Are you an accountant who used to be able to pull transcripts for your clients using a third-party software, then sometime last year, that service stopped working—and now you have to deal directly with the IRS?

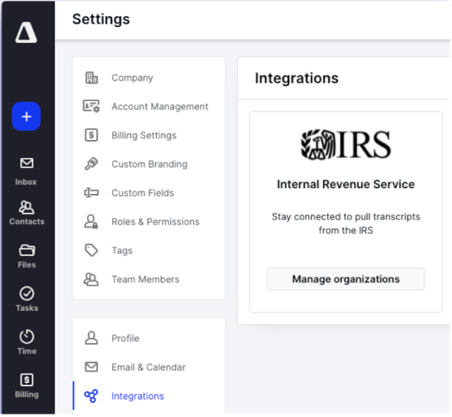

That’s what happens when the IRS changes its technical requirements. Pretty frustrating, right? If this is the situation you’ve found yourself in, you’ll be happy to hear that Canopy is partnered with the IRS to provide this service. In fact, Canopy is currently offering a free trial to anyone who wants to try it out.

Just go to getcanopy.com and sign up—no questions asked, as the saying goes. You’ll be able to pull your clients’ transcripts and notices for zero dollars and zero cents—hence the term “free trial.”

Transcript and Notice 101—what’s the skinny?

If you’re a tax professional, skip this section. If you’re an accountant that has never used a tax transcript or notice before, read on (you’ll be surprised at how useful these documents can be).

A transcript is like a receipt. The information it contains comes directly from the IRS. Similarly, a notice is a communication from the IRS. Notices get sent to the taxpayer for a variety of reasons—information regarding COVID-19 aid, for example, or an overdue payment.

Dealing with the IRS can sometimes put a person on the defensive. The client may not be as forthright with information as they need to be or may forget to tell you about a notice they didn’t think was important. The document shows what the client paid, what they were refunded, and maybe even what they were fined—if in fact, they were.

Of course, a transcript is a useful tool for any accountant. Thanks to COVID-19, the faithful citizens of the United States have received all kinds of notices regarding business aid, child tax credits, and other scenarios that the sooner you, the accountant, know about, the sooner you can adjust your protocols and procedures as necessary.

The most important thing to take away here is that Transcripts & Notices makes you the proactive accountant you want to be, preventing unnecessary surprises for your clients.

A quick and easy way to get transcripts and notices

For most of the last decade, transcripts weren’t that hard to get a hold of, granted the process could be cumbersome. Accountants had a variety of options to help them request and download the documents. Then, in May of 2021, the IRS changed its API requirements that made those options possible. As a result, a plethora of tools that worked perfectly fine one day were suddenly useless.

That meant that to order a transcript you had to go to the IRS website directly, work through one of the beloved processes the IRS is known for, wait for the transcript to be sent to you, open it in one software program, transfer it to another software program so you could begin using it... the list of steps seemed to go on forever.

With Canopy’s Transcripts & Notices, you no longer have to deal directly with the IRS. Nor do you have to wade through all of the mindless busy work to get the document you want. The information is delivered in a format that’s easy to read, easy to share, and easy to make use of.

Transcripts & Notices + Practice Management = the complete solution

If you’re an accountant, you’re obviously interested in the best way to obtain your clients’ transcripts and notices. For the time being, it’s going to be hard to beat Canopy’s free trial.

So, don’t try boiling the ocean. Instead, try Canopy’s free trial. You’ll get three transcript pulls and three notice creations. Trust us when we say you’ll be coming back for more.

Combine Transcripts & Notices with Canopy’s Practice Management suite and you’ve got a one stop shop to collect your tax data, take action on that data, communicate with clients regarding that data, and more.

With Canopy, you only need one subscription—one solution that handles all of your communications with clients, organizes and protects all of your client’s financial documents, monitors your workflow, keeps track of time and billing, pings the IRS and downloads your clients’ transcripts.

If you’ve never tried Canopy, signing up for a free trial with Transcripts & Notices is a good place to start. But if you’re serious about streamlining work processes, make sure you check out Canopy’s other solutions as well.

.png)

Dave Nielsen lives in Salt Lake City. He holds a PhD from the University of Cincinnati and writes regularly about business and healthcare.

READ MORE BY Dave

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.