Introduction: The Chaos of Inconsistency

For many accounting firms, the biggest bottleneck isn’t the work itself—it’s the inefficiencies that surround it.

Constantly chasing down client documents, responding to repetitive requests, and manually managing tasks creates a constant state of disorganization. This lack of structure often leads to frustration and delays, draining valuable time and energy that could be better spent on high-value activities.

Without standardized accounting processes in place, accounting teams are bogged down by administrative tasks that hinder productivity and slow firm growth. This makes it difficult to ensure that work runs smoothly, leading to more errors and inefficiencies.

This is where standardized templates become true game-changers. Whether it’s client requests, recurring tasks, or internal communication, templates bring much-needed structure, consistency, and efficiency to your practice.

With the right technology in place (such as Canopy’s practice management software) firms can implement standardized workflows that eliminate bottlenecks, improve accuracy, and elevate the overall client experience.

The Hidden Costs of an Unstructured Workflow

Accounting professionals know the frustration of sending multiple follow-up emails for missing documents or repeatedly preparing tasks from scratch.

These inefficiencies aren’t just a time drain—they have a deeper impact on the firm’s operations.

Without standardization, firms face the following challenges:

- Inconsistent client experience – When team members communicate in inconsistent ways, clients can become confused or frustrated by the lack of clarity.

- Increased errors – Without a uniform process, critical details can be missed, leading to mistakes that affect the accuracy of financials and client information.

- Reduced profitability – Time wasted on redundant tasks means fewer opportunities to offer higher-value services that contribute to firm growth.

These inefficiencies add up and often go unnoticed until the firm faces capacity or profitability issues.

But there’s a solution.

By implementing standardized templates, firms can streamline repetitive processes and create a more organized and productive environment.

Standardization Through Templates: A Solution That Works

The key to solving these inefficiencies is leveraging templates across three major areas: client requests, task management, and communication.

These templates are foundational in creating structure and driving efficiency throughout the firm.

1. Standardized Client Requests

One of the biggest pain points for accounting firms is the back-and-forth communication with clients to gather documents or other necessary information. Without a standardized process, this can result in missed deadlines, lost documents, and frustration for both staff and clients.

By using Canopy’s Client Request feature, firms can:

- Send pre-built document request lists – These templates automatically remind clients to submit required materials, reducing the need for follow-up emails.

- Reduce back-and-forth communication – Clear, structured instructions minimize confusion and ensure clients understand what they need to provide.

- Track responses in real-time – This removes the guesswork and ensures that all necessary documents are collected on time.

By creating standardized client request templates for recurring engagements like tax prep, financial reviews, and bookkeeping, firms can significantly reduce the friction of gathering necessary information. Templates lead to quicker document collection, fewer errors, and a better overall client experience.

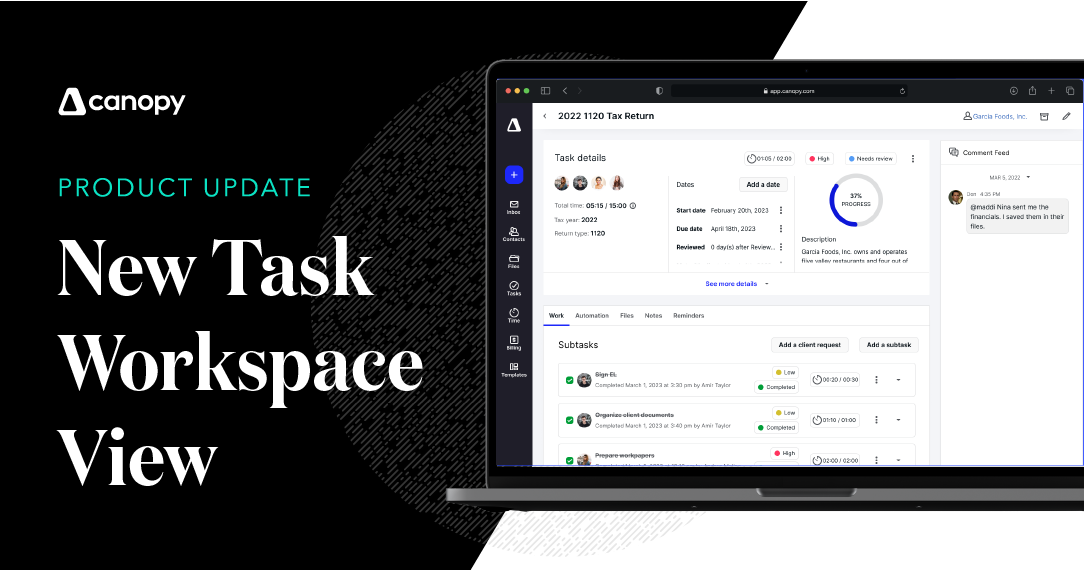

2. Task and Workflow Templates

Most accounting firms are constantly repeating the same tasks for different clients—whether it’s monthly reconciliations, tax return preparation, or payroll processing. Recreating tasks from scratch each time wastes valuable time and increases the risk of human error. As your team grows, keeping track of tasks, responsibilities, and deadlines becomes increasingly challenging.

With Canopy’s Workflow Automation, firms can:

- Set up predefined task templates – These templates include assigned deadlines and responsibilities, ensuring consistency and accountability across the board.

- Automate task creation – Tasks are automatically generated based on triggers (e.g., a new client onboarding), ensuring nothing is forgotten or delayed.

- Track progress across all team members – This ensures that deadlines are met, and the team remains aligned, improving overall workflow efficiency.

Standardizing these repetitive tasks allows firms to eliminate mistakes, maintain consistency, and save time on manual administrative work. This leads to a more efficient team and higher-quality service for clients.

3. Communication Templates

Clear, professional, and timely communication is essential for maintaining strong client relationships.

However, manually drafting new emails for routine scenarios, such as tax deadline reminders, engagement letters, or payment follow-ups, can be both time-consuming and inconsistent. Communication templates help employees communicate more efficiently, reducing errors and streamlining internal processes.

Using Canopy’s Email Templates and Automated Reminders, firms can:

-

Create pre-written email templates – These templates cover common client interactions, reducing the need to start from scratch every time.

-

Automate reminders for outstanding invoices – Remind clients about upcoming deadlines or missing documents without the need for constant manual follow-up.

-

Ensure brand consistency – By standardizing communication, firms can maintain a professional tone and consistent messaging across all client interactions.

This approach not only saves time but also ensures that each communication is clear, professional, and aligned with the firm’s brand identity.

Automating reminders also reduces the risk of missing important deadlines and improves overall client satisfaction.

Implementing Standardization in Your Firm

To successfully standardize client requests, tasks, and communication, firms should follow these steps:

- Identify Repetitive Processes – Look for tasks that are performed frequently and can be templated. This could include client document requests, internal workflows, or email communication.

- Create Templates with Best Practices – Develop clear, structured accounting workflow templates for these processes, ensuring they are easy to use and cover all necessary information.

- Leverage Technology for Automation – Use Canopy’s practice management tools to integrate these templates into daily operations, automating as much as possible to maximize efficiency.

- Train Your Team – Ensure your staff understands how to use the templates effectively. Provide training to ensure everyone is aligned and using the templates consistently.

Conclusion: Greater Efficiency Without Sacrificing Quality

Standardization doesn’t mean sacrificing the personal touch—it means gaining efficiency while maintaining professionalism and accuracy. By leveraging templates for client requests, task management, and communication, firms can create a seamless, consistent experience for both staff and clients.

With Canopy’s automation tools, firms can take standardization to the next level, reducing manual work and freeing up valuable time to focus on higher-value advisory services. This enhanced efficiency not only boosts profitability but also allows firms to offer more comprehensive and personalized services to their clients.

By embracing the power of templates and automation, accounting firms can break free from the chaos of inconsistency and position themselves for long-term growth and success.

Ready to standardize your workflows? Download our free accounting workflow templates

Brittany Malidore is the Co-founder of Ledgerly Consulting and a Top 50 Women in Accounting recipient. She left traditional accounting to build Ledgerly Consulting, where she leads a team of problem solvers and accounting alchemists. Brittany’s superpower is her ability to blend technical expertise with big-picture thinking, allowing her to serve as a true advisor to her clients.

READ MORE BY Brittany

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.