Imagine that Ashley Miller, CPA, wants to develop a social media presence for her practice. She googles "social media for tax pros" to find a place to start and immediately gets overwhelmed by the plethora of platforms to join and the seemingly endless number of articles providing tips for using hashtags, increasing audience engagement and gaining followers. Miller decides to close her browser, deciding that developing a social media presence is not worth the time and effort it demands—time away from working on client cases.

If this situation sounds all-too-familiar, look no further. Building a presence on social media doesn't have to be that taxing (pun intended). We've put together a few quick tips to help you get a head start on building a simple social media strategy for your tax practice.

Social Media Best Practices

Before diving into our tips for using individual social media platforms, it's good to be aware of general best practices across all platforms. As you begin building your social strategy, keep these guidelines in mind:

- Be aware of your brand. You should be making conscious decisions about how you want to present your brand any time you post anything on social media. Every single one of your social posts is like putting a billboard up in front of your tax practice and saying, "I support this and want it to represent me and my business." As much as a social media presence can be an asset to your business, it can also hurt your business if you're representing yourself poorly.

- Be aware of your audience. Who is the demographic that you're targeting on social media? Find out what times of the day they're active online and post at those times. Address their interests and concerns. Engage with them by following them back or sharing their relevant posts. You'll have more success with social media if you tailor your profiles to the people who are interested in you and your tax practice rather than trying to appeal to everyone.

LinkedIn is meant specifically for creating and maintaining professional connections and relationships, making it a great platform for tax pros. In fact, the financial industry is one of the top industries using LinkedIn. While more trendy social media platforms may not always meet your client demographic, you can count on LinkedIn to be strictly for business networking. LinkedIn is responsible for nearly four times more referrals to professionals' websites than Facebook and Twitter, according to Buffer.

Even if new clients do not find you through LinkedIn, it's still great for your professional presence to have a profile for networking with other tax pros. Here are a few tips for using LinkedIn:

- Be sure to add a professional profile picture. Doing so will make your profile seven times more likely to be found in a search.

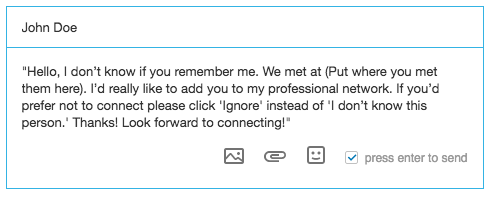

- Include a personal, but professional, message when you send someone an invitation to connect. Avoid using LinkedIn's default message. CoSchedule recommends a message along these lines:

- To reach the largest audience, publish content and updates during business hours. LinkedIn has significantly less engagement during the times when people are not at work.

Although Facebook is not as strictly professional as LinkedIn, having a Facebook page for your tax practice will definitely lead to greater exposure. Currently, there are 1.71 billion monthly active users—meaning there is an enormous pool of potential clients to connect with via posts, comments and questions.

Here are a few tips for improving your use of Facebook:

- Try to post between 1 and 3 pm. These are the times at which people are the most likely to click on and share your posts.

- Put some thought into your "About" section. This is one of the first places potential clients will look to learn about your tax practice and what services you offer. If basic contact and overview information isn't provided in that section, a potential client may move on from your page completely.

- Avoid using hashtags on Facebook, as users are more likely to disengage with your posts that include them.

Twitter is the newest platform of the three we've mentioned, and the least utilized among those 30 and older, but it definitely has benefits that you shouldn't overlook. Twitter is home to 313 million active monthly users who send 500 million tweets sent out every 24 hours, providing you with a huge opportunity to gain exposure. Plus, tweets are limited to 140 characters, giving you the unique challenge of having to be precise and succinct about what you say—which is great! There's nothing wrong with carefully curating your content before you send it out into the professional world. Twitter is especially useful if you're looking to relate to younger clients.

Keep these tips in mind when using Twitter:

- Use one to two hashtags to increase engagement by 21 percent. Hashtags allow users to find tweets about specific topics. However, if you use more than two hashtags, your followers are likely to find your tweets #overwhelming.

- Include images in your tweets as often as possible. Tweets with images get 18 percent more clicks than those without.

- Make sure the accounts and content you follow, like and retweet fit your brand. Potential clients who look at your profile can easily see who and what you're following, and it's in your best interest to make sure you're following accounts that properly represent you as a professional.

[bctt tweet="Make sure the accounts and content you follow, like, and retweet fit your brand." username="@canopytax"]

Looking for a few great examples of tax pros to follow on social media? Check out 10 of our favorites.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.