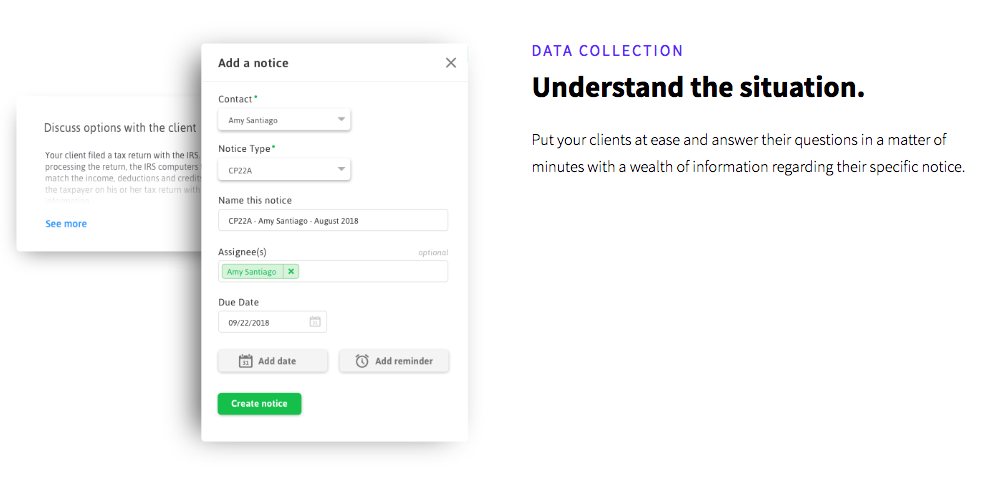

Canopy's Notices tool is the fastest way to help your clients deal with IRS notices, and it just got even better. We've recently expanded the number of supported IRS Notices and Letters to a total of 95. Check out the list below to see all 71 of our newly supported notices.

Haven't tried the Notices tool yet? Click here to check it out and request a demo.

Newly Supported IRS Notices and Letters (7/5/2018)

IRS Notice CP160, Reminder of Balance Due

IRS Notice CP23, Estimated Tax Discrepancy

IRS Notice CP297, Final Notice of Intent to Levy

IRS Notice CP297A, A Levy has been Issued

IRS Letter 4464, Financial Notice of Intent to Levy

IRS Letter 4987C, Requesting Spouse Preliminary Determination

IRS Letter 4988C, Requesting Spouse Preliminary Determination

IRS Notice CP01B, Potential Identity Theft

IRS Notice CP01H, Identity Theft Lock, We are unable to Process Tax Return

IRS Notice CP14H, SRP Balance Due

IRS Notice CP14I, IRA Balance Due with no Math Error

IRS Notice CP161, Request for Payment

IRS Notice CP21A, Data Processing Adjustment Notice

IRS Notice CP21E, Changes Made to Tax Return

IRS Notice CP22A, Changes Made to Tax Return

IRS Notice CP22E, Changes Made to Tax Return

IRS Notice CP22I, Changes Made to Tax Return

IRS Notice CP3219A, Notice of Deficiency (Individual Taxpayers)

IRS Notice CP3219B, Statutory Notice of Deficiency (Business Taxpayers)

IRS Notice CP3219N, Notice of Deficiency-Failure to File

IRS Notice CP39, Overpayment Applied to Balance Due-Secondary SSN

IRS Notice CP42, Refund Applied to Secondary Social Security Number

IRS Notice CP49, Overpaid Tax Applied to Other Taxes You Owe

IRS Notice CP71, Reminder of Overdue Taxes

IRS Notice CP71A, Reminder of Balance Due

IRS Notice CP71C, Reminder Notice of Balance Due

IRS Notice CP71D, Reminder Notice of Balance Due

IRS Notice CP71H, Shared Responsibility Payment (SRP) Balance Due

IRS Letter 3573, Income Tax Examination

IRS Letter 5035, IRDM Informational

IRS Letter 5036, IRDM Amended Return

IRS Letter 5039, IRDM Worksheet Initial Contact

IRS LP61 Additional information required

IRS Letter 565, Acknowledge and Request Additional Information

IRS Letter 131C, Information Insufficient or Incomplete for Processing Inquiry

IRS Notice CP259G, Request for Information about Form 1120-POL (1st notice)

IRS Form 14420, Verification of Reported Income

IRS Letter 4883C, Integrity and Verification (Potential Identity Theft)

IRS Letter 2626C, Request for Additional Information

IRS Letter 2625C, Request for Additional Information

IRS Letter 99C, Notice of Employment Tax Problem

IRS Notice CP298, Final Notice of Intent to Levy

IRS Notice CP87B, Someone Else Has Claimed an Exemption for You

IRS Notice CP87C, Duplicate Dependent Filed Return

IRS Notice CP87D, Duplicate Dependent Filed a Joint Return

IRS Letter 3540A, Proposal to Add Alimony Income, Request for Additional Info

IRS Notice CP152, Tax Exempt bond Acknowledgement

IRS Notice CP20, Audit/Unallowable Items Notice

IRS Letter 3339C, Audit Reconsideration-Additional Substantiation IRS Letter

IRS Letter 3338C, Audit Reconsideration Acknowledgment IRS Letter

IRS Notice CP19, Unallowable items Notice

IRS Letter, 3457 Notice of Beginning of Partnership Audit

IRS Notice CP54B, Different Name/ID on Tax Return

IRS Notice CP54E, Different Name/ID on Tax Return

IRS Notice CP54G, Different Name/ID on Tax Return

IRS Notice CP54Q, Different Name/ID on Tax Return

IRS Notice CP2100A, Missing and/or Incorrect Payee Names/TIN's

IRS Notice CP2100, Missing and/or Incorrect Payee Names/TIN's

IRS Notice CP58, Notice of Spouse's Missing Social Security Number

IRS Letter 105C, Notice of Claim Disallowance

IRS Letter 106C, Notice of Partial Claim Disallowance

IRS Letter 569, Disallowance for Claim of Refund or Credit

IRS Letter 1363, Notification of Partial Claim Disallowance

IRS Letter 1364, Notification of Full Claim Disallowance

IRS Notice CP10A, EIC Math Error

IRS Notice CP11A, EIC Miscalculation, Balance Due

IRS Notice CP12A, EIC Overpayment

IRS Notice CP09, EIC Entitlement (Dependent Children)

IRS Letter, 3727 EIC Denial

IRS Notice CP27, Potential Earned Income Credit (Taxpayer)

IRS Notice CP102, Math Error, Balance Due

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.