The Coronavirus Aid, Relief and Economic Security (CARES) Act recently signed into law is the largest emergency aid package in US history and will provide $2 trillion to individuals and businesses during this uncertain time. According to the Tax Policy Center, about 90% of Americans will receive money under this act.

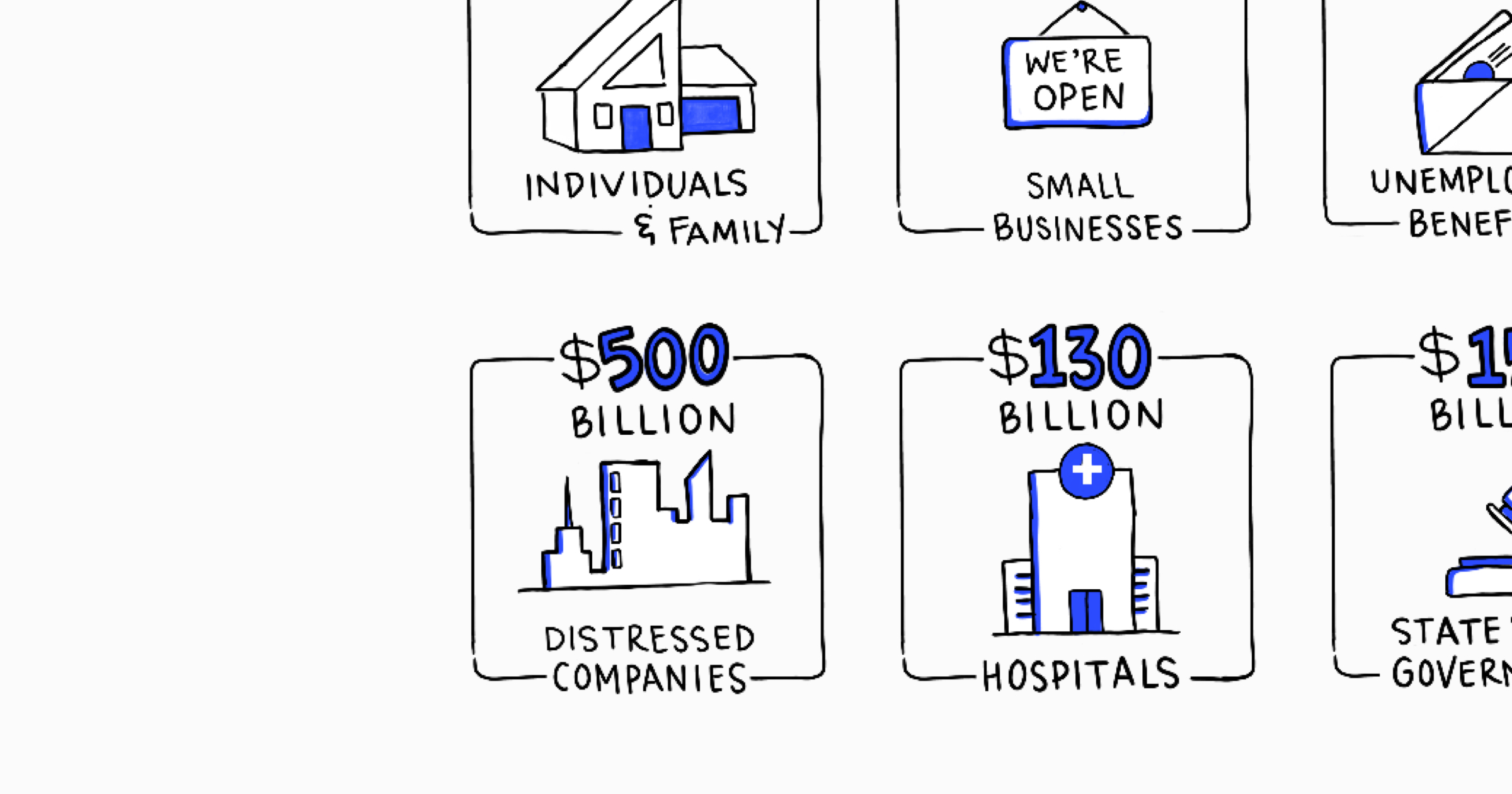

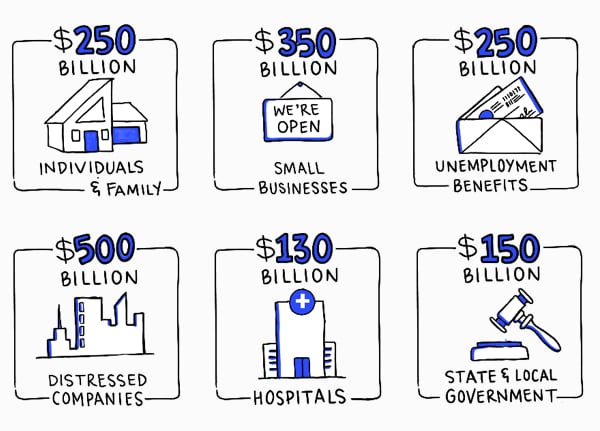

The breakdown of the $2 trillion

- $250 billion for individuals and families

- $350 billion for small businesses

- $250 billion for unemployment insurance benefits

- $500 billion for distressed companies

- $130 billion for hospitals

- $150 billion for state and local governments

What you need to know about stimulus payments for individual taxpayers

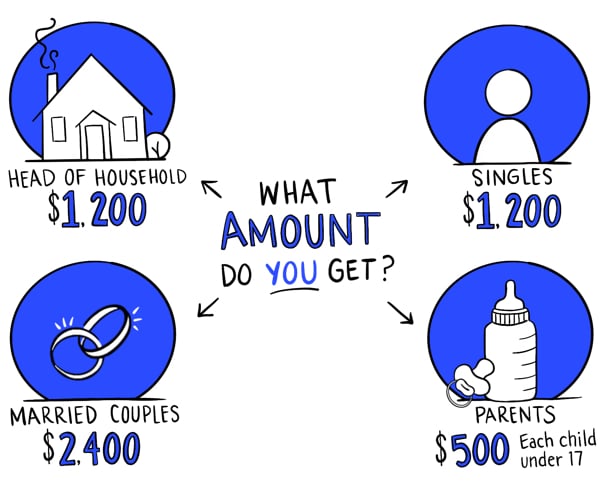

Stimulus payment amounts for individuals and families are as follows:

- Singles - $1,200

- Head of household filers - $1,200

- Married couples - $2,400

- Parents - $500 for each child under age 17

Payments begin to phase out at certain adjusted gross income (AGI) levels based on a taxpayer’s 2019 tax return if they’ve already filed and their 2018 tax return if they haven’t filed yet.

Phaseout levels

Singles - Begins at $75,000, phases out completely at $99,000

Head of household - Begins at $112,500, phases out completely at $136,500

Couples (with no children) - Begins at $150,000, phases out completely at $198,000

Children - No limit to how many children under age 17 a parent can receive $500 for.*

For every $100 above income thresholds, the amount the taxpayer receives will decrease by $5.

*Note: A couple whose AGI is more than $198,000 and has children may still receive some money. But for every $1,000 above $198,000, they'll receive $50 less. For example, if a couple's AGI is $200,000 and they have 2 children, that puts them $2,000 above the income phaseout level so they'll receive $100 less from the child rebate. Instead of $1,000 ($500 per child), they will receive $900.

Still not sure how much money you'll receive? Check out this stimulus payment calculator from Nerd Wallet.

Quick tax facts to keep in mind

- The money received is nontaxable.

- Stimulus payments are technically advances of a refundable tax credit.

- If someone receives an underpayment, they’ll be able to get the money they were owed when they file their 2020 tax return.

- If someone receives an overpayment, they shouldn’t have to pay anything back.

- Stimulus payments do not affect 2019 tax refunds.

- Taxpayers should still receive a stimulus payment even if they owe a tax debt.

- Seniors who do not file a tax return will still be able to receive money if they meet the income qualifications based on their SSA-1099 form or RRB forms.

- Adults who are claimed as dependents (such as college students or seniors) will not receive money.

- U.S. citizens living abroad will receive money if they meet income requirements and have a social security number.

When will individual taxpayers see this money?

US Treasury Secretary, Steven Mnuchin, said stimulus payments will start going out 3 weeks after the bill passed, but some speculate it could be months for certain taxpayers. Those who selected direct deposit for their tax return will likely receive their money sooner than those who opted to receive their refund by mail. However, the IRS will also be offering an online portal to those taxpayers who opted to receive their refund by mail to provide their banking information.

What you need to know about small business relief

The CARES Act specifically outlines the Paycheck Protection Program, a forgivable loan program that allows small businesses to get cash qwhen uickly and incentivizes them to not lay off employees.

Note: As of April 24, 2020, an additional $310 billion was allocated to help small businesses under the Paycheck Protection Program and Healthcare Enhancement Act. $60 billion is specifically set aside for small- and medium-sized community banks, credit unions, and lending companies.

Paycheck Protection Program

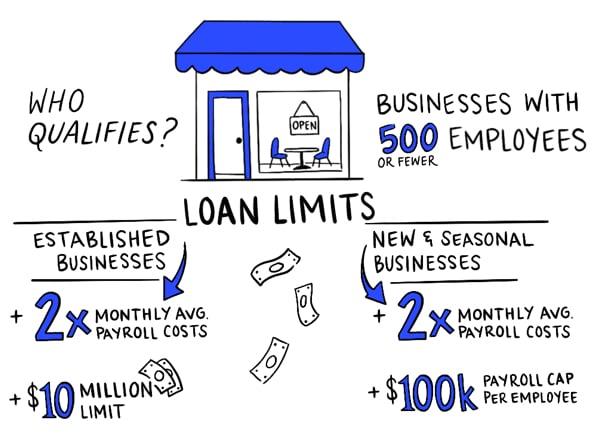

Who qualifies for a forgivable loan?

Businesses with 500 or fewer employees

How much are the loans for?

Loan amounts for established businesses:

- 2.5x monthly average payroll costs (based on payroll costs in 2019)

- $10 million limit

Loan amounts for new and seasonal businesses:

- 2.5x monthly average payroll costs (Based on whichever time period is applicable: March 1, 2019 - June 30, 2019 or Jan. 1, 2020 - Feb. 29, 2020)

- Payroll cost cap of $100,000 per employee (annualized)

What is the interest rate?

1% fixed rate

When can businesses apply?

April 3 for small businesses and sole proprietors

April 10 for self-employed individuals and independent contractors

How can businesses apply?

Businesses can apply through the following:

- Existing SBA lenders

- Federally insured banks

- Federally insured credit unions

- Farm Credit System institutions

What qualifications does a business have to meet for their loan to be forgiven?

The loan should be used to pay for the following expenses over an 8 week period after receiving the loan:

- Payroll

- Mortgage interest

- Rent

- Utilities

Forgiveness is reduced if a business decreases full-time employee headcount or if they decrease wages by more than 25% for any employee who makes less than $100,000 in 2019.

When do businesses have to start paying loan interest?

Payments are deferred 6 months, but interest will accrue over that time.

When are these loans due?

In 2 years.

Quick facts for business taxes

- Refundable tax credit on 50% of worker wages paid between March 12, 2020 and Jan. 1, 2021 with a maximum amount of $10,000 in qualified wages per employee.

- Employers’ portions of payroll taxes for Social Security will be delayed until 2021 and 2022.

- Net operating loss rules under the Tax Cuts and Jobs Act have been modified. Losses for 2018, 2019, and 2020 can be carried back 5 years and the 80% rule is suspended until 2021.

The law sets aside $60 billion for small- and medium-sized community banks and credit unions and less traditional lending companies that are SBA-approved.

Looking for more information about small business relief? Check out 5 Ways Businesses Can Maximize Cash Flow Under the CARES Act.

Note: This information was up to date to the best of our knowledge at the time of publication. The IRS will be continuing to release guidance.

Updated 4/27/2020

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.