Q: Is Canopy IRS compliant?

Yes, Canopy complies with all published requirements by the IRS. The IRS has several requirements for tax software solutions to ensure compliance, which were top-of-mind when we designed Canopy. Canopy uses the same authorization procedures and security that the IRS uses to pull transcripts. Your e-Services credentials are not retained in Canopy and all passwords are encrypted.

Q: What is Canopy?

Canopy is a modern tax preparation, resolution, and practice management software solution for CPAs, enrolled agents, and tax attorneys.

Q: Is Canopy for tax professionals or individuals?

Canopy is intended for use only by authorized tax professionals and requires a valid CAF number and an e-Services login.

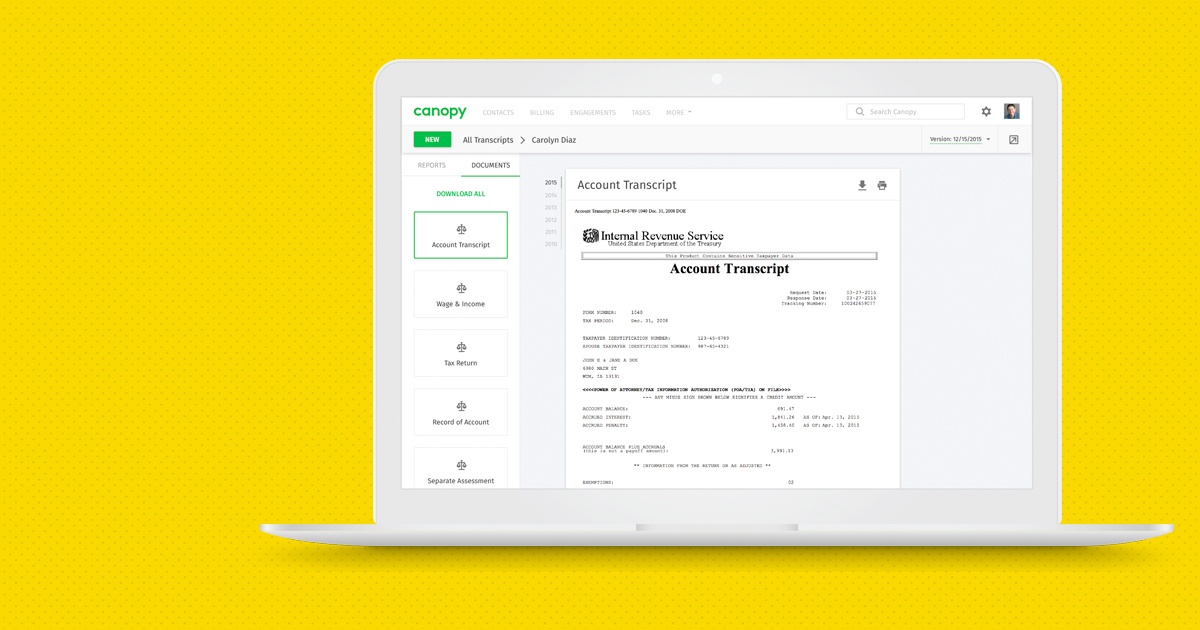

Q: Can I pull multiple years of transcripts at once?

Yes, Canopy allows you to pull multiple years of transcripts quickly and easily.

Q: Do I still need to go through the IRS to get a PoA and CAF number in order to pull transcripts?

Yes. In order to pull client transcripts through Canopy, a tax professional needs a valid CAF number and a signed Power of Attorney or Form 8821.

Learn the best ways to use IRS Transcripts in your practice:

Q: I can already pull IRS transcripts through e-Services for free. What is different about using Canopy’s tool to pull transcripts?

Transcripts are free through e-Services, but your time is not! The process of requesting transcripts from the IRS is cumbersome and time-consuming. Canopy streamlines the process and allows you to pull multiple years of individual and business transcripts in as little as 2 minutes. In addition, Canopy provides easy-to-read, downloadable transcript reports that allow you to quickly compare data year-over-year, view CSED calculations, and more.

Q: How is Canopy so much faster than going through the IRS?

Canopy uses the same service and credentials as the IRS to pull transcripts; however, Canopy bypasses the inefficiencies of the IRS website to pull transcripts more quickly and then delivers them electronically, as opposed to faxing them.

Q: Is my clients’ personal information secure on the Canopy platform?

In order to pull transcripts for an individual, a tax practitioner needs to have authority to do so. That authority is granted by submitting a valid Power of Attorney or Form 8821 to the IRS. The IRS has several safeguards in place to ensure only authorized practitioners can access transcript records. In addition, Canopy’s platform and servers are encrypted, so all of your (and your clients’) information stays secure.

Try Canopy's Transcripts tool here.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.