondering, “why bother with the 8821 if you can just fill out Form 2848?” Here’s why:

In many cases, clients don’t always tell you the full story. This can make it difficult to decide if you want to take a client on.

In these instances, start with Form 8821. You will be able to assess your client’s tax situation before becoming more liable yourself.

Once you file Form 2848, you are expected to represent your client. If you do not meet the expectation of a rigorous defense on behalf of your client, you may be subject to a professional liability lawsuit, or “malpractice”. By filing Form 8821 first, you can fully understand your client’s situation and determine if full Power of Attorney is necessary to help your client.

Tip 3: Tax Information

A commonly misunderstood section in Form 8821 is found in Part 3: Tax Information. There are two parts of this section, and both can cause confusion.

Intermediate Service Provider

The first part instructs you to check a box if you want access to IRS records via an intermediate service provider. By checking this box, tax information (such as transcripts) can be easily accessed through third party software like Canopy. If this box is left unchecked, you must access these forms directly from the IRS.

If you’re not sure whether or not to check this box - check it. It allows you multiple options for retrieving your client’s tax documents.

Tax Information Details

The second part of this section deals with the identification of the tax documents you need access to. The difficulty is recognizing the difference between column A and D.

Column A asks for the type of tax such as Income, Employment, or Payroll. In some cases, simply stating the type of tax won’t provide all of the information you need. To access information outside of your client’s tax transcripts, specify it in column D.

For example, there may be a lien filing you wouldn't have access to through transcripts. You would need to write “lien information” in column D for the IRS to provide access to this information. If no additional information is needed, you can write “not applicable”.

Also, as a general rule, make sure to be specific when filling out this section. State the form number in column B and the specific years or periods in column C. Terms such as “all forms”, “all years”, or “all periods” will result in a rejected form.

Well, that’s all we have for you today. Thanks for watching. If you had any other questions about Form 8821 please comment below. Also, if there is another Form you would like us to explain, mention that below as well. Canopy is here to help.

See you next time!

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.