If you’re still manually building tax questionnaires from scratch? Stop.

Whether you're collecting details for a simple individual return or wrangling documents for a complex trust, the right prompt can do the heavy lifting. That means fewer follow-ups, less client confusion, and no more chasing W-2s via email.

This post gives you 8 plug-and-play prompts designed to help you auto-generate questionnaires that are tailored, efficient, and (most importantly) usable.

Each prompt is optimized for a major IRS tax form and includes instructions for built-in conditional logic and smart file requests—so you're only asking clients what’s relevant.

Let’s dive in.

Prompts for Major Tax Forms

Form 1040 — Individual Income Tax Return

“Create a client-facing questionnaire for preparing Form 1040. Include sections for filing status, dependents, income types, deductions, and credits, with conditional logic that only surfaces follow-up questions when a user indicates relevant income or life events. Add conditionally required file-upload requests (e.g., W-2s, 1099s, mortgage interest statements) whenever supporting documents are needed.”

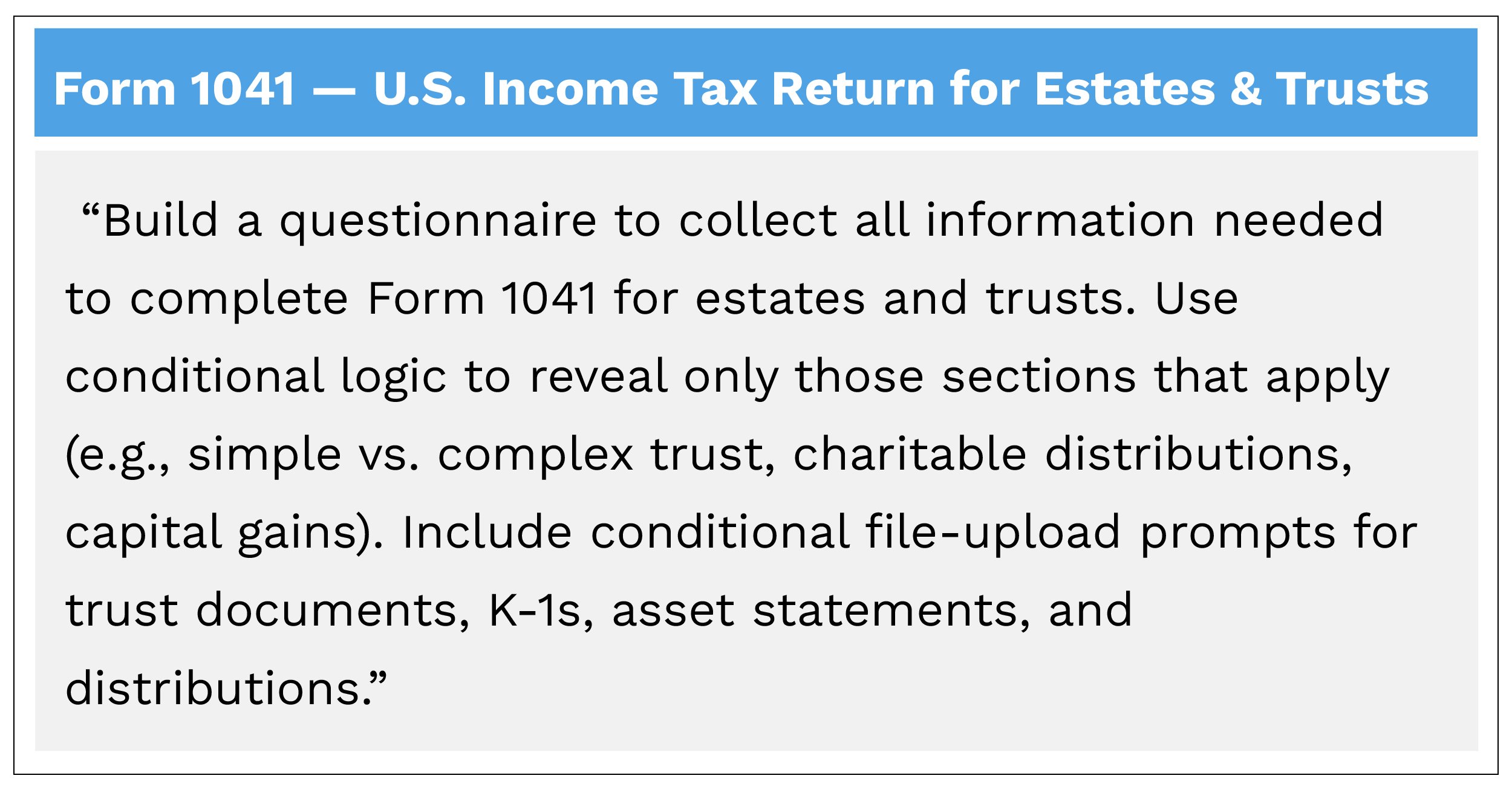

Form 1041 — U.S. Income Tax Return for Estates & Trusts

“Build a questionnaire to collect all information needed to complete Form 1041 for estates and trusts. Use conditional logic to reveal only those sections that apply (e.g., simple vs. complex trust, charitable distributions, capital gains). Include conditional file-upload prompts for trust documents, K-1s, asset statements, and distributions.”

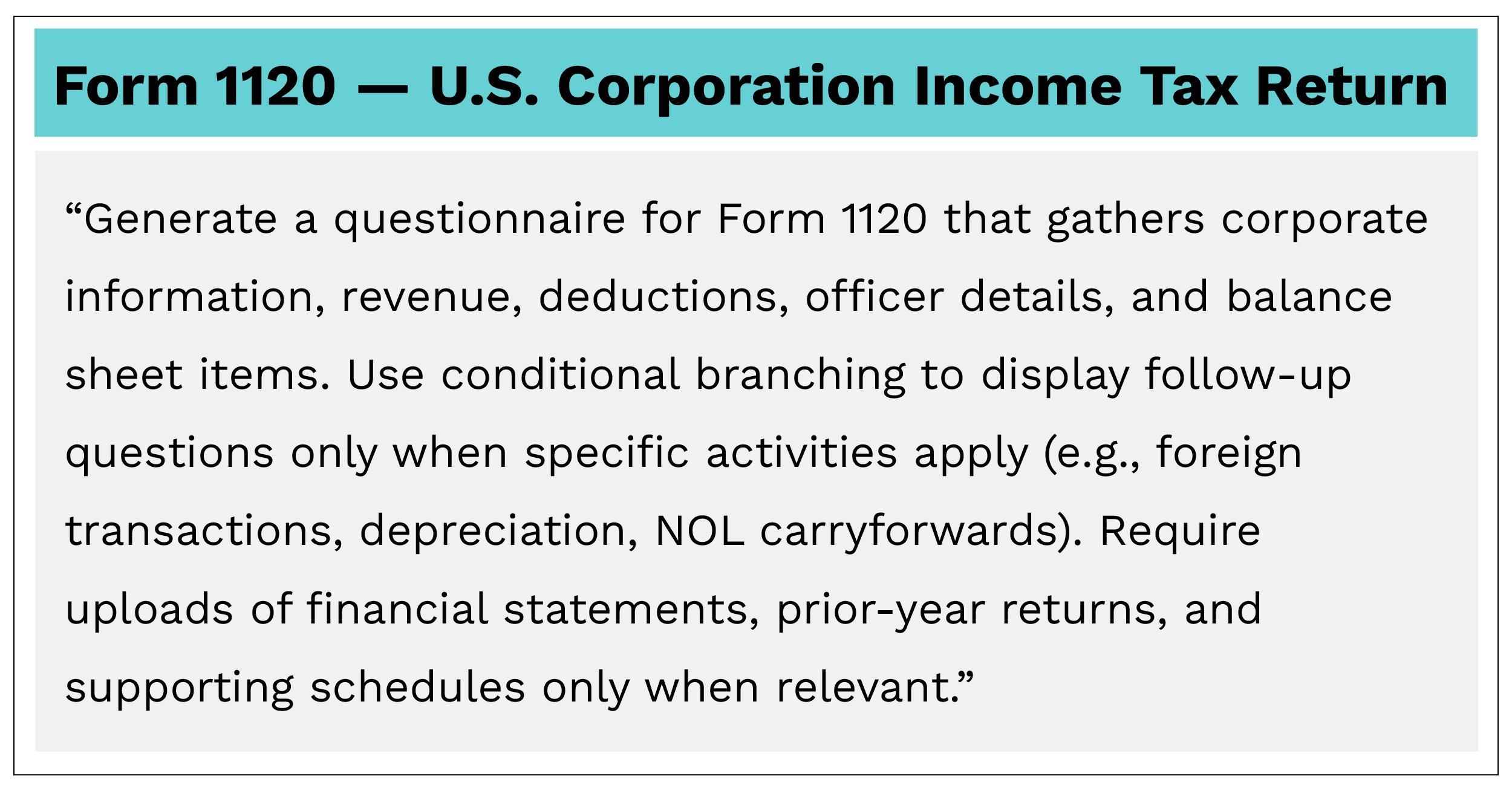

Form 1120 — U.S. Corporation Income Tax Return

“Generate a questionnaire for Form 1120 that gathers corporate information, revenue, deductions, officer details, and balance sheet items. Use conditional branching to display follow-up questions only when specific activities apply (e.g., foreign transactions, depreciation, NOL carryforwards). Require uploads of financial statements, prior-year returns, and supporting schedules only when relevant.”

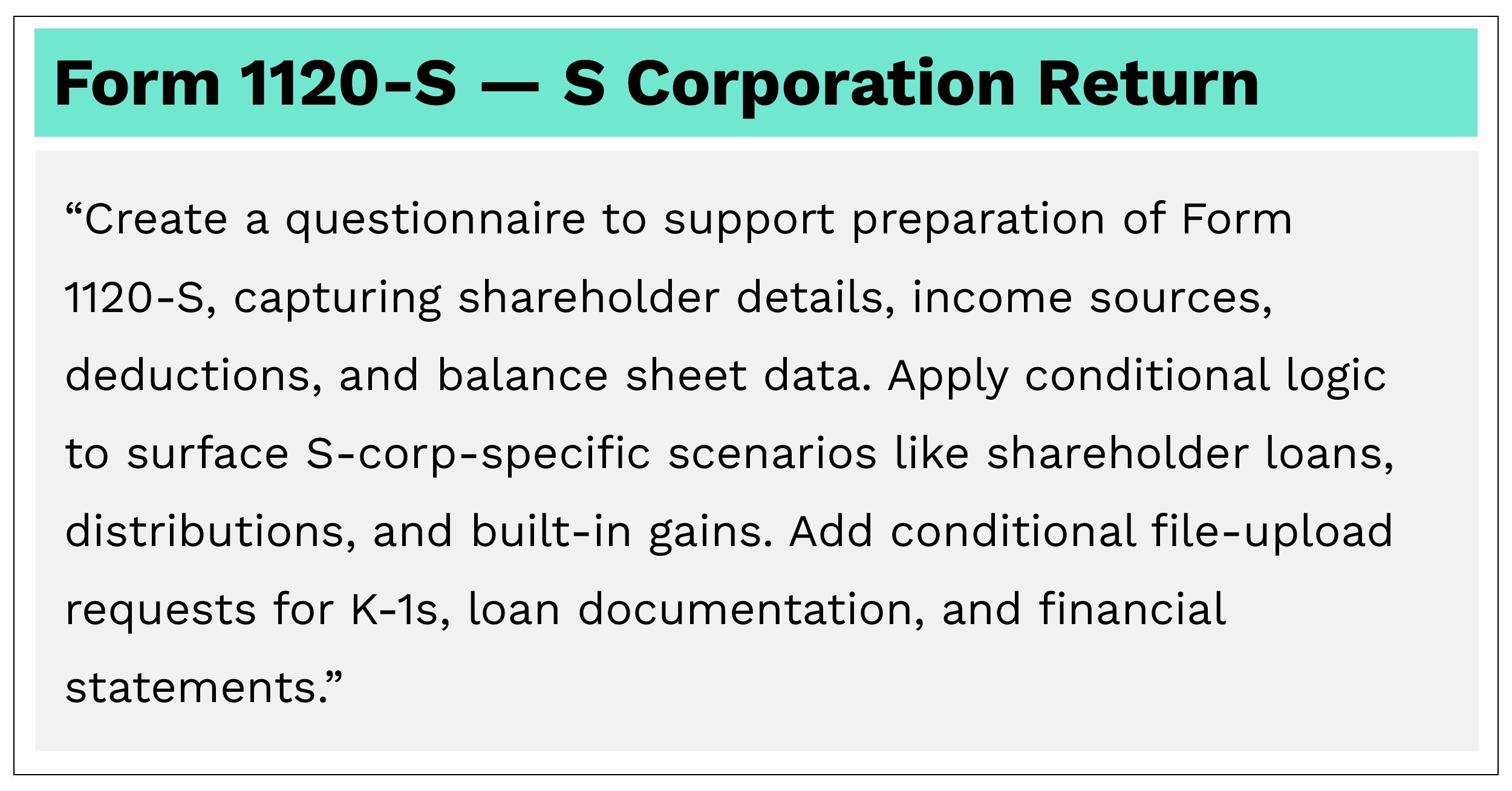

Form 1120-S — S Corporation Return

Prompts for Less Frequently Used Forms

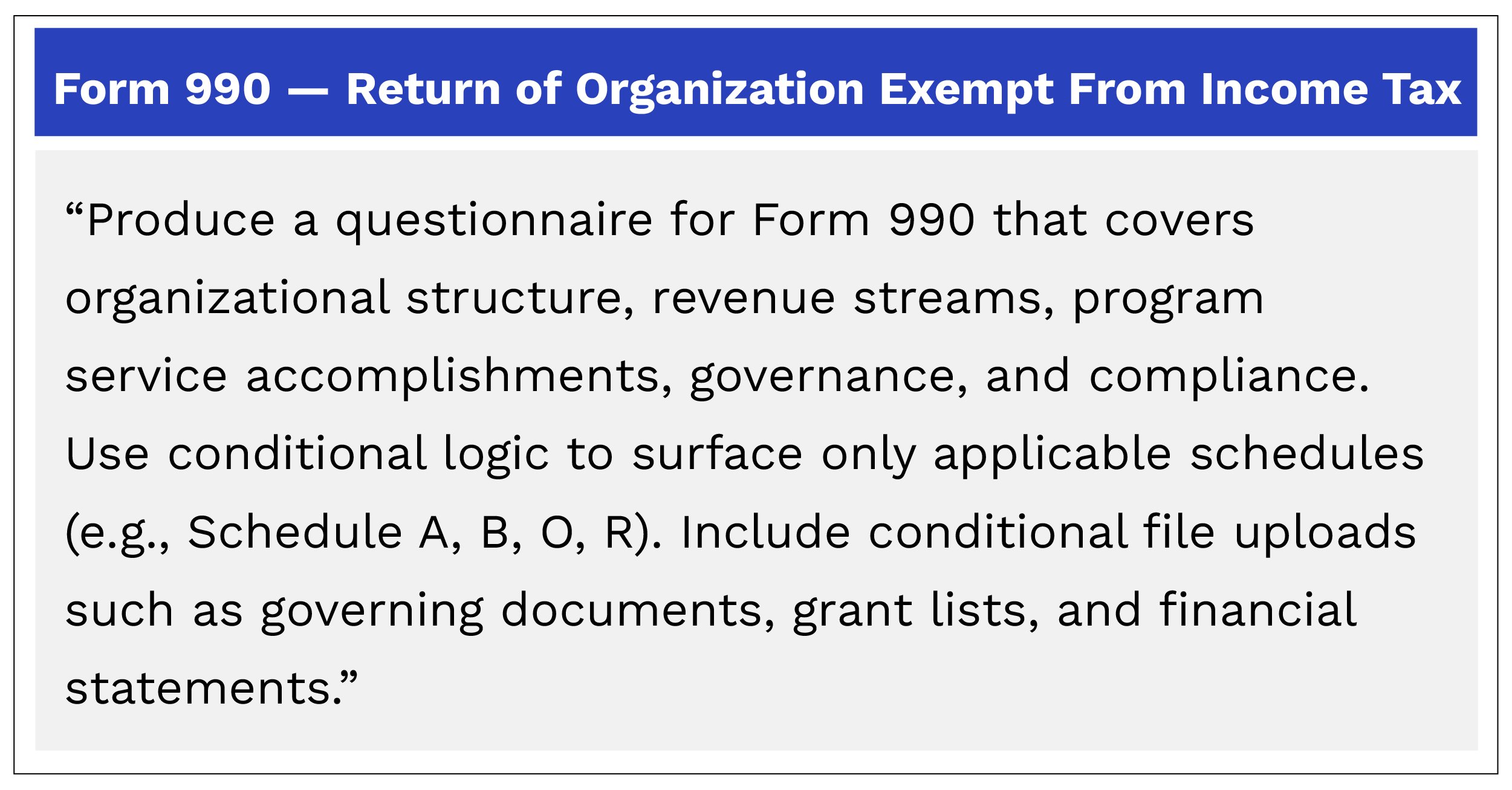

Form 990 — Return of Organization Exempt From Income Tax

“Produce a questionnaire for Form 990 that covers organizational structure, revenue streams, program service accomplishments, governance, and compliance. Use conditional logic to surface only applicable schedules (e.g., Schedule A, B, O, R). Include conditional file uploads such as governing documents, grant lists, and financial statements.”

Form 990-EZ — Short Form Return

“Create a simplified questionnaire for Form 990-EZ with sections for program service revenue, contributions, expenses, governance, and key officers. Add conditional logic to show additional fields only when thresholds trigger them. Include conditional file uploads for contribution records, financial statements, and disclosures.”

Form 990-PF — Private Foundation Return

“Build a detailed questionnaire for Form 990-PF covering foundation structure, investment income, qualifying distributions, and excise tax considerations. Apply conditional logic to uncover required Schedules and additional questions only when a foundation meets certain activity or asset criteria. Add conditional file uploads for grant lists, investment statements, and governing documents.”

Form 1065 — Partnership Return (bonus optional form)

“Create a questionnaire for Form 1065 that collects partnership details, income, deductions, partner allocations, and activities that require supplemental schedules. Use conditional branching to gather information only for applicable items such as guaranteed payments, foreign activities, or special allocations. Include conditional file uploads for agreements, capital account statements, and partner documentation.”

Ready to learn more about Canopy?

Krista is a creative and strategic content marketer who loves crafting compelling stories that connect with audiences. As part of the Canopy team, she brings a passion for storytelling, a keen eye for detail and a talent for creating engaging content.

READ MORE BY Krista

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.