It’s a week after Tax Day, and if you’re like most tax professionals, you made the majority of your income for the year in the last few months. And you definitely put in the hours to earn it. But what if there was a way you could make hundreds of dollars per hour throughout the year, relieving some of your February to April stress? The good news is, there is. The opportunity lies in offering tax resolution services. Here’s a look at how tax resolution can make your practice more lucrative outside of busy season.

Big Market Opportunity

According to the 2015 IRS Data Book, there were more than 13 million open collections cases with the IRS, with a 23% growth in the tax resolution market since 2010. That’s a huge market opportunity that most tax professionals aren’t even taking part in. According to the NAEA, less than 2% of enrolled agents offer representation services. And according to the AICPA, only 10% of licensed public accountants do.

People who have IRS problems require services all year long, not just during tax season, and there is more demand for tax resolution work than there are professionals currently offering it. Why not offer the help these taxpayers need and set yourself apart from your competitors while you’re at it?

There is more demand for tax resolution work than there are professionals currently offering it.

Flexible, Non-Seasonal Workload

As mentioned in the previous section, tax resolution clients require the help of a tax professional at all different times throughout the year. The IRS isn’t flexible with their deadlines once they’re set, but often you'll get to decide when to formalize a case with the IRS. Plus, your clients' cases will be in varying states of urgency. The nature of tax resolution gives you much more schedule flexibility and potential for planning your workload than tax preparation does. Because of this, you can spread out your workload effectively and make a more consistent income outside of tax season.

Tax resolution marketing expert Jassen Bowman said, “Offering IRS problem resolution is the best way I know of to make good money year-round, grow your tax prep and accounting business, and eliminate the seasonal nature of being a tax professional.”

Offering IRS problem resolution is the best way I know of to make good money year-round, grow your tax prep and accounting business, and eliminate the seasonal nature of being a tax professional. -Jassen Bowman

High Average Fees

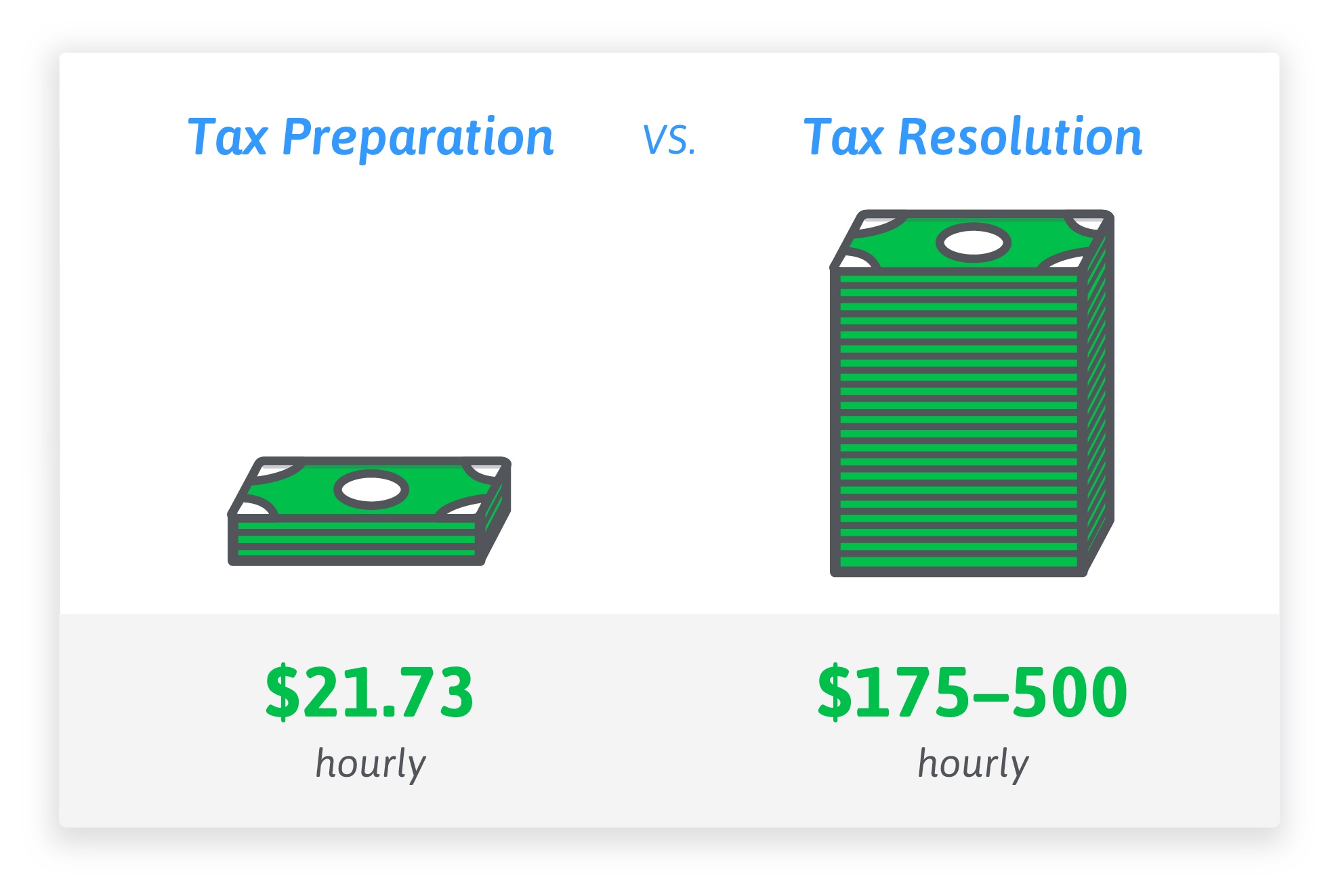

Tax preparation pays an average of $21.73 an hour. In comparison, tax resolution pays anywhere from $175-$500 an hour. That’s up to 23 times more! Client fees per case usually range between $3,000 and $5,000. Plus, a lot of the busywork can now be automated and streamlined, which means you can make more money in less time. At those rates, you wouldn’t have to take on very many cases per month to significantly increase your yearly income. In fact, at an average of $3,000 per case, you would only need to take on two to three cases every month, and you would more than double your monthly income.

Related: 4 Ways to Get More Tax Resolution Clients

Tax resolution pays up to 23 times more than tax prep.

Strategic Pricing Models

The way you price your tax resolution services should be intentional. There are a few different pricing models that are commonly used within the industry—choose the one that works best for your practice. If you need a place to start for reference, you can check out this pricing report we’ve put together.

Keep in mind, one simple way to increase cash flow is to have clients pay you at least a portion of the amount owed upfront before you start working on their cases.

The way you price your tax resolution services should be intentional.

Related: The Strategic Pricing Guide for Tax Pros

Interested in earning up to $500 an hour with tax resolution but don't know where to start? First, download this checklist for adding tax resolution to your practice. Then for more information, download our free ebook below!

Get Our Latest Updates and News by Subscribing.

Join our email list for offers, and industry leading articles and content.