It’s the dream of every person who owes back taxes—the IRS somehow ignores or forgets about a tax debt long enough that the debt simply expires. Nice as it sounds, the IRS is unlikely to let that happen. However, that doesn’t mean that tax pros can’t use the collections statute expiration date (CSED) to their advantage in helping their clients.

Canopy’s Transcripts tool makes it easier than ever to find the CSED for every client you work with.

Canopy’s Transcripts tool makes it easier than ever to find the CSED for every client you work with. With just a few clicks, tax pros now have access to simple, powerful IRS transcripts reports—including a CSED report. But understanding how the IRS determines a CSED is still vital for tax pros. That simple knowledge will allow you to help keep your clients from taking any action that could inadvertently extend their CSED and potentially cost them thousands of dollars.

When things are simple, the CSED is easily calculated as 10 years from the date of assessment. This means that no matter how little the IRS has been able to collect on a tax debt assessed in April of 2007, they must cease collection on that debt in April of 2017.

When things are simple, the CSED is easily calculated as 10 years from the date of assessment.

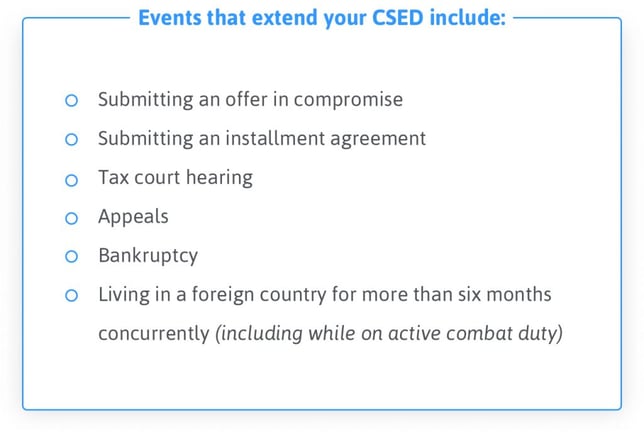

However, when you’re working with the IRS, things are rarely as simple as you’d like. There are a handful of events that can result in extending the CSED date (sometimes called “tolling events”).

Events that extend your CSED include:

Each tolling event extends the CSED differently. Some events only extend the CSED by small amount—30 days in the case of an installment agreement. Others, like submitting an offer in compromise, can extend the CSED much longer. Be sure to consult the most recent version of the IRM to see the full list of tolling events and how each affects the CSED.

Of course, you want to help your client avoid CSED extensions to the extent possible, but some tolling events are unavoidable as you engage in the tax resolution process. Just be sure that when you do something to extend the CSED that the extension is worth the desired outcome.

Additionally, being aware of your client’s CSED can give you additional bargaining power with the IRS.

Additionally, being aware of your client’s CSED can give you additional bargaining power with the IRS. The Service is much more likely to be flexible if their window to collect is coming to a close, and less likely to compromise if the collections expiration date is still years away.

This article is a modified excerpt from our free ebook, An Introduction to Partial Payment Installment Agreements. Click here to download the entire thing, free!

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.