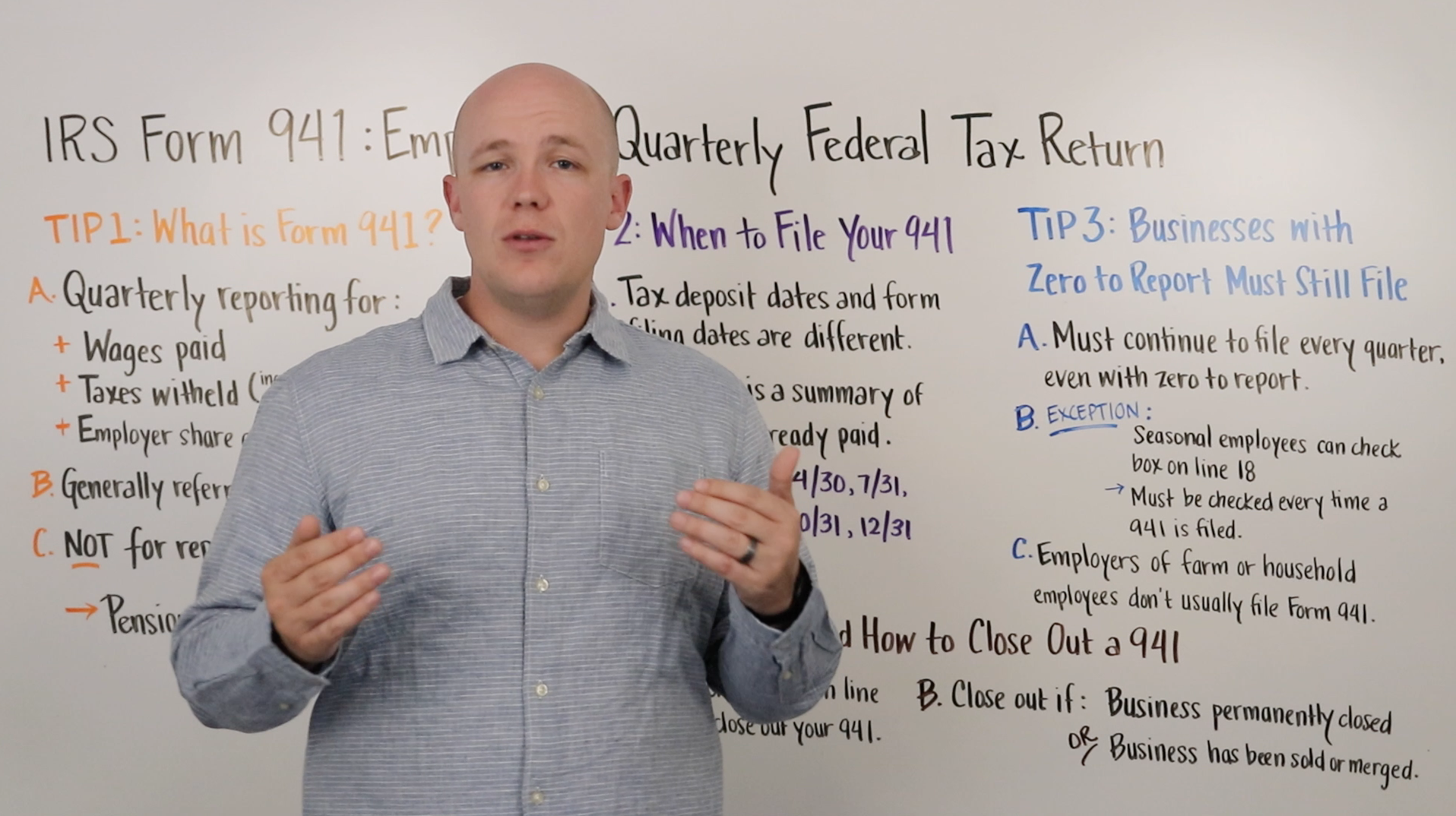

Hi! Welcome to another IRS Forms video. Today we’re covering tips for filling out IRS Form 941, Employer’s Quarterly Federal Tax Return. If you’re doing payroll taxes for your clients, you’ll be filling out Form 941 form regularly.

Even if your business clients use some other service for payroll (such as ADP or Gusto), it’s good to be aware of their payroll situation so you can help them avoid costly penalties. Let’s jump in.

Tip 1: What is Form 941?

Federal law requires employers to withhold certain taxes from their employees' pay—typically income, Medicare, and social security taxes. In addition, employers are responsible for paying an additional “employer share” of social security and Medicare taxes. Collectively, these withholdings are generally referred to as “payroll taxes.”

Form 941 is used to report these payroll taxes, as well as wages paid by an employer. However, that doesn’t mean that all income should be reported on form 941. Don’t use this form to report backup withholding or income tax withholding on non-payroll payments such as pensions, annuities, or gambling winnings. Withholding from these forms of income are reported on form 945: Annual Return of Withheld Federal Income Tax.

Tip 2: Deposit Dates vs. Form Filing Dates

Tax deposit dates and form filing dates are different. Don’t confuse the two.

Payroll taxes are typically paid either monthly or semi-weekly, depending on the amount of employment taxes paid by the employer the previous year. Form 941 filing dates, however, are the same for everyone—and not the same as deposit dates.

Form 941 is a summary of what you’ve already paid in payroll taxes and must be submitted quarterly. Filing dates are April 30th for Q1, July 31 for Q2, October 31 for Q3, and January 31 for Q4 of the previous year.

Tip 3: Businesses With Zero To Report Must Still File Form 941 (Most of the Time)

Once a business has started filing their quarterly 941s, they must continue to file every quarter thereafter. This is true even for small businesses that have no taxes to report for that quarter. The IRS will hit the business with a failure to file penalty if you don’t file form 941 every quarter, even if they have no wages to report.

However, the IRS does make a few exceptions to this rule. Seasonal employers such as lawn care companies can check the box on line 18 of the 941 to indicate that they will only be filing a 941 for quarters when they paid wages. This box must be checked every time a 941 is filed by or on behalf of a seasonal employer.

Additionally, employers of farm or household employees don't usually file Form 941. For more information on household employee tax, refer to Publication 926. For more information on agriculture employee tax, refer to Publication 51.

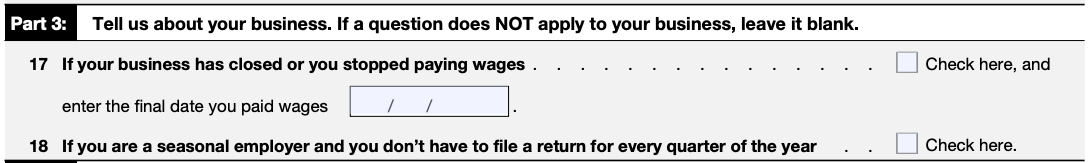

Tip 4: When and How to Close Out a 941

Closing out a 941 is fairly simple—just check the box on line 17 and enter the final date the employer paid wages. There are two reasons to close out a 941 for an employer. The first reason is because the business has closed permanently. In this case, the employer will no longer be paying out wages or collecting payroll taxes, so there is no need to continue reporting.

The second reason to close out a 941 is a business sale or merger. In each case, both the buyer and seller must fill out a 941, reporting only the wages and taxes they were responsible for. The seller will check the box on line 17 to indicate that they are closing out their 941.

That’s all we have for you this time. If you have any tips for filling out form 941 that we missed, let us know in the comments. Be sure to hit that like button if this video was helpful to you, and don’t forget to subscribe so you can see when we release new content. See you next time!

If you're looking for more information about the lookback period and deposit schedules for Form 941, check out this blog post.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.