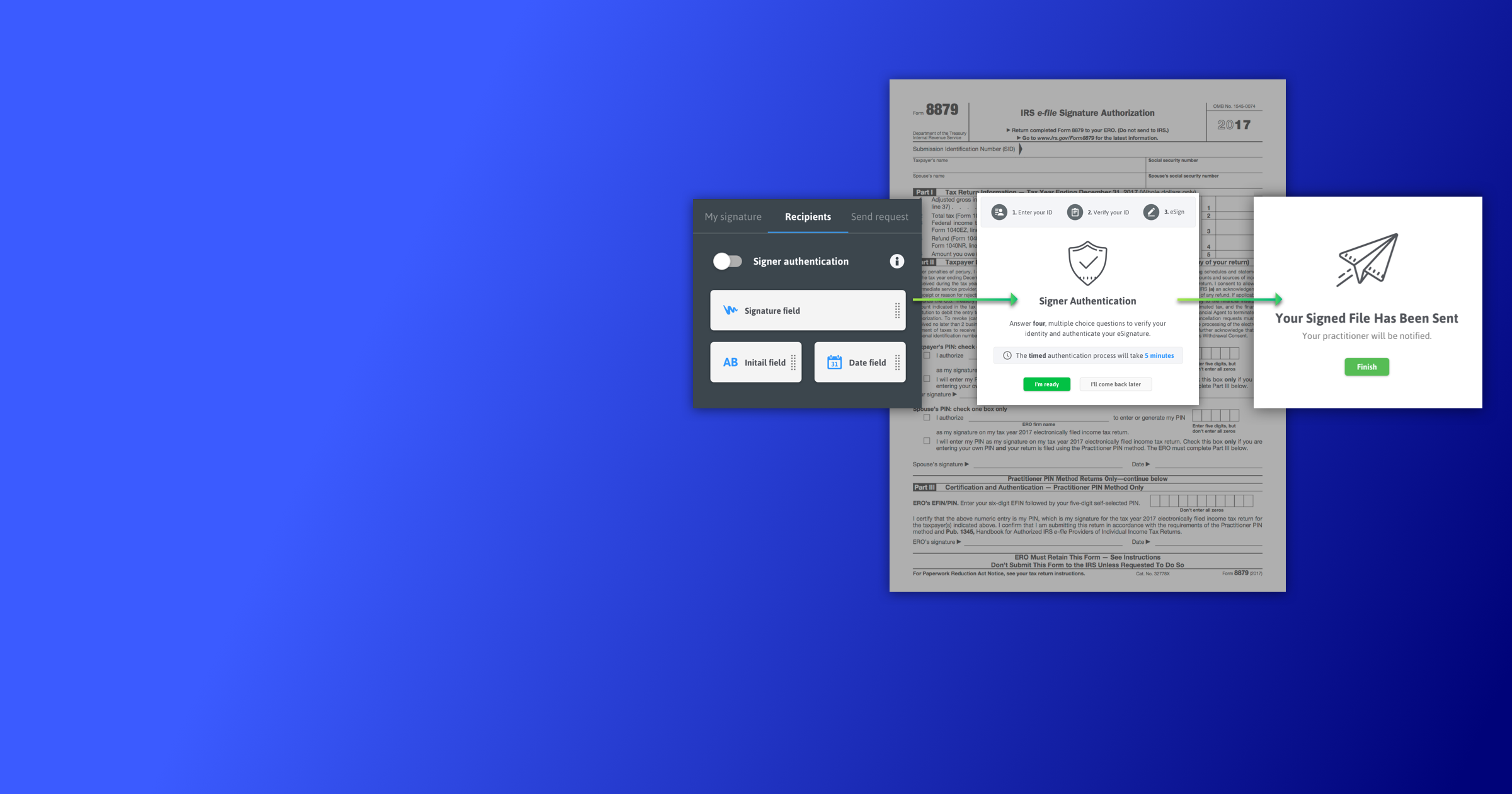

Canopy’s eSign helps you securely and seamlessly create an authoritative and instant agreement between you and your clients on any of your documents, and it just got better. With dynamic knowledge-based authentication (KBA)—an enhanced identity verification method required by the IRS—Canopy’s eSign now allows you to quickly sign IRS forms 8878 and 8879 electronically. This, in turn, enables you to much more quickly and efficiently file returns and extensions online. With eSign and KBA, you’ll have the benefits of enhanced security, an optimized collection process, and an improved tax practice.

Enhanced security

KBA requires clients to answer a series of questions before electronically signing documents in order to verify the signer’s identity. When signing, your clients will verify their name, address, date of birth, and social security number. They will then answer a series of randomly generated questions that only they would know. Clients need to answer three out of four questions correctly to pass. This improves security through enhanced identity verification.

Optimized collection

At Canopy, we understand that failed verifications sometimes occur with clients, so we have optimized the workflow of your online signature collection. If a client fails their first authentication request, they will have the opportunity for a second attempt, free of charge. Should they fail their authentication a second time, eSign handles the process by conveniently prompting the client to download the form, sign, and upload a handwritten signature. And of course, every e-signature will come attached with a certified audit trail that tracks client logins, IP addresses, and timestamps.

Unlike some other e-signature software, you will not be charged for the additional validation attempt. With KBA you’ll have confidence knowing your forms will be signed without any additional intervention from you. This automated and hands-free process will offer you even more convenience this upcoming tax season.

Improved tax practice

Signing documents is a time-consuming process. Canopy’s eSign will make the process seamless and give you comfort in knowing your documents are secure and in compliance with the IRS. Combined with custom branding, you can ensure that every client interaction is branded with your firm’s look and feel—your clients will know they are in the right place when they sign.

eSignature Templates Now Available

Canopy now offers eSignature template creation for frequently used documents, streamlining the signature placement process. These templates can include optional Knowledge-Based Authentication (KBA) for enhanced security. Available KBA credits are displayed next to the document when placing signatures, and includes those reserved for pending signatures in the total.

Interested in more of Canopy’s awesome features? Sign up for a free demo and learn how Canopy can help your tax practice.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.