While over 85% of accounting tasks can be automated, too many firms are still buried under manual spreadsheets, email follow-ups, and redundant data entry (Accounting Today).

The biggest problem is that manual work isn’t just tedious. It drains billable hours, increases error rate, and keeps your team from focusing on higher-value advisory work.

But there is good news. This definitive list breaks down seven accounting tasks your firm can automate, so you can reclaim your time and build a more scalable firm (and you won’t need to add headcount to start seeing results).

Let’s dive into the seven processes that will make the biggest impact.

1. Accounts Receivable

Late payments throw off cash flow and create unnecessary stress. You did the work. They agreed to the work. So, where’s the money?

Getting paid should be the easiest part of your job, and with accounting automation, it can be.

By using accounting software automation to trigger invoices automatically at project milestones and schedule recurring payment reminders, firms are getting paid up to 58% faster. That means steady cash flow and fewer month-end scrambles.

Accounting Automation Tip

Set up invoice generation and reminder sequences tied to project completion stages.

2. Data Entry

Manual data entry is the productivity killer that refuses to die. Whether you’re keying in bank transactions or categorizing expenses, it’s time-consuming and error-prone.

Automating data entry tasks eliminates duplicated work, reduces errors, and frees your team to focus on client-facing insights instead of typing numbers twice.

With AI-powered accounting software automation, firms can use smart categorization and document parsing tools to automatically import, match, and reconcile data, cutting hours off month-end close.

Accounting Automation Tip

Leverage AI tools that pre-fill data from uploaded documents and client history to reduce manual input.

3. Reporting

If you’re still compiling reports manually or chasing down team members for status updates, you’re wasting valuable time.

With automation, real-time dashboards and scheduled reports keep you informed without any manual effort.

Firms that adopt automated reporting tools can surface key metrics like turnaround times, capacity, and realization rates in seconds.

Accounting Automation Tip

Use customizable dashboards that sync across time tracking, billing, and workflow systems for a complete picture.

4. Month-End Close

If your month-end close still feels like chaos, you’re not alone. Manual consolidations and unclear task ownership make the process drag.

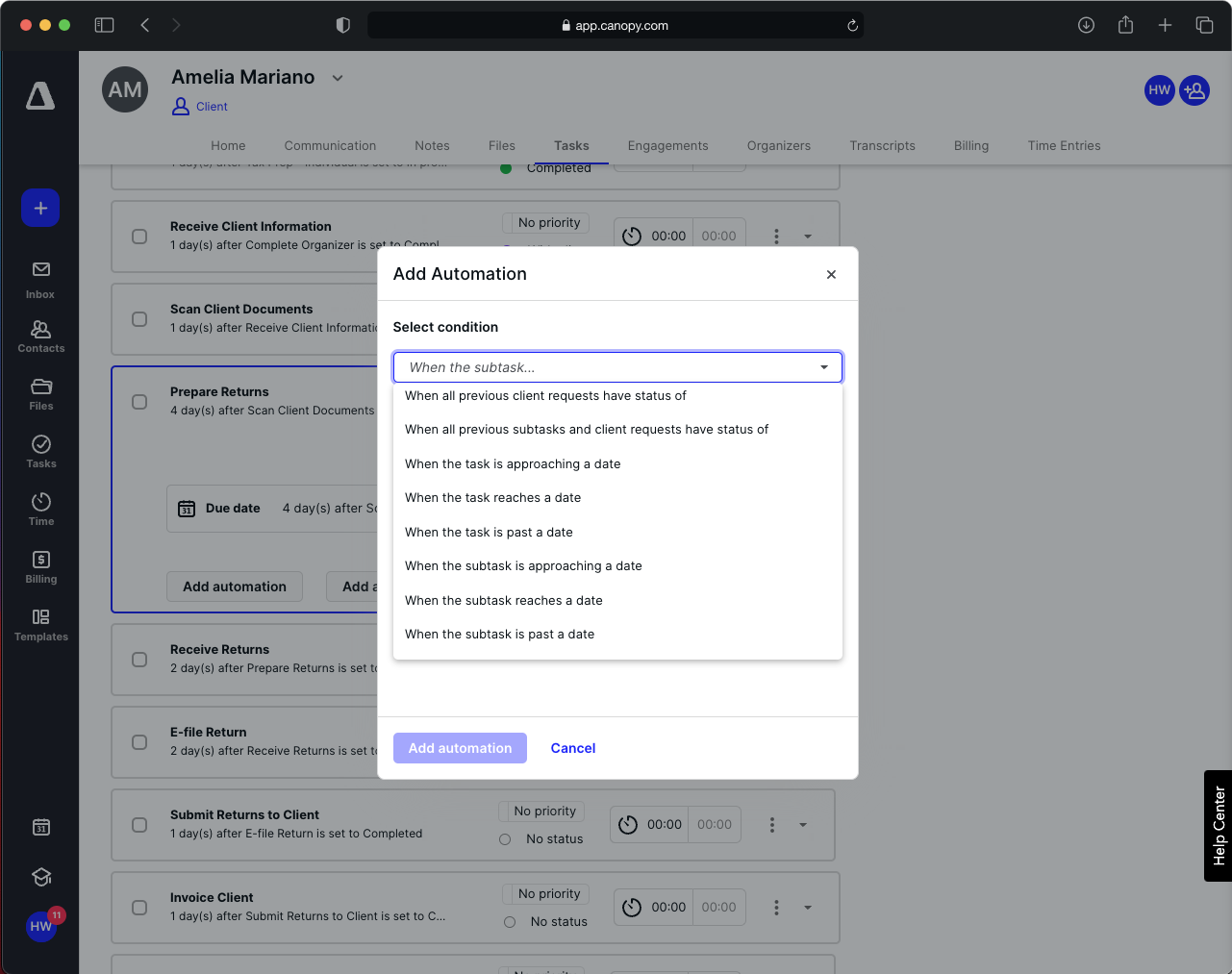

Automation solves that with recurring templates, workflow triggers, and task dependencies that assign, remind, and escalate automatically.

Your team always knows what’s due, what’s next, and who’s responsible without needing to chase status updates.

Accounting Automation Tip

Build automated task sequences that trigger based on due dates or data completion to eliminate bottlenecks.

5. Client Communication

Client communication shouldn’t feel like an inbox warzone. Endless back-and-forth emails waste hours and create opportunities for things to slip through the cracks.

Automated client communication tools handle routine updates, reminders, and document requests, keeping clients informed while freeing your team for billable work.

Accounting Automation Tip

Use client portals that automate reminders and organize client communication in one place.

6. Document Management

If “Client_TaxReturn_v2_FINAL_FINAL.pdf” sounds familiar, you’re overdue for automation.

Manual document management wastes time and risks errors. Automation brings AI-powered file naming, tagging, and categorization, ensuring everything is properly stored and instantly retrievable.

With smart folder rules and version tracking, firms stay organized and compliant without constant oversight.

Accounting Automation Tip

Automate file routing by client, project type, or service line to eliminate manual uploads and reduce chaos during tax season.

7. Insights

When your data lives in disconnected spreadsheets, you miss out on insights that could improve profitability and workload balance.

Automated analytics turn your data into decisions. AI can flag anomalies, identify trends, and help you spot inefficiencies before they become costly problems.

With accounting automation tools, you can ask natural-language questions like, “Which clients are overdue?” and get answers instantly.

Accounting Automation Tip

Adopt analytics dashboards analytics dashboards that integrate across billing, workflow, and time tracking to keep firm leaders informed in real time.

Automation for Accountants

42% of finance activities could be fully automated, but only 37% of accountants actually automate their processes. The firms leading the industry aren’t hiring more people, they’re automating what slows them down.

Whether it’s faster billing, smoother month-end close, or smarter communication, automation for accountants is the competitive edge.

You don’t need a full tech overhaul to start seeing results. Begin with a few small wins, like automating document naming or recurring client requests, and watch your time (and sanity) return.

Looking for modern, easy-to-use software that helps your team work smarter, not harder?

Krista is a creative and strategic content marketer who loves crafting compelling stories that connect with audiences. As part of the Canopy team, she brings a passion for storytelling, a keen eye for detail and a talent for creating engaging content.

READ MORE BY Krista

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.