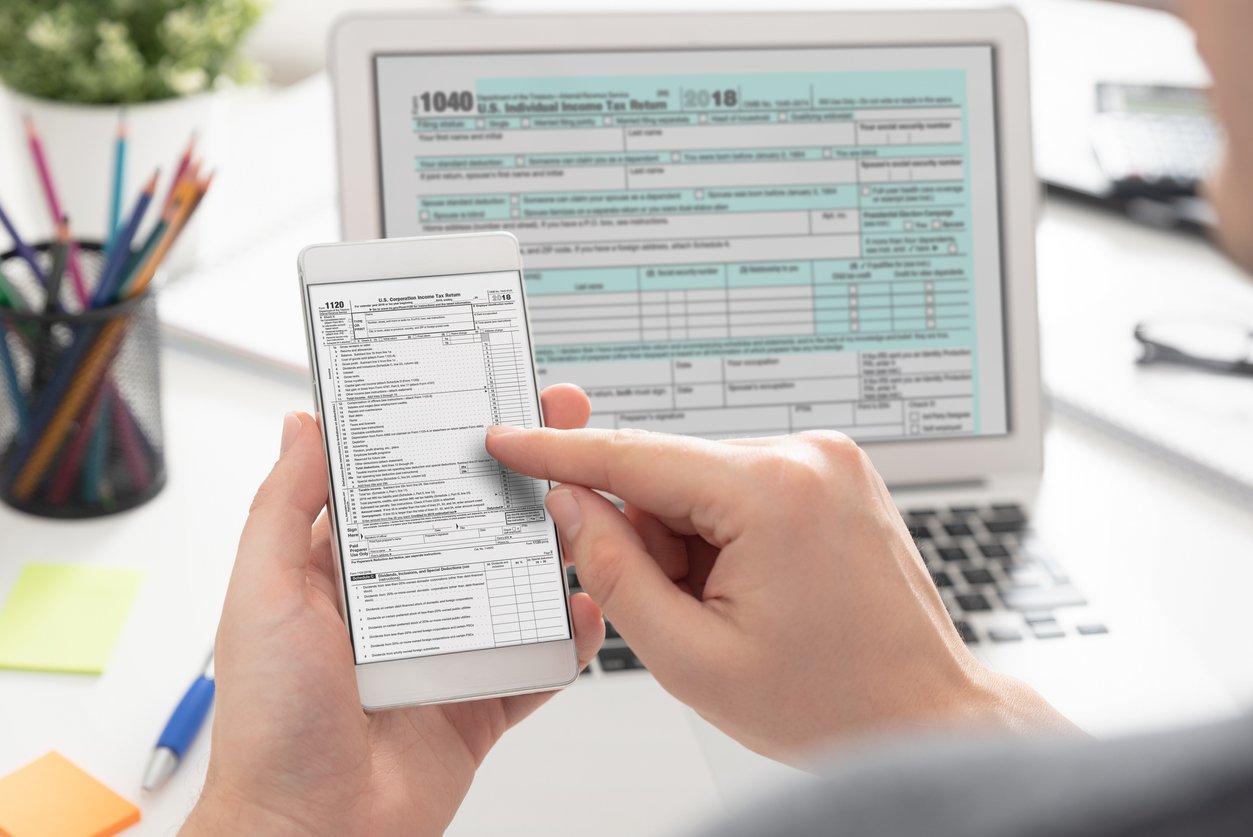

The third economic impact payment, or EIP3, and advance child tax credit payments have added to the ever growing list of uncertainties when preparing 2021 tax returns. As filers and accountants get ready to file, we have outlined a few things to look out for.

What EIP3 and advance child tax credit payments have your clients received?

OK, this is where things start to get confusing. In December and January, the IRS sent out Letter 6419 which included the total amount of 2021 advance child tax credit payments, as well as the number of qualifying children used to calculate these advance payments. This letter was intended to help taxpayers reconcile child tax credit amounts. However, there have been reports of Letter 6419 displaying inaccurate advance child tax credit payment amounts, as reported by Accounting Today.

The IRS has also launched a website for the child tax credit with updated amounts for taxpayers to use on their 2021 tax returns. Potential inconsistencies between Letter 6419 and the child tax credit website could create unnecessary confusion, in which case pulling IRS transcripts is a great solution.

Another payment to look out for on 2021 returns is the third economic impact payment. The IRS has indicated that some individuals have received more than one EIP3 payment. As tax season looms, the EIP3 is another place to look for potential inconsistencies. A good way to verify IRS payments is by pulling transcripts, both in the case of EIP3 payments and advance child tax credit payments that taxpayers may have received for their 2021 returns.

Use IRS transcripts to reconcile payments

Pulling IRS transcripts is a powerful way to view and verify activity on your client's tax account, including EIP3 and advance child tax credit payments. There are a variety of ways to achieve this, including directly through the IRS. However, tax season can be a challenging time to call the IRS with high tax season volumes.

Canopy has built a solution that allows you to quickly and securely pull, organize, and store IRS transcripts. This award-winning transcript tool can be used to reconcile advance child tax credit and EIP3 payments by verifying the amounts the IRS issued. You can also get visibility into whether a payment check was returned to the IRS as undeliverable. And the transcript tool delivers transcript reports that are easy to read and digest with actionable recommendations.

If you’re already using Canopy, but not utilizing the transcript tool, here is a great place to start learning how.

Not an existing Canopy customer? Schedule a demo to learn more about the transcript tool and how it can save time and headaches for your firm.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.