The way you price your accounting services shouldn’t be arbitrary. The correct accounting pricing strategy can effectively mean the difference between scraping by and robust growth.

If you are unsure about how to set prices that work for your firm, you may need to look deeper into pricing psychology and how other successful businesses make their products and services more attractive to customers who are more than willing to pay for them.

Here are common pricing strategies for accountants and CPAs and tips to keep in mind when pricing your services.

The pricing challenge for accounting firms

There are plenty of ways that accounting firms can proceed when looking at pricing options. It begins by examining each service provided and determining its value to the target market, maximizing the profit margin, and remaining competitive. The benefits of a thoughtful pricing strategy include organic growth, stability, and profitability.

Because no two clients find the exact same value in accounting services, many firms offer a menu or package pricing. This allows clients to choose the level of service they want, identifying what value they see in the offering. Pricing psychology reveals that clients certainly want choice because they all have individual wants and needs. A hierarchy of packages plus customized add-ons gives clients the information they need to understand how you can best help them.

Common pricing strategies for accounting firms

If you’re starting to evaluate what pricing strategy makes sense for your firm, you may consider taking a look at some common pricing structures other accounting firms use. We’ve rounded up five common pricing strategies and included an overview of some of the advantages and disadvantages of each.

1. Cost-plus pricing

A basic strategy for pricing your accounting services is cost-plus pricing. In this strategy, you take what it costs to offer your services and add a percentage to that amount to determine how much you should charge clients in order to make a profit. While there are advantages of cost-plus pricing, it often leaves a lot of money on the table for businesses that offer a service rather than a product.

Advantages

- Simple to implement and easy for clients to understand

- Still allows for profit if your expenses are variable

Disadvantages

- Doesn’t take competitors into account

- Often doesn’t capture as much value as clients get from your service

2. Flat-fee pricing

Flat-fee pricing is exactly what it sounds like: you charge your client a flat fee for your services. Typically, your client would be aware of the fee to expect before you start any work for them. Flat-fee pricing is different from cost-plus pricing in that it doesn’t fluctuate based on what your expenses are; it remains constant no matter how much time and resources you devote to a project. This approach can work well for pricing basic or repetitive services such as preparing simple tax returns. It doesn’t work as well for more complex projects.

Advantages

- Simple to implement and easy for clients to understand

- You and your clients know what to expect

Disadvantages

- Inflexible

- Doesn’t always reflect as much value as clients get from your service

3. Competition-based pricing

Another strategy for pricing your services is competition-based pricing which involves comparing your offering to that of your competitors. What are your competitors doing, and what can you do to differentiate yourself? To stand out from the crowd you can employ one of three modes of competition:

- Your practice provides an equivalent product at a lower price than your competitors.

- Your practice can provide a better service or experience at a price point equal to your competitors.

- Your practice can provide a truly superior service or experience and charge more than the competition.

It’s good to be aware of how your competitors are pricing their services if for no other reason than so you can know where you fall on this spectrum. Even better, try to learn from how other accountants are charging for their services. Keep an open mind and be prepared to change strategies if the change will help your business.

Advantages

- Can help prevent losing out to competitors

- Can help you market your services

Disadvantages

- Prices could be set too low

- Sometimes creates a passive mindset toward pricing rather than proactive

4. Time-based pricing

The time-based pricing approach is often the default approach to pricing for many accounting firms. This long-standing traditional way of billing clients requires firms to track every hour spent on a project. Then you present a list of services performed along with the hourly rate for your client.

Advantages

- Simple to implement

Disadvantages

- Leads to a surprise bill for clients at the end of an engagement

- Doesn’t always reflect the value your firm can offer

5. Valued-based pricing

Value-based pricing is when you price your services based on what your clients are willing to pay, or the value they perceive in your service. Value-based pricing isn’t all about charging the most, it’s about setting prices based on customer segments and information you have about the market.

Once you understand what kind of clients are interested in your services and know what your competitors charge for the same services, you then identify what differentiates your business. Value-based pricing is putting a dollar amount on that differentiation.

Advantages:

- Can improve client loyalty and sentiment if used effectively

- Helps prioritize clients

Disadvantages:

- Requires you to know a lot about customer profiles

- More complex to implement

6. Choose a pricing strategy that matches your values

The way you charge for your services shouldn't be an afterthought in the way you run the rest of your business. Let the values and ideals that guide your everyday work inform the way you structure the fees for your clients.

Do you pride yourself on being open and transparent with your clients? Expand that ideal into a fee structure that lets the client keep close track of what you’re working on and where they’re spending their money.

Do you market your firm as a simple, painless accounting solution? Back that claim up with a simple, no-surprises, flat-fee pricing structure.

Do you work with wealthy clients or large businesses who expect an exceptional experience? Clients who expect a premium experience will look for products with a premium price tag. Set your prices accordingly.

There are many other ways you can match your pricing structure to your values, each of them unique to you and your firm. When done correctly, this will effectively turn your pricing into a feature that clients regard as an advantage rather than simply a cost.

Tips to remember when pricing your accounting services

Any price must reflect value for the client

Value is what sets an accounting firm apart from the competition and that perceived value influences how much clients are willing to pay. The higher the value, the higher you can set your accounting firm’s prices. To clients seeking accounting services, they may place value in an accountant’s years of experience, the portfolio of clients, industry awards, and level of education. The quality and experience your accounting firm offers establishes the value of your service, which will help you to set the right prices.

When it comes to setting prices, you can’t rely on just one variable. Look at numerous different angles, from your competition’s prices to the value of your unique services to your overhead expenses, to discover your firm’s worth. To attract paying clients, you need to find that zone where clients are willing to pay for your services, so you can generate a strong customer base while maximizing your profit.

Consider price anchoring

What’s the best way to sell a $2,000 watch? Next to a $10,000 watch.

That’s a result of a principle called “anchoring,” and it doesn’t just apply to watches. Whether you realize it or not, you encounter price anchoring nearly every time you shop for something. It looks like this:

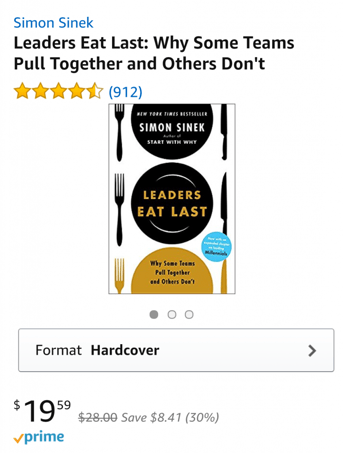

Has anyone ever paid the list price of $28 for this book? Not on Amazon. So why bother showing it at all? The same reason generic brands are placed next to more expensive name brands at the grocery store and new cars are always priced “below MSRP.” People make purchasing decisions by comparison. People tend to measure the value of a product or service by comparison rather than by the actual usefulness of the thing.

And that’s the heart of price anchoring. Sometimes it’s hard to convey the true value of a product or service just by the way you price that product or service. Price anchoring gives you a good way to convey that value by showing the buyer that they are getting a good deal.

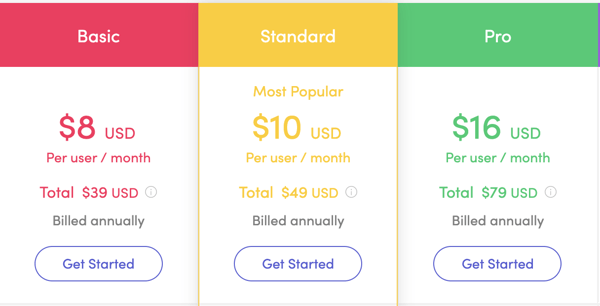

Offering a “discounted price” isn’t the only (or even best) way to utilize price anchoring. Often the most effective way to employ anchor pricing is to place your standard offering next to one or more contrasting options. Take a look at Monday's pricing model as an example of this:

Monday is subtly steering you to the offer they want you to choose: the Standard plan for $10 per month. On one end, $10 doesn’t feel like a whole lot more than eight dollars, and you get a lot more storage and features for the money. On the other end, the Pro plan includes a lot of features that may not feel necessary to most users, so many users may choose to save the money.

This principle translates well to accounting services. Even though you can’t do extra taxes for a client or incorporate their business twice, you can still design your pricing to utilize anchor pricing. In addition to your standard pricing, design some premium pricing packages.

Of course, there needs to be added value to justify charging the additional price, but you don’t have to put in double the hours. Add (or extend) a warranty, include weekly progress updates over the course of the case, or include a detailed report with relevant forecasts and action items. The exact service that sets your premium package apart isn’t a huge deal. Remember, the primary purpose of the premium package isn’t to entice people to buy it, but to more accurately showcase the value of your standard services.

Choose the pricing strategy that works for your firm

It’s easy to see how pricing ties in so closely with other aspects of operating a successful firm. For example, marketing to prospective clients must effectively communicate your firm’s ability to relieve their pain points and showcase how you will save them time and money. When your target market understands the incredible value related to your firm, they will pay for that assurance.

The success of your accounting firm depends so much on implementing a pricing strategy that boosts profitability while sustaining longevity without damaging your brand. Instead of sticking with a safe but short-range pricing strategy, develop purposeful prices that will lead to more success.

Want to see what other accounting firms charge for tax preparation services? Download our 2020 Tax Prep Pricing Guide.

Chris is a content manager for Canopy, joining the team with a combined eight years of experience as a copywriter, editor-in-chief, and content marketer. He's a skilled wordsmith and strategic thinker who shapes brand identity through compelling content and fosters a collaborative and innovative environment. With a passion for storytelling and a dedication to excellence, he is a driving force behind any company's success in content marketing. Champion of the Oxford comma.

READ MORE BY Chris

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.