According to SUMO, the average financial return for email marketing is $44.25 for every $1 spent! Still think email marketing shouldn’t be a priority for your tax practice during tax season?

It turns out that people actually like getting marketing messages in their inbox. 92% of adults use email, while 61% use it daily. Whether your goal is to gain new tax prep clients or to keep in touch with current clients, email marketing is a great place to focus your marketing efforts. Let’s look at some best practices to help guide you along your way.

Write compelling subject lines.

One of the best ways to increase your open rate (the percentage of people who open your email) is to write better subject lines. In fact, 35% of people open emails based on the subject line alone. Check out the tips in this Hubspot article to become a subject line writing genius.

Provide value.

Email marketing is all about building relationships with your list. That relationship has to be give-and-take for it to work. To create valuable emails, focus on providing useful content such as tips, guides, and how-tos for your clients. Give your list a dozen good reasons to open your emails every time they land in their inbox.

Sell relevant things.

Just because your emails shouldn’t primarily focus on selling doesn’t mean you should never use your emails to sell. When a person puts themselves on your email list, they're indicating a preference. They want to do business with you, so long as you fulfill a need.

So, tell people about your services. Remind them when and why they need your accounting expertise. And of course, always include a call to action that encourages the reader to take the action you want: "Sign up today." "Call us to schedule a consultation." "Book your appointment now."

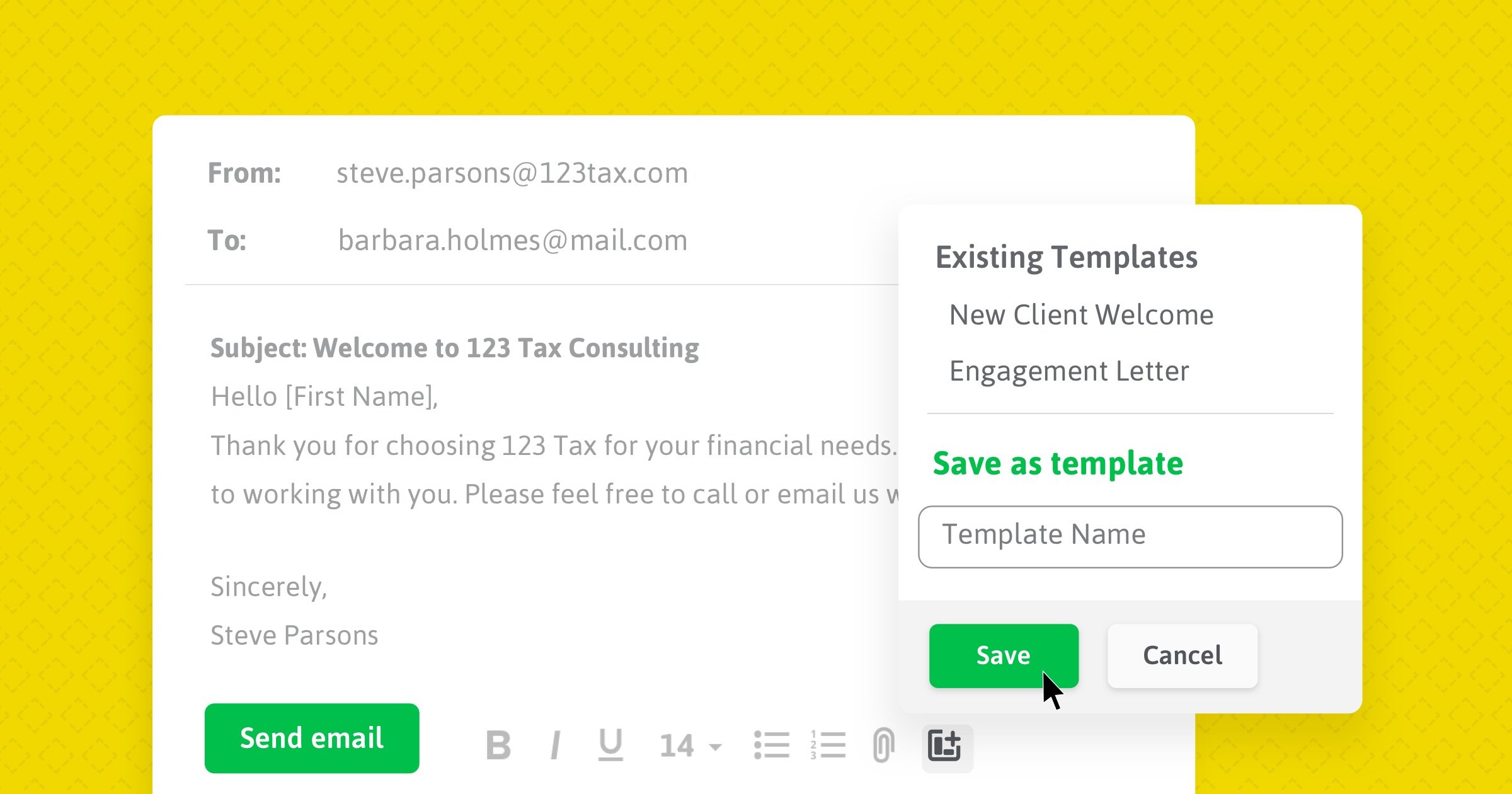

Send welcome and confirmation emails.

When someone adds themselves to your contact list or schedules a consultation, thank them. Automated emails are easy to set up with the help of email marketing software, and can make a big impact on your clients.

You want to build lasting connections with clients. You want them to come back to your practice repeatedly – and not just during tax season. Sending a welcome email is the perfect opportunity to start building that relationship.

Want to learn more about simple marketing strategies you can use during tax season?

Download our free email ebook now!

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.