The trust fund recovery penalty (TFRP) is a penalty assessed against those who have the responsibility of collecting and paying over trust fund taxes to the government and willfully evade or attempt to evade payment. Trust fund recovery cases are a niche part of tax resolution. Not every qualified tax professional offers trust fund recovery services, but every individual who is assessed the TFRP requires the help of a good tax professional, meaning the opportunity for working on these cases is huge. With Canopy, handling trust fund recovery penalty cases become simple and less time consuming.

But first things first, let’s go over a few of the basics you need to know about the trust fund recovery penalty.

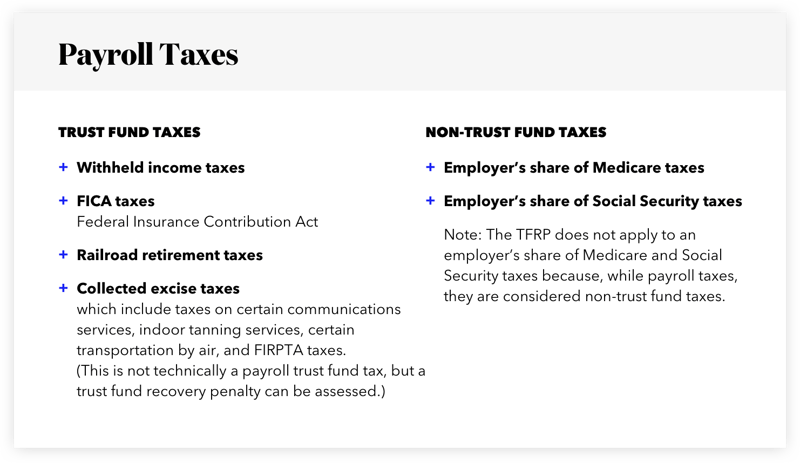

What are trust fund taxes?

Trust fund taxes are made up of both withheld income tax and an employee’s share of Medicare and Social Security taxes. They are called trust fund taxes because an employer holds their employees’ money in trust until the employer pays over the taxes to the federal government. Trust fund taxes include:

- Withheld income taxes

- Federal Insurance Contribution Act (FICA) taxes

- Railroad retirement taxes

- Collected excise taxes which include taxes on certain communications services, indoor tanning services, certain transportation by air, and FIRPTA taxes. (This is not technically a payroll trust fund tax, but a trust fund recovery penalty can be assessed.) More information on excise taxes here.

Payroll trust fund taxes are only paid to the government quarterly, not every pay period. Between quarterly due dates, the most common way businesses get into trouble with the IRS is by using employees’ trust fund taxes to pay for other expenses besides those for which they are intended.

The trust fund recovery penalty does not apply to an employer’s share of Medicare and Social Security taxes because, while payroll taxes, they are considered non-trust fund taxes.

Why does the government take trust fund tax evasion so seriously?

Like most penalties the trust fund recovery penalty is assessed to encourage prompt payment from those who owe the government, but the IRS is particularly aggressive about assessing and collecting the TFRP. This is because the IRS considers the TFRP to be a “pecuniary” penalty, meaning that because of the unpaid trust fund taxes, the government has suffered an actual monetary loss. If trust fund taxes aren’t paid, the government cannot fund federal programs such as Medicare and Social Security.

However, more than being considered a pecuniary penalty for the government, the IRS also views trust fund tax evasion as stealing from employees since they are eventually the beneficiaries of said programs. Additionally, it is seen as theft from employees because trust fund taxes are taken out of employees’ paychecks with their understanding that the taxes will be paid to the government on their behalf.

You can check out IRC Secs. 6672, 7501, and 3505 for more information about trust fund taxes and the trust fund recovery penalty.

How to handle a trust fund recovery penalty case with Canopy

The main defense you have for negotiating an assessment of the TFRP against your client is proving that they were not a responsible and/or willful person in trust fund tax evasion. However, this defense is to the detriment of other potentially responsible persons. Someone has to be found liable, so if it’s not your client, it will be someone else.

To successfully defend your client against the TFRP, you should understand and take the following steps:

1. Gather pertinent information

The most important step for defending a client against the TFRP is gathering enough information about their duties and other parties’ duties to prove that someone other than your client should be held responsible. This strategy should be employed in every trust fund recovery case you handle.

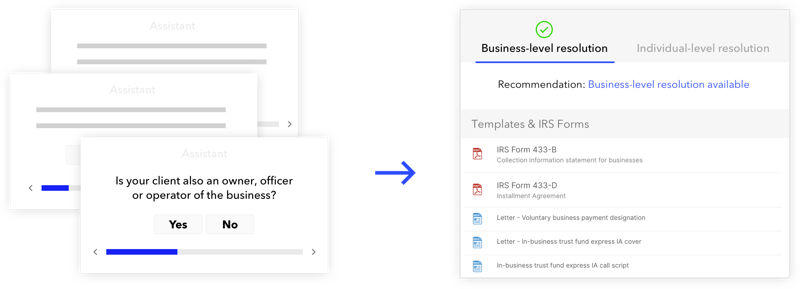

Canopy's Trust Fund Recovery Assistant is a great place to start gathering information about your client's case and determining what your line of defense will be. The assistant asks a series of questions (reducing hours of research) that help you determine which direction to take your client's unique situation.

You can also use the questions on Form 4180 (Revenue Officer Interview Questionnaire) to gather information, which can be filled out using Canopy's forms experience. Additionally, your client should fill out a Collection Information Statement to determine if successful collection is likely. In Canopy, you can send your client an electronic survey and once they fill it out, their Collection Information Statement will be populated.

Another good method for gathering information is asking your client to write a narrative of their role in paying trust fund taxes.

As best practice, you should look into your client’s previous payroll tax liabilities, if applicable. If they have been held liable in a previous trust fund recovery penalty case, they may be subject to a criminal penalty. See IRC Sec 7202 for more information.

2. Obtain affidavits

Next, you should obtain affidavits from other employees that describe your client’s duties, other employees’ duties, and any problems that existed during the time trust fund taxes weren’t being paid. The more complete picture you have of the circumstances surrounding the trust fund tax evasion, the more thoroughly you'll be able to defend your client to a Revenue Officer.

3. Check the statute of limitations

Generally, the TFRP must be assessed within three years of the date a Form 941 (Employer’s Quarterly Federal Tax Return) or Form 944 (Employer’s Annual Federal Tax Return) was filed. If the statute of limitations has expired, the penalty can’t be assessed against an individual. However, if a fraudulent form or no form was filed, there is no statute of limitations—the penalty can be assessed at any time.

4. Negotiate with the revenue officer

After collecting the above-mentioned information, you should be able to address, on a quarter-by-quarter basis, why your client was not responsible for the tax evasion and/or willful. Be sure to provide documentation to support your claims during the presentation.

To determine the responsible party, a Revenue Officer will identify those who:

- Are officers, directors, or shareholders of the corporation

- Hire and fire employees

- Exercise authority to determine which creditors to pay

- Sign and file IRS Form 941or IRS Form 944

- Control payroll and/or fund disbursements

- Control the corporation’s voting stock

- Make federal tax deposits

The amount of information needed to defend a client in a trust fund recovery penalty investigation can be overwhelming, but Canopy makes it simpler. Canopy provides potential outcomes, best practices, letter templates, call scripts, and other resources for each TFRP case. You can prepare yourself for negotiating with a Revenue Officer by looking over the comprehensive information Canopy provides beforehand. We've done the heavy research so that you can jump right into your case and focus on what's important: helping your client.

5. Review the decision

After the initial interview, you and your client should meet with the Revenue Officer to review their decision and verify that all of the information collected is accurate. Any errors should be brought to the Revenue Officer’s attention. If there are no errors, and your client is found responsible and willful, you should counsel them on whether to apply for an appeal.

6. Consider likelihood of collectibility

If your client would not have the ability to pay if a penalty were to be assessed, you should consider supplying the IRS with a voluntary Form 433-A and requesting that the IRS not assert the TFRP based on your client's financial condition.

All forms needed throughout your client's case can be downloaded straight from Canopy.

Learn more about Canopy's tax resolution software

Canopy’s tax resolution software helps you get your clients back on track with the IRS. Besides helping with trust fund recovery penalty cases, it also helps you respond to IRS notices, pull client transcripts, and resolve other post-filing cases such as penalty abatement and innocent spouse cases.

Sign up for a demo and a product specialist will walk you through a personalized tour of Canopy’s tax resolution suite.

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.