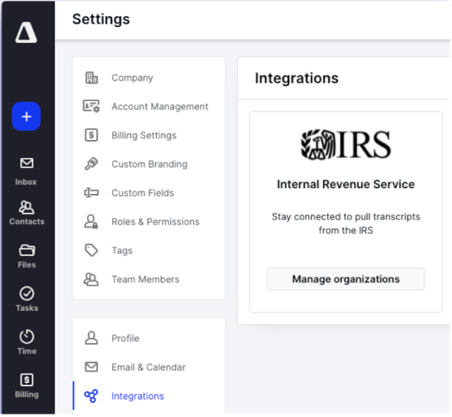

Canopy recently partnered with the IRS to provide exclusive access to tax transcripts through our Transcripts & Notices service.

How to request a tax transcript online

You can obtain a tax transcript from the IRS. When you do, you’ll have five different types of transcripts to choose from. These transcripts aren’t impossible to get your hands on—but let’s be honest: the IRS probably isn’t your favorite entity to request documents from.

If you want an easier way to get transcripts than dealing with the IRS, order your tax transcripts from Canopy instead. Just go to getcanopy.com and click the Product tab. You’ll see a link to Transcripts & Notices in the right column.

When you order a transcript through Canopy, it comes in a digital format that you can download and review as you like—much easier than waiting for the snail mail version.

Understanding tax transcripts

The IRS offers five types of transcripts, and they’re different enough that you’ll definitely want to know what each one contains before making your request. Let’s go through them one at a time, with special emphasis on what makes each type of transcript unique:

Tax Return Transcript. This is the peanut butter and jelly version of the tax transcript, the one most of the other accountants at the lunch table will be requesting. It shows the majority of line items from the original 1040 form and includes any forms or schedules that accompanied it.

You can request a Tax Return Transcript for the current and three prior tax years. Don’t request this transcript, however, if you’re looking for information about changes that were made after the return was originally filed. It won’t show them.

Tax Account Transcript. Okay, let’s say you actually do need information about changes that were made after the return was originally filed. This is the transcript you want. It shows the changes, as well as basic data about the client’s filing status, his or her taxable income, and also payment types.

The IRS makes this transcript available for the current tax year and nine prior tax years. Hopefully, your client isn’t trying to resolve issues from nine years ago. But if they are, this transcript has what you need to get them out of trouble!

Record of Account Transcript. Sometimes you can’t make up your mind between the Tax Return Transcript and the Tax Account Transcript. Not really, but maybe you do need elements of both. If that’s the case, you want the Record of Account Transcript.

The Record of Account Transcript combines both of the first two transcripts into a single document. If that’s not exciting, then you’re not a true tax accountant at heart. You still have to make a living, though, so keep reading.

Wage and Income Transcript. This transcript shows much of the data the IRS receives from information returns such as the W-2, 1098, 1099, and famous 5498. Which begs the question: is the 5498 really famous? To the accountant who needs it, it is!

The IRS website says that the Wage and Income Transcript is limited to “approximately” 85 income documents. After that, you probably won’t be able to generate this type of transcript.

Verification of Non-filing Letter. This transcript doesn’t contain a whole lot of information. It simply states that at the time of the transcript request the IRS had no record of a processed Form 1040-series tax return.

It doesn’t specify whether or not your client is required to file a tax return for the current year—so don’t get excited and assume your client is getting a free pass. You, of all people, should know free passes don’t exist. The transcript isn’t available for the current tax year until after June 15.

Tax transcripts are easy to request—when you go through Canopy

The IRS website points out that a transcript isn’t a photocopy of a person’s tax return. It does contain valuable information, however, that accountants need to do their jobs.

If you’re feeling unusually brave and/or unusually patient, you can go directly to the IRS’s website and start ordering transcripts today. Then again, if you’re short on time, or you just don’t like to think too hard about things that don’t deserve hard thinking about, you can just go to Canopy and order your transcripts there.

Transcripts come in digital format, and you can access them night or day, whenever you need them.

Add to that the fact that the first three transcripts are free, and it’s really sort of a no-brainer. Don’t waste time trying to figure out how to get your client’s tax transcripts. Canopy’s done the hard work. All you have to do is take advantage of it!

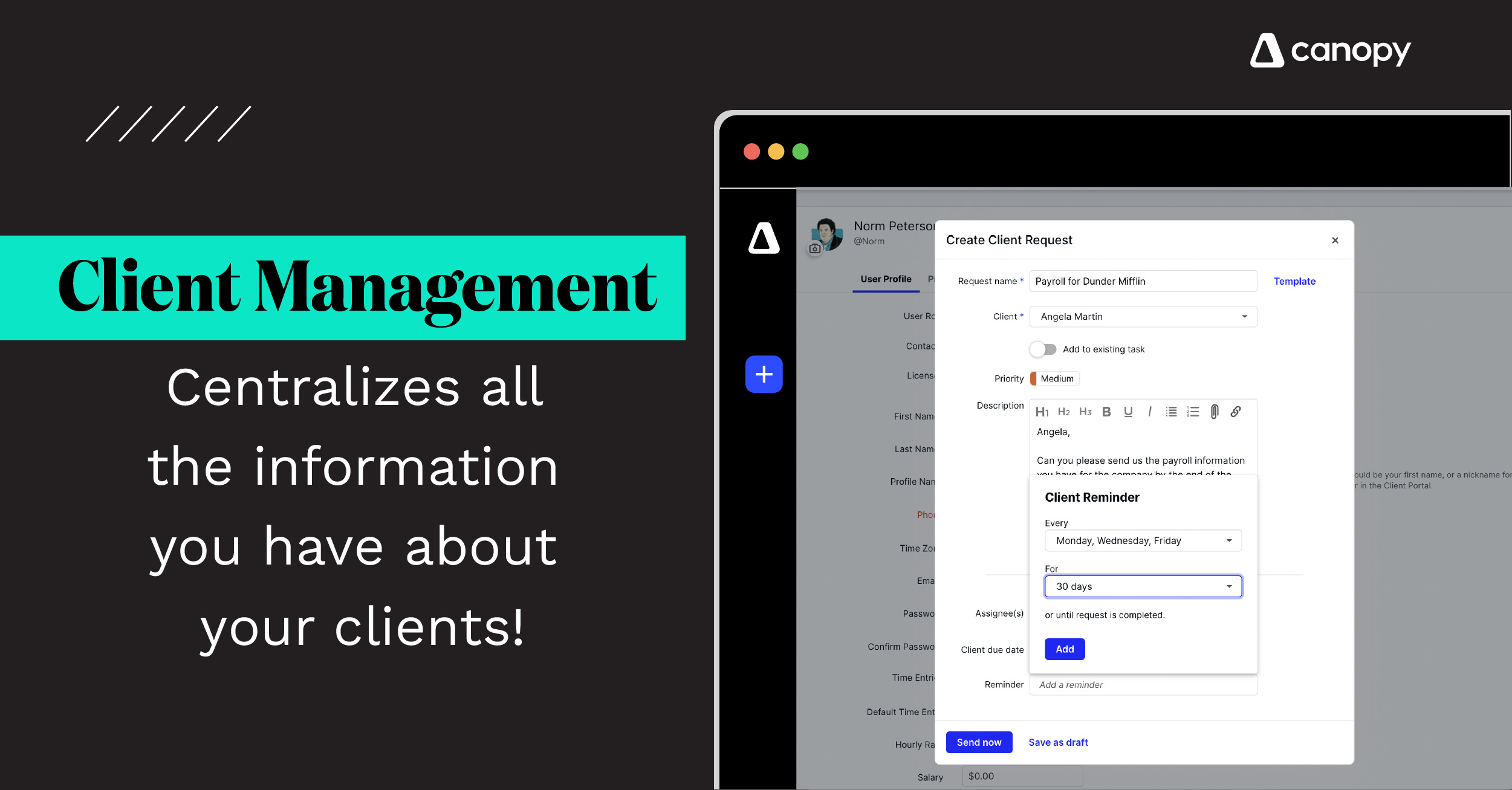

Canopy is a one-stop shop for all of your accounting firm's needs. Sign up for free to see how our full suite of services can help you today.

.png)

Dave Nielsen lives in Salt Lake City. He holds a PhD from the University of Cincinnati and writes regularly about business and healthcare.

READ MORE BY Dave

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.