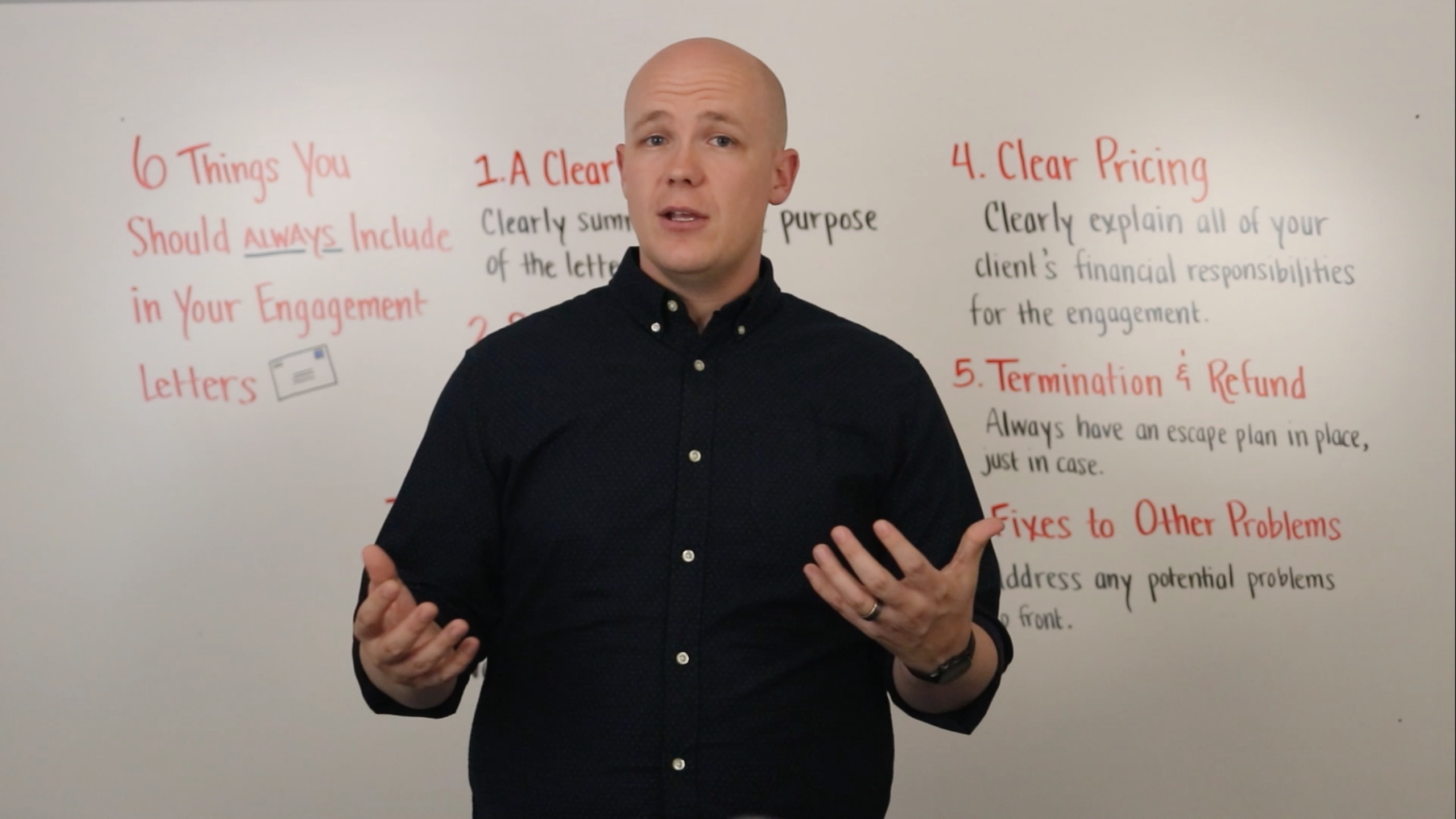

Today we’re covering something that every practitioner has to do frequently: write an engagement letter. Getting your engagement letter right a vital beginning to every case and will give both you and your client peace of mind. With that in mind, let’s take a look at six things you should include in all of your engagement letters.

1. A Clear Introduction

Your introduction should be simple and to-the-point. You really only need to quickly summarize the purpose of the letter, which is to define important aspects of the engagement such as scope and pricing. Be sure also to write in a way that makes sense to your clients—this applies to the entire document. Just because an engagement letter is legally binding doesn’t mean it needs to sound like nonsensical fine print.

2. Services Offered

An engagement letter should state the services you will be providing as part of the engagement. The more specific you can be, the better. For instance, stating that the engagement will include preparing and submitting a doubt as to liability offer in compromise is far more effective than saying you will aid the client in resolving their tax debt.

3. The Term of the Engagement

Your engagement letter should state that the engagement will end after a specific time (such as 12 months) or until services are completed, whichever is first. The last thing you want is to be responsible for a case with no end in sight and no easy way to get out of it. If the case hasn’t been resolved at the end of the term and you want to continue to represent a client, you can always start a new engagement.

4. Clear Pricing

The engagement letter is the perfect place to make sure your client understands their financial responsibility. You should include relevant specific information such as the total your client can expect to pay to your practice, fees due upfront, available discounts, potential penalties, and any expenses they can expect to pay the IRS.

It’s also a good idea to include language explaining that in rare, extraordinary cases, the engagement will prove to be significantly more complicated than expected. In such cases, you can reserve the right to adjust your fees to reflect the additional time or expertise required, promising to notify the client promptly if their case will require such an adjustment.

5. Termination and Refund

If you find that it’s in your best interest to terminate the arrangement early for whatever reason, it’s nice to have an escape plan built into the engagement letter. If your firm offers a refund for any unperformed services, be sure to make the terms of the refund clear as well.

6. Fixes to Other Problems

Your engagement letter should be personalized to you and your practice. That means that you have the opportunity to address the needs of your practice in the language of the engagement letter.

If you find that certain things tend to break down in your relationship with your clients, consider building provisions that address those problems into your engagement letter. For example, if you constantly have to wait for weeks for a client to respond with needed information, then build in a communications clause into your engagement letter. If you are insistent that the client defer all contact with the IRS to you and others within your practice, make that clear in the engagement letter. The engagement letter is the place to put all your expectations in writing.

Want more information on why engagement letters are so vital to your practice? Check out this article by Canopy's founder, Kurt Avarell.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.