It's about that time – the year is winding down and you're hard at work checking off your pre-tax-season checklist. One thing that should be on the top of your list? Earning those CPE credits.

Update: These courses are now available for free on Canopy's CE and CPE platform. Click here for access to dozens of high quality webinar and self study courses.

Most states require CPAs to complete a certain number of Continuing Professional Education (CPE) courses to retain CPA status and to improve and maintain their professional skills. How many CPE credits you need and how often you must earn them varies by state. You can check how many you're required to earn this year on the National Register of CPE Sponsors website.

But regardless of whether you need to complete yours by the end of 2016 or you have another year to get it done, the slow season is the perfect time to check it off your to-do list. After all, getting it done now means one less thing you have to worry about during the holiday season.

And thanks to Canopy's new Technical Tax Resolution CPE Series, there's never been an easier way to earn those CPE credits. The Canopy CPE series was produced with the help and expertise of Tanya Baber, EA, a public accountant, accounting consultant, and the owner of two accounting firms. Presented in partnership with the NATP, the series offers affordable access to some of Tanya's most popular tutorials.

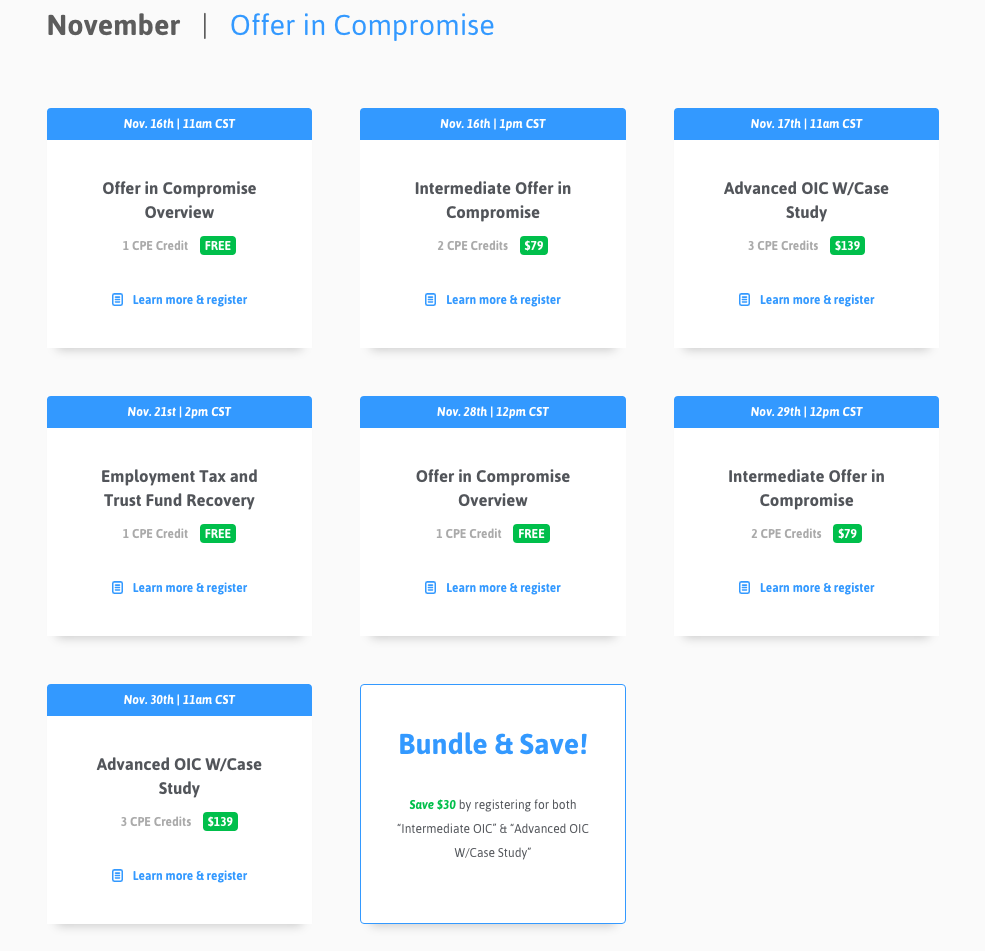

Even better? If you register for more than one course, you can bundle and save.

Even better? If you register for more than one course, you can bundle and save.

With course titles like "Employment Tax and Trust Fund Recovery" and "Advanced Offer in Compromise," the Canopy CPE series is the perfect place to brush up on all of your skills before tax season hits. You can learn more and register for Canopy CPE series courses through the end of 2016 at canopytax.com/cpeseries. But hurry–space is limited and popular courses will fill up quickly.

Want more options for earning your CPE credits? We rounded up our 10 favorite course providers from around the web.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.